Introduction

For decades, Indian investors were limited to domestic equities. But today, with the rise of fintech platforms and global PMS offerings, investing in international stock markets has never been easier.

From Apple and Microsoft to Nvidia and Novo Nordisk, many of the world’s most innovative companies are listed outside India. For investors, the key question is: “How do I access these opportunities, and why should I?”

In this guide, we’ll cover:

-

Why global diversification is essential.

-

The impact of INR vs USD currency movement.

-

The different routes available: Mutual Funds, ETFs, PMS (like BayFort Capital), and direct platforms such as Vested.

-

A 2025 performance comparison of different markets (India vs US vs Korea vs Brazil etc).

-

A comparison table and FAQs for clarity.

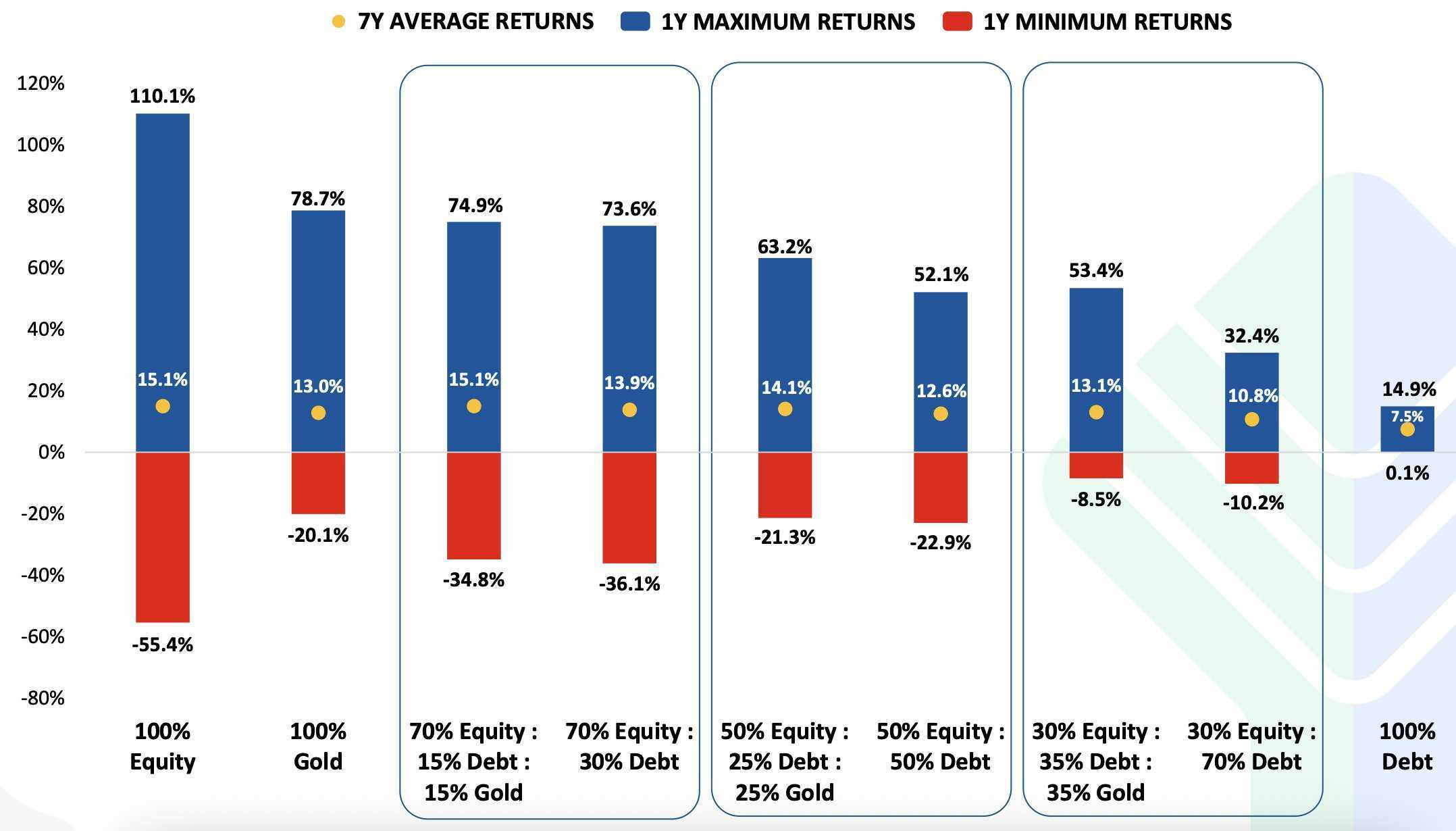

Why Global Diversification Matters

a) Reducing Country Risk

Investing only in India exposes you to risks such as political changes, sector concentration, or regulatory shocks. Global diversification spreads these risks.

