Introduction

TradingView is a comprehensive charting platform used by more than 60 million traders. It’s rated the world’s #1 investing website. TradingView allows traders to chart, add indicators, and analyze real-time market data to accurately predict stock price movements and profit from short-term price changes.

TradingView was primarily built for stocks and ETFs but has recently added coverage for cryptocurrencies. Traders will also find financial derivatives like futures and CFDs. While exploring, be sure to check out the best platform for CFD trading.

In addition to its key charting features, TradingView offers additional features like paper trading (virtual trading to hone skills before risking real money), fundamental data, broker connections with brokers such as Interactive Brokers, and more across its browser-based application, iOS and Android apps, and desktop software.

TradingView is a platform for active traders to perform technical analysis, primarily on stocks and crypto. While long-term, fundamental investors may want to do some basic charting for entry/exit points (which they can do with the free version of TradingView), they’re not who TradingView is built for.

Here’s what TradingView does really well: It’s easy to use for new traders who are learning about different indicators and trading strategies and developing their own unique style while being exceptionally powerful for traders with decades of experience and their own custom scripts.

Who is TradingView For?

TradingView is a platform for active traders to perform technical analysis, primarily on stocks and crypto.

While long-term, fundamental investors may want to do some basic charting for entry/exit points (which they can do with the free version of TradingView), they’re not who TradingView is built for.

Here’s what TradingView does really well: It’s easy to use for new traders who are learning about different indicators and trading strategies and developing their own unique style while being exceptionally powerful for traders with decades of experience and their own custom scripts.

TradingView Features

The Basic (free) plan will not be enough if you’re a day trader. You will want to upgrade to a paid plan or use another software.

TradingView is packed with features while maintaining an exceptionally sleek interface, making it the perfect solution for both new and veteran traders.

Here are a few of TradingView’s key features – if you’re interested in everything it has to offer, head to their website for more details.

