Introduction

In today’s fast-paced business environment, efficient spend management and corporate card solutions are critical for companies aiming to control expenses and streamline financial processes. Wallester and Pleo are two leading fintech platforms competing in Europe and the UK, each offering distinct approaches to expense automation and card issuing. This article provides an unbiased, side-by-side comparison of Wallester and Pleo, covering features, pricing, use cases, and pros and cons to help you decide which spend tool best fits your company’s needs in 2025.

Quick Comparison Table

| Feature | Wallester | Pleo |

| Card Issuing | Direct issuing, virtual & physical cards | Virtual & physical cards |

| Pricing | Free for SMEs, transparent fees on scaling | Subscription-based pricing, FX markup & seat charges |

| Automation & Integrations | Extensive API, real-time spend controls | Polished automation, strong integrations with accounting |

| User Experience | Direct control, scalable for large teams | User-friendly, polished UI with cashback feature |

| Best for | Fast issuing, cost control, agencies, marketing teams | SMEs valuing automation and software experience |

| Key Differentiator | Scale, direct issuing infrastructure | Software ease of use, cashback perks |

Detailed Feature Comparison

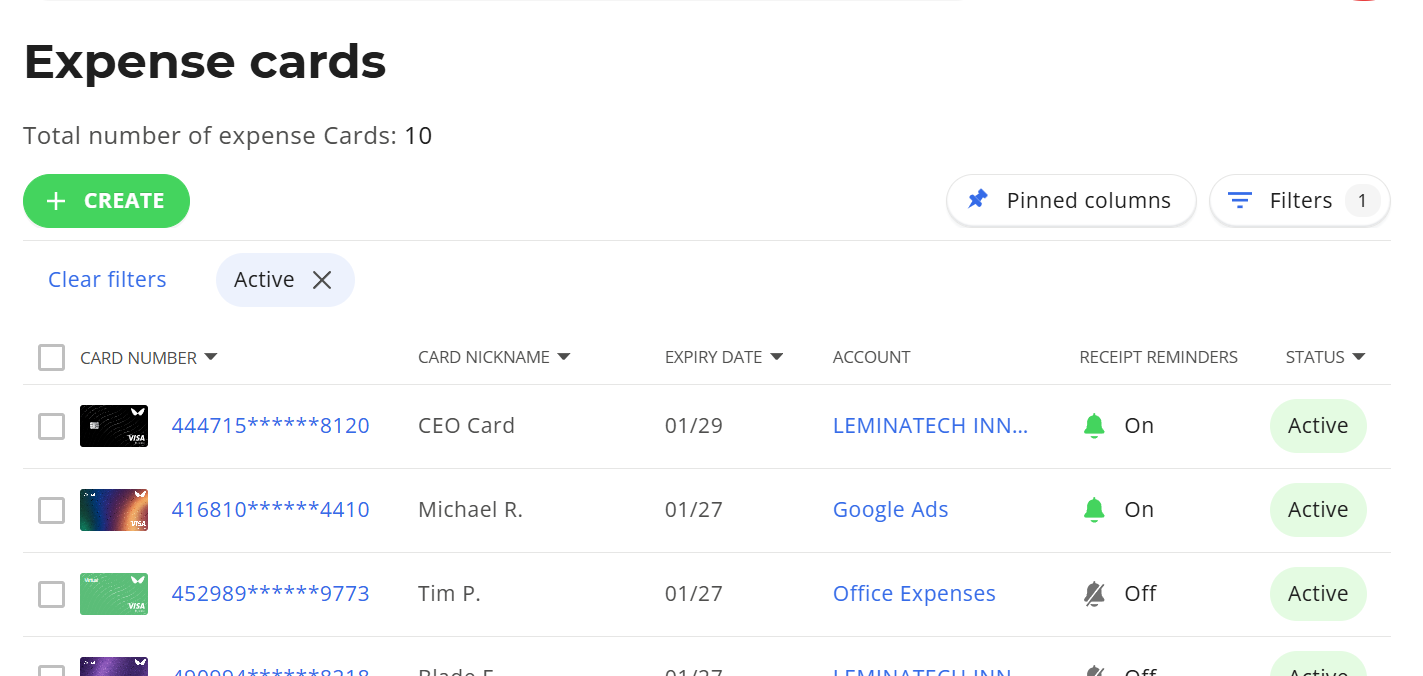

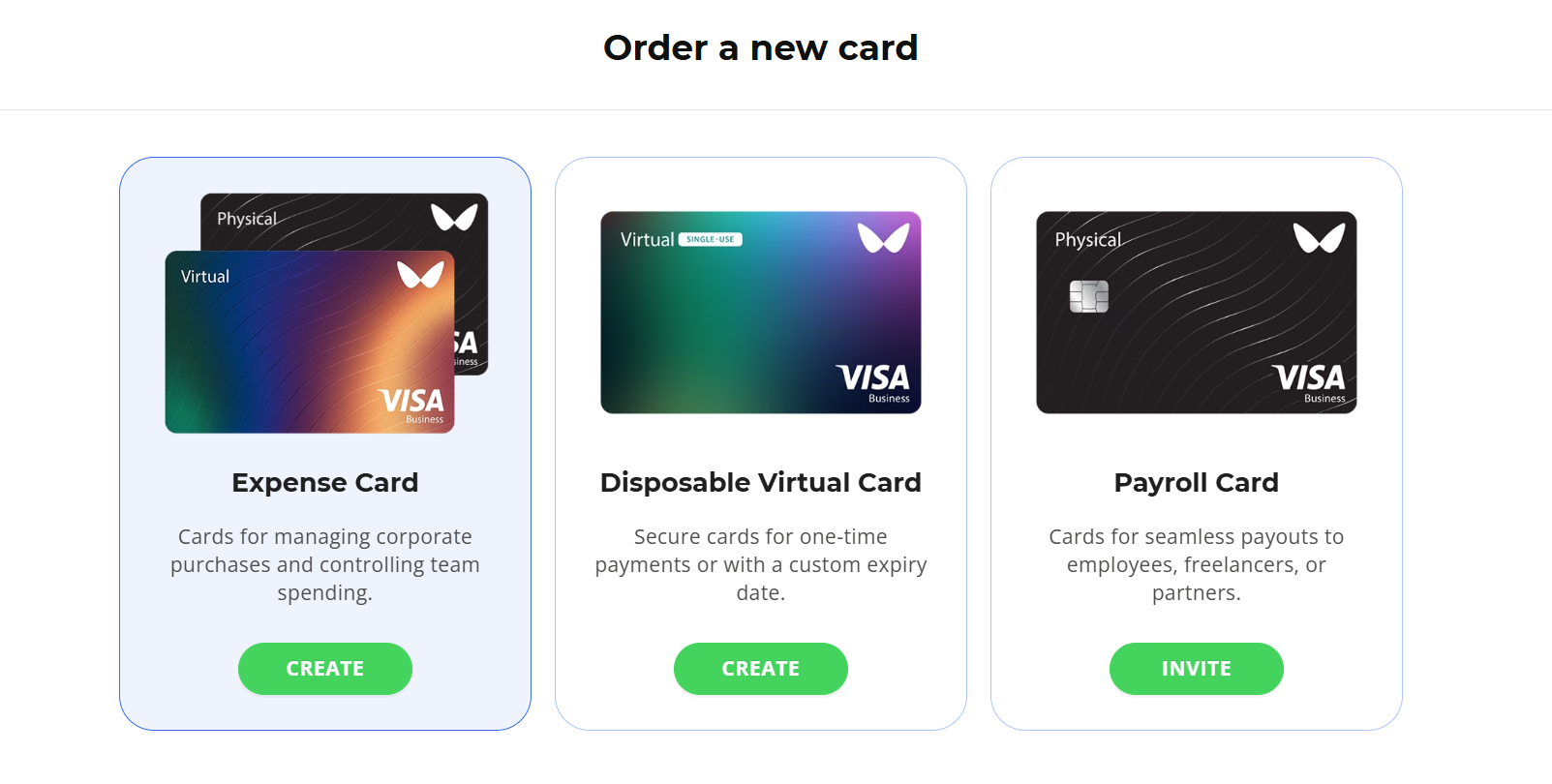

Card Issuing and Spend Controls

Wallester specializes in direct card issuing at scale, serving companies that need rapid card deployment with multi-department controls and FX cost management. Pleo offers a smooth experience emphasizing software-centric spend automation and a subscription pricing model with seat licenses.