Charting Features

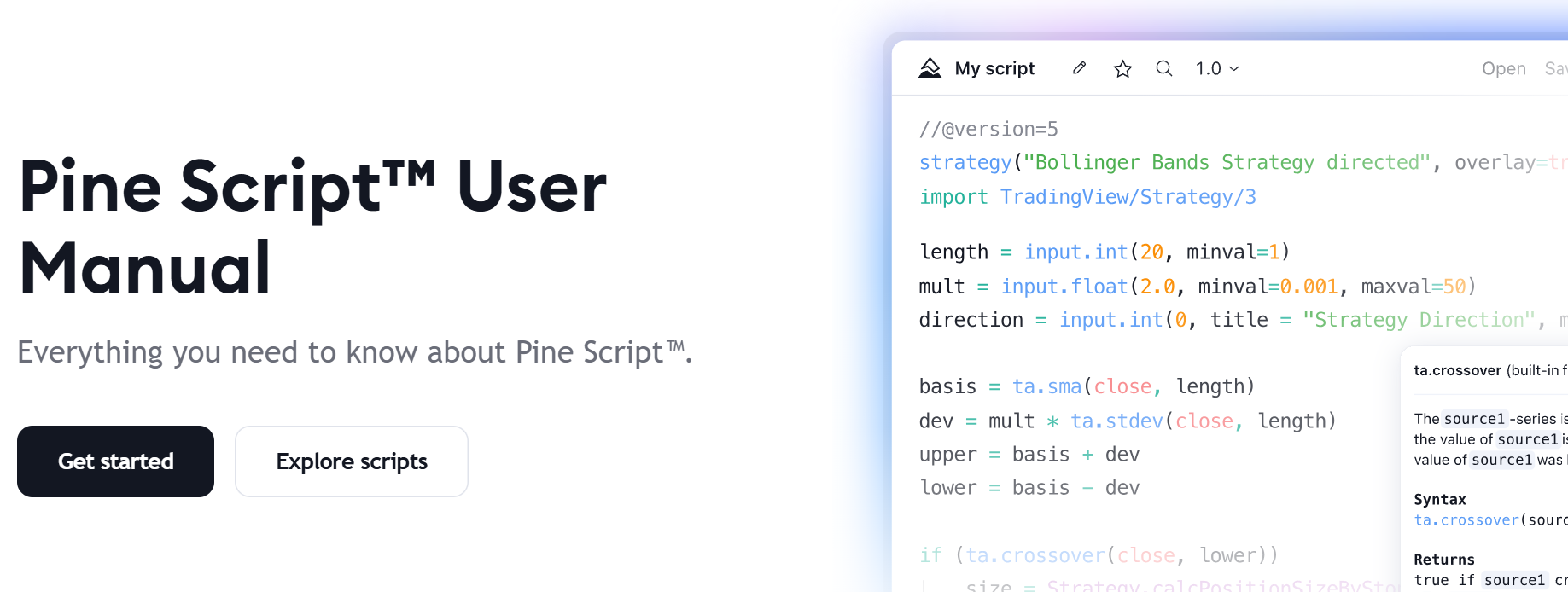

TradingView offers powerful charting capabilities that are highly customizable. Traders can choose from 14 different chart types including candlestick, line, heikin ashi, etc to visualize price data in different ways. Over 90 drawing tools are available like trendlines, Fibonacci retracements, Elliott waves, etc to analyze the charts technically. Traders can add over 100+ pre-built indicators or create custom scripts using TradingView’s Pine scripting language. Popular indicators like Moving Averages, RSI, and MACD can be overlaid on charts for technical analysis.

Charts can be viewed on various time frames ranging from minutes to months like daily, 4 hourly, and weekly charts. This allows traders to analyze different periods and timeframes. Templates and styles are available to customize the look of charts. Time intervals can also be customized beyond the standard periodicity if required.

However, when it comes to actually using these features (especially in combination), you’ll be severely limited by a Basic plan. First off, here are the chart limitations: Traders are limited to one chart per tab. And here are the technical analysis limitations: Traders can use only 3 indicators per chart. There’s no question: If you’re serious about your trading, you need to upgrade. Fortunately, you can experience TradingView’s full capabilities risk-free with a 30-day free trial.

Screener Features

TradingView offers powerful stock, forex, and cryptocurrency screeners. These screeners pull massive amounts of market data and allow the filtering of securities based on various technical, fundamental, or quantitative criteria. Traders can search for trading opportunities by filtering indicators, patterns, price levels, and other parameters. Technical indicators like RSI and MA crossovers can be used as filter criteria.

This huge database of market instruments can be efficiently combed through to find potential trades. Screener output can be exported to analyze results further. TradingView’s proprietary technical rating provides an overall rating on each instrument to simplify the filtering process.

Tradingview App

The TradingView app is a popular mobile and desktop tool for traders and investors, providing real-time data, advanced charting, and a wide array of technical indicators. It supports markets worldwide, including India’s NSE and BSE, allowing users to monitor stock prices, set alerts, and perform in-depth technical analysis on the go.

Alerts Features

Server-side alert functionality on TradingView notifies traders when predefined price triggers are hit, even when the platform isn’t open. Price alerts can be created at different price levels like resistance, support, etc. Alerts can also be based on common indicators crossing levels. This allows traders to multitask without constantly staring at charts or missing potential trade entries.

Alerts are triggered in real-time from TradingView’s servers rather than a local machine. This allows traders to get alerts on phones, emails, etc even when charts aren’t open. However, the maximum number of alerts is limited to free plans.

Community Features

TradingView has a thriving community with millions of members. The social features allow the sharing of trading ideas, strategies, setups, and discussions. Traders can learn continuously from each other here. Popular sections are for sharing trade ideas near entry/exit points.

This exposure to techniques from experienced traders is extremely valuable in improving one’s own skills. Traders can also get their assumptions tested by the community. Overall, social features aid faster learning of both technical and soft skills of trading.

Other Features

TradingView supports assets from major stocks and indices to options, futures, forex, and cryptocurrencies. Market data is available from over 50 exchanges globally. Direct order placement is possible through offered broker integrations.

The platform is available on the web, in desktop applications, and in well-designed mobile apps. Backtesting and scripting capabilities through Pine allow automation and strategy development. Fundamental data, earnings calendar, and economic events are also integrated.

In summary, TradingView is a highly comprehensive and customizable platform for technical analysis, idea sharing, and community learning for global traders and investors.

TradingView Platform Performance and Reliability

We’ve talked about the platform and shared some of the reasons it’s enjoyable. Now, let’s fast forward to performance and reliability based on user feedback. From conversations to reviews, here is what we’ve found: In our experience, the alerts work reliably overall. If indicator alerts aren’t working well, it could be a problem with the indicator as alerts based only on price are reliable.

Interactive Brokers is the most popular broker integrated though delays exist with order placement showing up which doesn’t impact swing traders but matters for scalpers. The platform still gets used over alternatives. At this time, TradeStation doesn’t support big brokers like Schwab, Fidelity, etc but they do have brokers in various categories.