Automation and Integrations

Pleo excels at automating expense approvals, receipt capture, and categorization, integrating tightly with popular accounting platforms like Xero and QuickBooks. Wallester offers a robust API allowing custom integrations and real-time transaction monitoring, ideal for companies needing granular control.

User Interface and Experience

Pleo’s UI is polished and intuitive, which appeals to smaller teams who want minimal setup friction and an engaging user experience with cashback incentives. Wallester’s interface focuses on scalability and direct operational control, preferred by larger or fast-moving organizations.

Pricing Comparison

Important: Wallester and Pleo use fundamentally different pricing structures, so your true cost depends on the number of cards/users and transaction volumes.

Pleo Pricing (Subscription Model)

| Plan | Monthly Cost (GBP) | What’s Included |

| Starter | £9.5 (max 3 users, yearly billing) | Cards, expense management, integrations for basic bookkeeping |

| Essential | £11/additional user/month (3 users included) | All Starter features + reimbursements, approval workflows |

| Advanced | £15/additional user/month (3 users included) | All Essential features + 0.5% cashback, budgets, HRIS integrations |

| Beyond | £18/additional user/month (3 users included) | All Advanced features + 0.75% cashback, insights, sub-accounts |

Typical Teams:

- 10 users on Essential: £11 x (10 – 3) = £77 + £0 (3 users included) = £77/month

- 10 users on Advanced: £15 x (10 – 3) = £105/month

Annual Examples:

| Team Size | Essential (Annual) | Advanced (Annual) | Beyond (Annual) |

| 5 users | £11×2 = £22/month x12 = £264 + 3 included users (£0) = £264/year | £15×2=£30/month x12=£360/year | £18×2=£36/month x12=£432/year |

| 10 users | £77/month x12 = £924/year | £105/month x12 = £1,260/year | £126/month x12 = £1,512/year |

| 25 users | £242/month x12 = £2,904/year | £330/month x12 = £3,960/year | £396/month x12 = £4,752/year |

Additional Costs:

- FX fees: 1.99–2.49% (Essential/Advanced/Beyond, depending on plan)

- ATM withdrawal: £5/withdrawal

- Invoice payments: £0.95–1.50/invoice (most plans)

- Direct reimbursements: 0.9% (Essential/Advanced), Free (Beyond)

- Setup: Included

- External bookkeeper: £12/month[user]

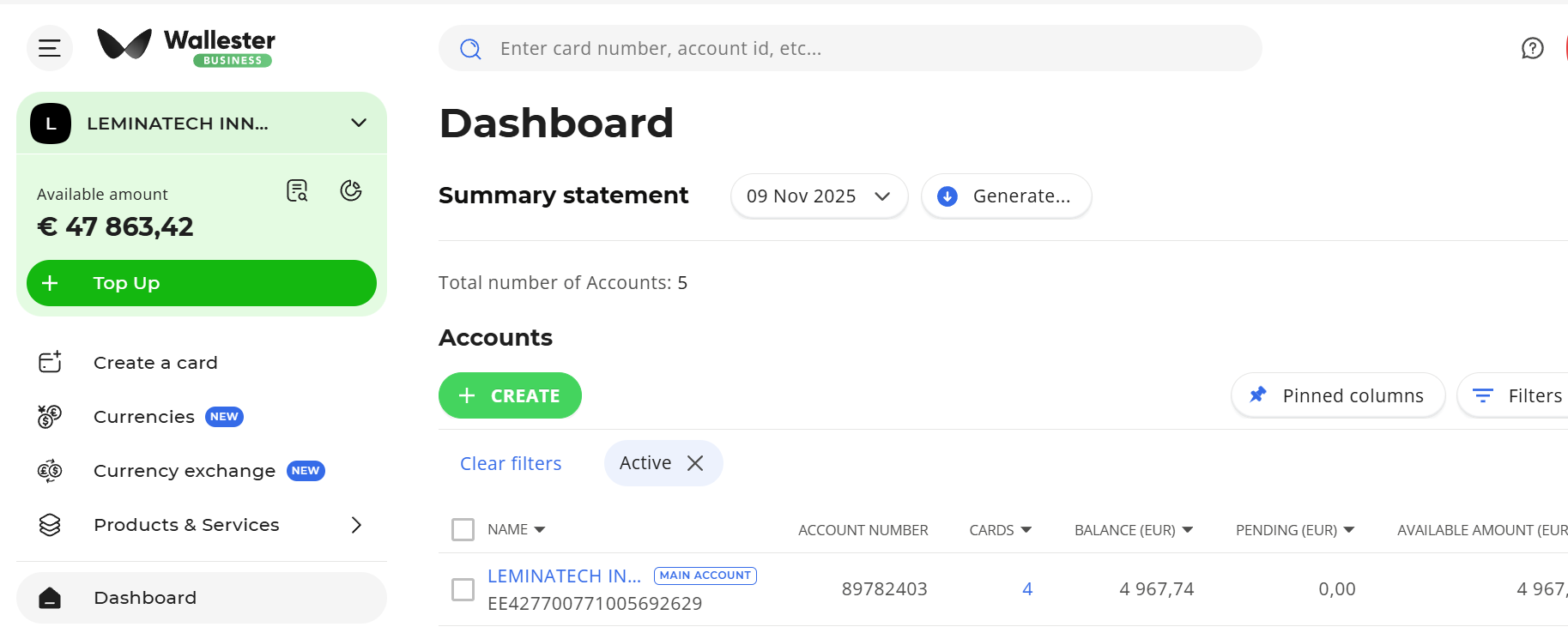

Wallester Pricing (Usage-Based Model)

| Plan | Monthly Cost (EUR) | What’s Included |

| Free | €0 | 300 virtual cards, unlimited physical cards, unlimited users |

| Premium | €199 | 3,000 virtual cards, advanced analytics |

| Platinum | €999 | 18,000 virtual cards, onboarding support |

| Enterprise | Custom | Custom contracts, dedicated support |

Costs & Add-ons:

- Additional virtual cards: €0.35/month (Free/Premium), €0.10/month (Platinum)

- Physical cards: Standard delivery €5/card (Unlimited issued)

- Account top-up by card: 1.2% (EUR only)

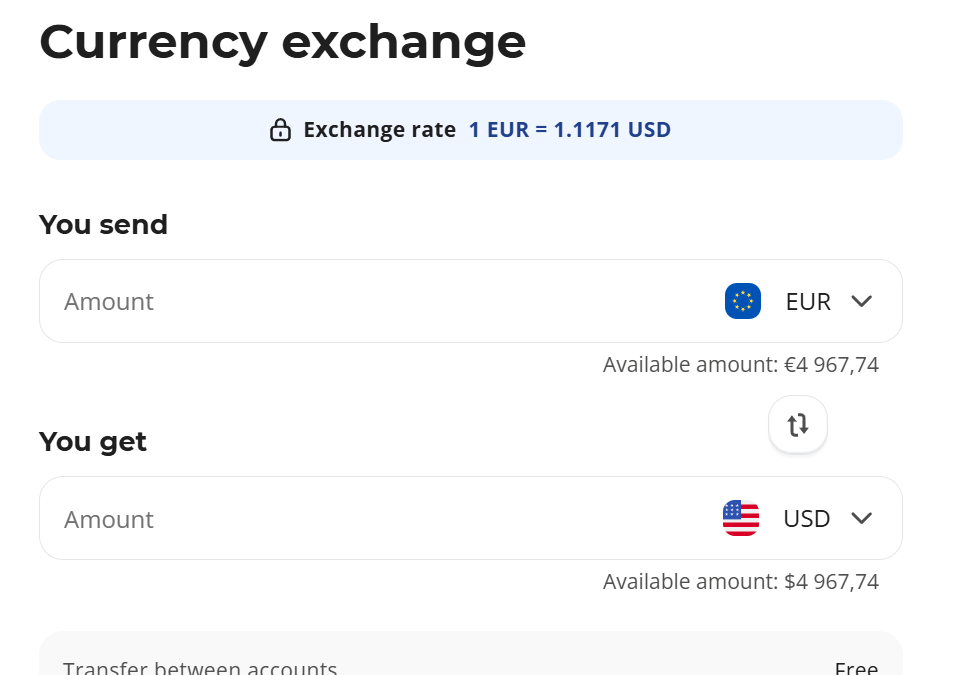

- FX fees: Visa rate + 2%

- ATM withdrawal: 2% (min €2, Europe), €2 + 2% (international)