Regarding plans, the paid options are worth it for advanced users to access full capabilities. While free provides a lot of value, limitations will likely prompt an upgrade. TradingView constantly performs software updates and bug fixes to ensure optimum performance.

TradingView Pricing and Plans

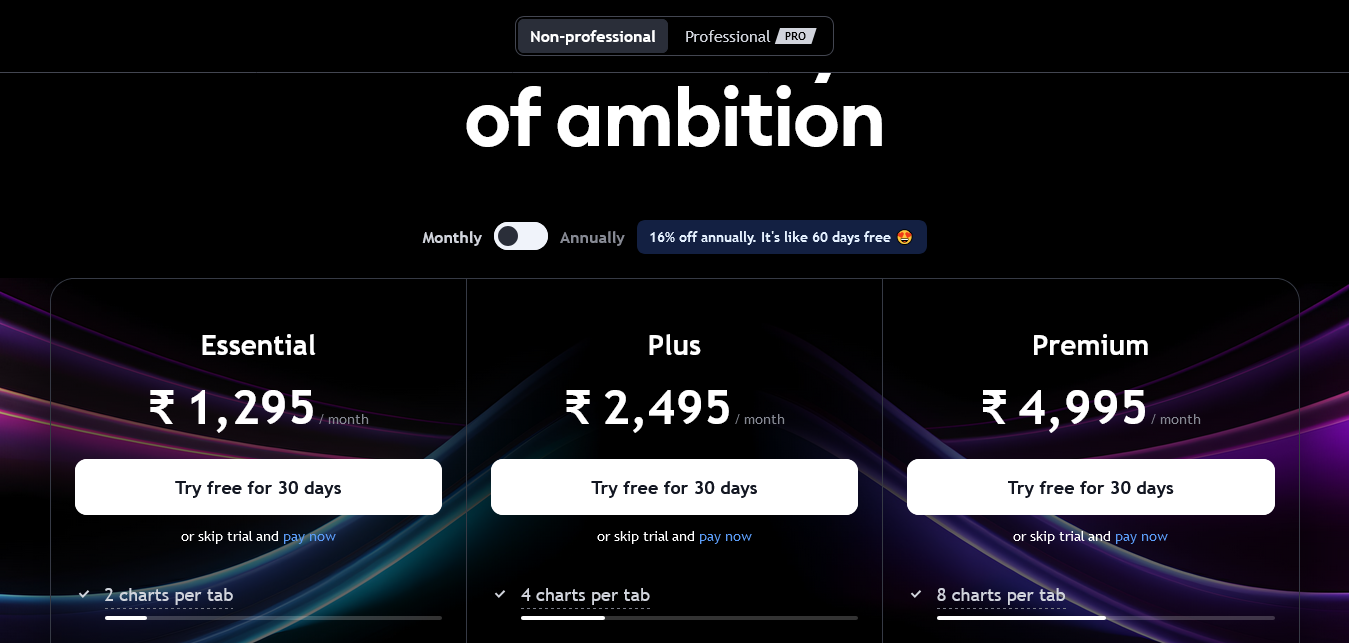

It wouldn’t be much of a TradingView review without comparing plans and pricing. Let’s simplify – the basic plan is free but more serious traders wanting alerts or charts per tab will want a paid plan like Essential, Plus, or Premium. These plans access more features.

Professional plans also exist for firms. Here is the information on TradingView Pricing and Plans:

Non-Professional Plans

Monthly Subscription:

- Essential: ₹1,295 per month

- Plus: ₹2,495 per month

- Premium: ₹4,995 per month

Yearly Subscription:

- Essential: ₹995 per month | ₹11,940 per year

- Plus: ₹1,995 per month | ₹23,940 per year

- Premium: ₹3,995 per month | ₹47,940 per year

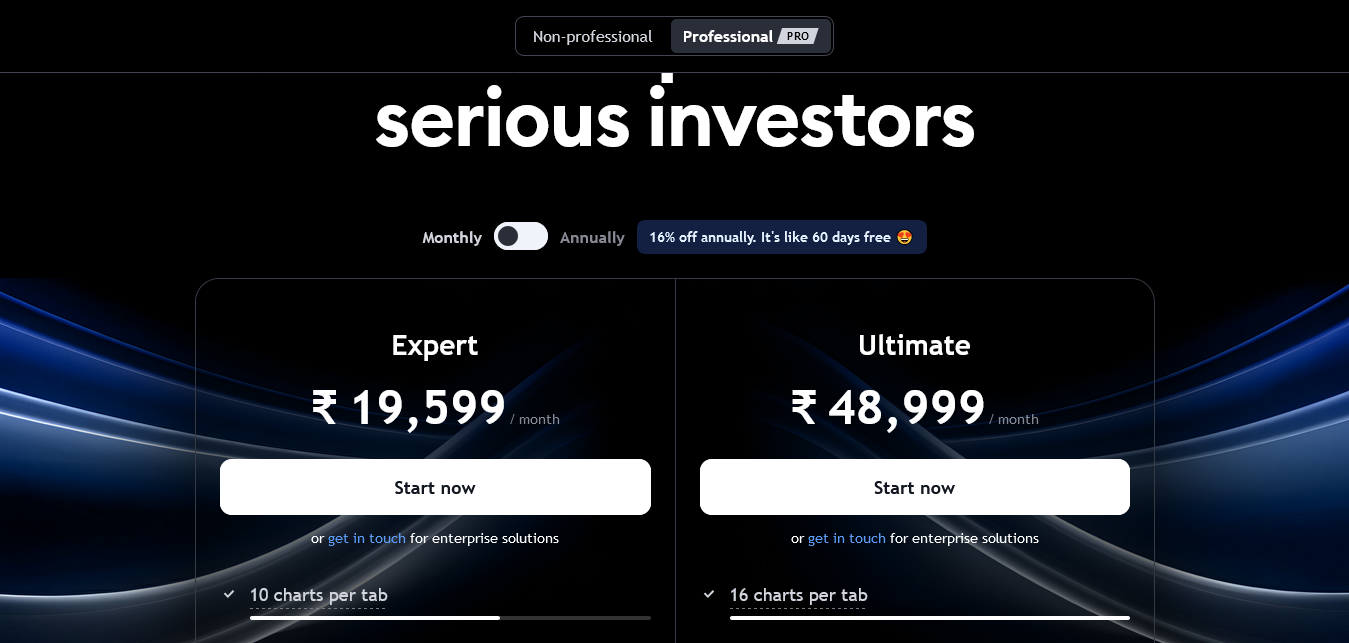

Professional Pro Plans

Monthly Subscription:

- Expert: ₹19,599 per month

- Ultimate: ₹48,999 per month

Annually Subscription:

- Expert: ₹16,333 per month | ₹1,95,999 per year

- Ultimate: ₹40,833 per month | ₹4,89,999 per year

TradingView Pros and Cons

To round up some pros and cons:

Pros:

- Options for every trader from basic to professional

- Broker integration

- Customization makes it suitable for all trading styles

- A social network for connecting

- Try risk-free for 30 days

Cons:

- Many plans can confuse new users

- The basic plan has ads

- Access to trade execution may be limited

- Best features require paid plans

Tradingview Alternatives

In India, there are several alternatives to TradingView that offer specialized features for Indian stock traders and investors. Chartink is a popular choice with powerful charting tools and custom screener options tailored to NSE stocks. It allows users to create custom scans based on technical indicators, making it ideal for those who want Indian-market-focused screening.

Zerodha Kite is another robust platform, known for its seamless integration with Zerodha’s brokerage services. It offers advanced charting, indicators, and tools designed specifically for the Indian market. Similarly, Upstox Pro offers a clean interface with real-time data, customizable indicators, and charting for both NSE and BSE stocks.

For traders focused on technical analysis, Investing.com provides an India-specific version with NSE/BSE stock charts, screeners, and indicators for free. TickerTape is also popular among Indian investors, focusing on fundamentals and offering easy-to-use stock screening and research tools.

Finally, Sensibull is an options trading platform that integrates well with several Indian brokerages, offering powerful analytics, strategy recommendations, and real-time options data, which is useful for those trading options on Indian exchanges.

Some fundamental analysis tools have been covered in detail in the post – best stock analysis platforms

Final Thoughts

TradingView is an absolute necessity for technical analysis. It has every indicator and tool needed, displayed simply and effectively. It’s extremely affordable too. Whether a newbie or a professional, TradingView is a great solution and is trusted by over 60 million traders. Use it for a 30-day free trial to experience the difference TradingView offers. Get started risk-free today.

Investors who want to explore assets beyond the stock market can check out more detailed articles below