- No per-user or monthly seat fees

Annual Examples:

| Team Size | Free Tier (Annual) | Premium (Annual) | Platinum (Annual) |

| 5 users | €0 + cards as needed | €199×12=€2,388 | €999×12=€11,988 |

| 10 users | €0 + €5/card fee | €199×12=€2,388 | €999×12=€11,988 |

| 25 users | typically €0 (300 free cards) | €199×12=€2,388 | €999×12=€11,988 |

| 50+ users | typically €0 (300 free cards) | €199×12=€2,388 | €999×12=€11,988 |

Add-ons increase with volume—calculate using card issue/delivery and FX/spending fees as required.

Cost Comparison Table (Representative Calculations)

| Team Size | Pleo Essential (Annual) | Wallester Free+Add-ons (Annual) | Difference |

| 5 users | £264 | €0–50 (cards) + usage fees | Wallester 75–90% cheaper |

| 10 users | £924 | €0–100 (cards) + usage fees | Wallester 80–90% cheaper |

| 25 users | £2,904 | €0–200 (cards) + usage fees | Wallester 80–90% cheaper |

| 50 users | £5,544 | €0–400 (cards) + usage fees | Wallester 80–90% cheaper |

*Wallester costs depend on card delivery, monthly FX/ATM/transaction fees, and chosen plan (Premium/Platinum for more cards/users). Contact Wallester for custom volume pricing.

Choosing the Right Pricing Model for Your Team

Choose Pleo if:

- Want predictable, all-inclusive monthly costs.

- Need extensive features and integrations.

- Prefer budgeting simplicity.

Choose Wallester if:

- Want scalable card issuance and only pay for what you use.

- Have many cards/users but limited monthly spend.

- Prefer true pay-as-you-go, no per-seat charges.

Hidden Costs to Consider

Pleo:

- FX fees (starting at ~2%), ATM, invoice, and bookkeeper fees.

- Forced to pay for all seat/license slots (inactive included).

- Tiered features require whole-team plan upgrades.

Wallester:

- FX/ATM/transaction costs increase with spend.

- Card delivery fees if using physical cards.

- Premium/Platinum upgrades for large teams.

- Custom plans may require sales negotiation.

Best Use Cases: Which Business Should Pick Which Platform?

- Choose Wallester if:

- You need to issue a large number of cards quickly to teams or agencies.

- Controlling FX and operational costs is a high priority.

- You want direct infrastructure control and scalable spend rules.

- Choose Pleo if:

- You prefer a polished, software-first spend management experience.

- Your team values easy receipt capture, automatic categorization, and cashback.

- You are a smaller or mid-sized company wanting speed and simplicity.

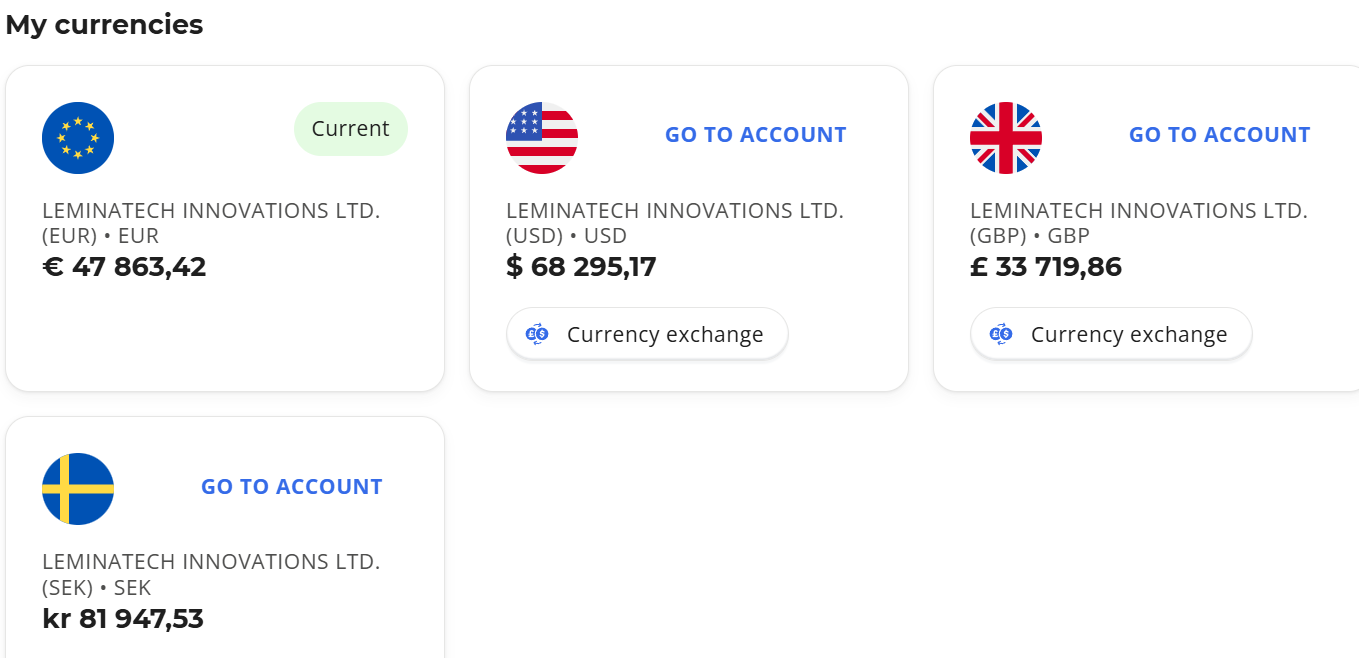

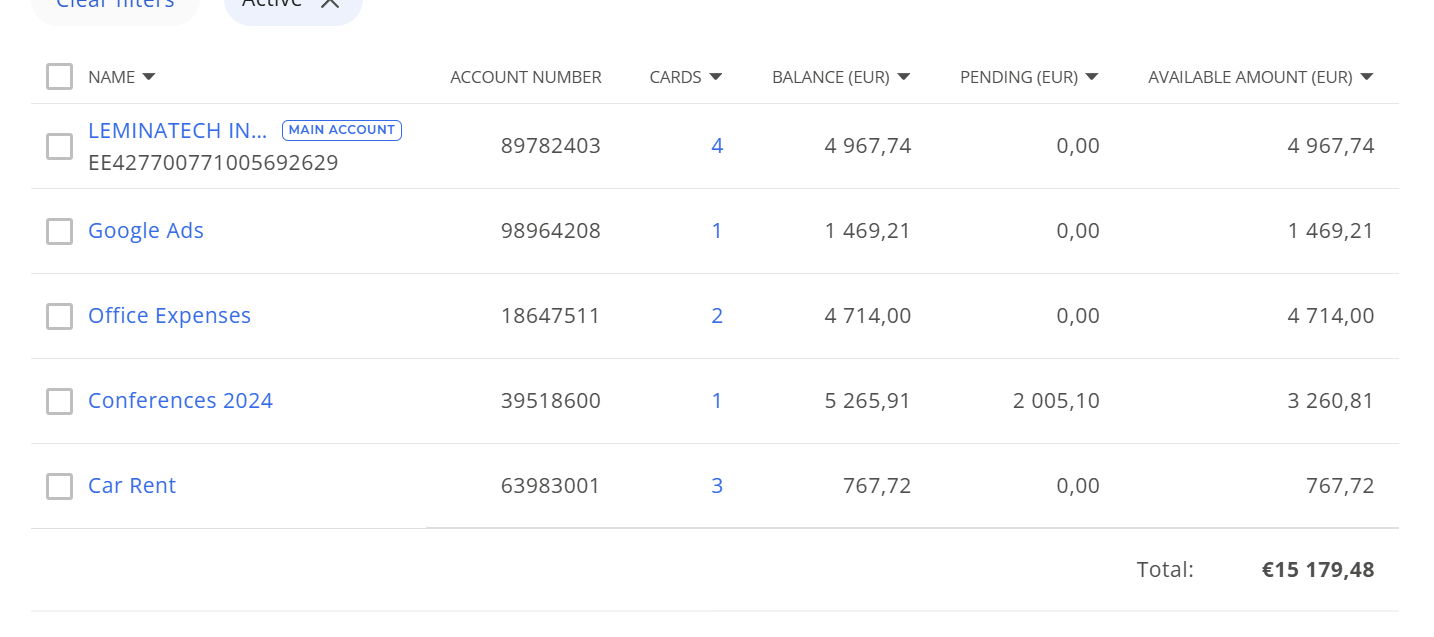

Real Screenshots

Pros and Cons

| Aspect | Wallester Pros | Wallester Cons | Pleo Pros | Pleo Cons |

| Card Issuing | Scalable, fast issuance | UI less polished than Pleo | User-friendly UI, cashback perks | FX fees and seat licenses can add up |

| Integration | Strong API, real-time control | Some integrations complex | Easy integrations, automation | Limited direct issuing control |

| Pricing | Transparent, no per-seat charges | Less attractive for small teams | Easy setup, cashback offsets cost | Pricing can escalate quickly |

User Reviews: Balanced Feedback from Real Customers

Wallester – What Users Like and Dislike

-

- Positive:

“Easy to use with strong customer service,” and “Great for managing large volumes of cards without seat fees.”

- Positive:

- Negative:

“High fees on out-of-Europe ATM withdrawals,” “Customer service can be slow or unhelpful in resolving some issues,” “Difficulties buying stock via virtual cards,” and “Insufficient balance notifications.”

(Source: G2, Capterra, Trustpilot)

Pleo – What Users Like and Dislike

- Positive:

“Beautifully designed UI and excellent automation,” “Cashback helps offset FX fees,” “Fast and responsive support.” - Negative:

“Subscription fees higher than competitors, especially for larger teams,” “Accumulating foreign exchange fees,” “UI could use better onboarding,” and “Paying for inactive users is frustrating.”

(Source: G2, Capterra, Finder)

Final Verdict

Both Wallester and Pleo replace outdated expense reports with real-time, transparent spending visibility but optimize for different customer priorities:

- Wallester is the choice for companies wanting scale, direct issuing, cost control, and granular spend governance, especially agencies, marketing, or operations teams handling large card volumes.

- Pleo caters to companies that prioritize a smooth, user-friendly interface with software automation and cashback benefits, ideal for smaller or medium teams looking to simplify expense management with an engaging user experience.

For startups or businesses growing rapidly, consider your needs for scale versus polish and test product demos of both to identify the best fit.

FAQ: Wallester vs Pleo

- What is the main difference in pricing between Wallester and Pleo?

Wallester uses a freemium, usage-based pricing model with a free tier offering 300 virtual cards and pay-as-you-go fees for cards and transactions. Pleo uses a subscription model with tiered plans charging per user, and additional fees for FX and other services. - Can I issue unlimited cards on both platforms?

Wallester offers unlimited physical cards and 300 free virtual cards even on the free plan. Pleo has card limits based on your subscription plan, with physical cards available on higher tiers. - What about foreign exchange fees?

Wallester charges at Visa’s interbank rate plus a 2% markup on FX conversions with no internal issuer fees. Pleo includes an FX markup between 1.49% and 2.49%, depending on your plan level. - How does onboarding compare?

Wallester onboarding is fast, typically completed within hours. Pleo offers self-serve onboarding for entry tiers but requires sales demos for advanced plans, leading to longer setup times. - Which platform has better automation and integrations?

Pleo provides strong native integrations with popular accounting tools like Xero and QuickBooks plus expense automation and reimbursements. Wallester offers APIs for custom integrations and focuses more on scalable card issuance. - Are there rewards or cashback programs?

Pleo offers cashback (0.5–0.75%) on higher-tier plans, which can offset some fees. Wallester does not have cashback but provides savings through free card issuance and no seat fees. - Are there any hidden costs to watch for?

Wallester users should budget for potential FX markups, ATM fees, and card delivery costs. Pleo users pay FX fees, subscription per-seat charges, and invoice or reimbursement fees depending on plan. - Which platform is better for large teams?

Wallester is generally more cost-effective for large teams due to no per-user fees and a scalable card issuance model. Pleo’s per-seat subscription costs can become expensive as headcount grows.