Example:

-

China grew its GDP at ~13.5% CAGR (2000–2021), yet the Hang Seng Index returned just 1% CAGR due to governance and market structure issues

Lesson: GDP growth ≠ and stock market returns. Diversifying across countries protects investors from such mismatches.

b) Performance Comparison: India vs Global

Over the last decade, returns varied across geographies:

-

S&P 500 (US): ~11% CAGR in USD.

-

Nikkei 225 (Japan): ~9% CAGR in recent years.

-

Nifty 50 (India): ~12% CAGR, but with more volatility.

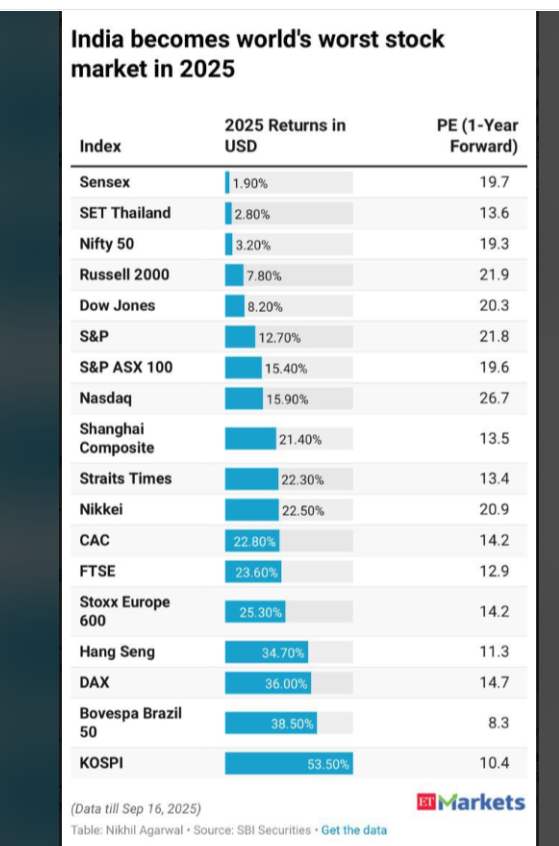

This year (2025 YTD), global markets tell a powerful story:

Global Equity Market Performance YTD 2025

-

The year 2025 has been a mixed bag across geographies. While some markets surged, others lagged due to sectoral and macroeconomic reasons.

Country/Index YTD 2025 Performance Key Drivers India (Nifty 50) ~0% Slower earnings growth, banking sector drag. US (S&P 500) +12.8% AI and tech rally (Nvidia, Microsoft), strong corporate earnings. South Korea (Kospi) +40.5% The semiconductor boom led by Samsung and SK Hynix. Brazil (Bovespa) +25.0% Commodity rally (iron ore, oil), central bank rate cuts fueling momentum.

Investors who were globally diversified captured Korea and Brazil’s strong run, while India lagged.

INR vs USD – The Currency Impact

When investing globally, Indians must factor in currency movement:

-

The INR depreciates against USD by ~3–4% annually on average.

-

In 2005, $1 = ₹44. In 2025, $1 = ₹83+.

Impact on returns:

-

If the S&P 500 delivers 10% in USD terms, an Indian investor could earn ~13% in INR terms after currency adjustment.

-

This depreciation has historically boosted INR returns from global markets.

Risk case: If the INR strengthens (rare, but possible), returns may reduce. But over the long term, rupee depreciation usually benefits global investors.

Routes for Indians to Invest Internationally

a) Mutual Funds (FoFs)

-

Indian AMCs offer International Mutual Funds via Fund of Funds (FoF).

-

Examples: Motilal Oswal Nasdaq 100 FoF, Franklin US Opportunities.

-

✅ Easy to buy, INR-denominated.

-

❌ Double expense ratio, limited choice.

b) International ETFs (India-listed)

-

Example: Motilal Oswal Nasdaq 100 ETF.

-

✅ Lower cost, traded on NSE/BSE.

-

❌ Limited liquidity, narrow exposure.

c) Global PMS / AIFs (HNIs/UHNIs)

Global PMS allows curated portfolios of international stocks.

Case Study: BayFort Capital PMS

BayFort Capital

-

1Y return (as of Aug 2025): +19.6% INR.

-

Benchmark S&P 500: +20.3%.

-

Nifty 50: -3.2%.

-

Since inception (2022): +127.9% cumulative.

A strong example of how a professional PMS can deliver global exposure.

Ticket size: ₹10 lakh+ (HNIs only).

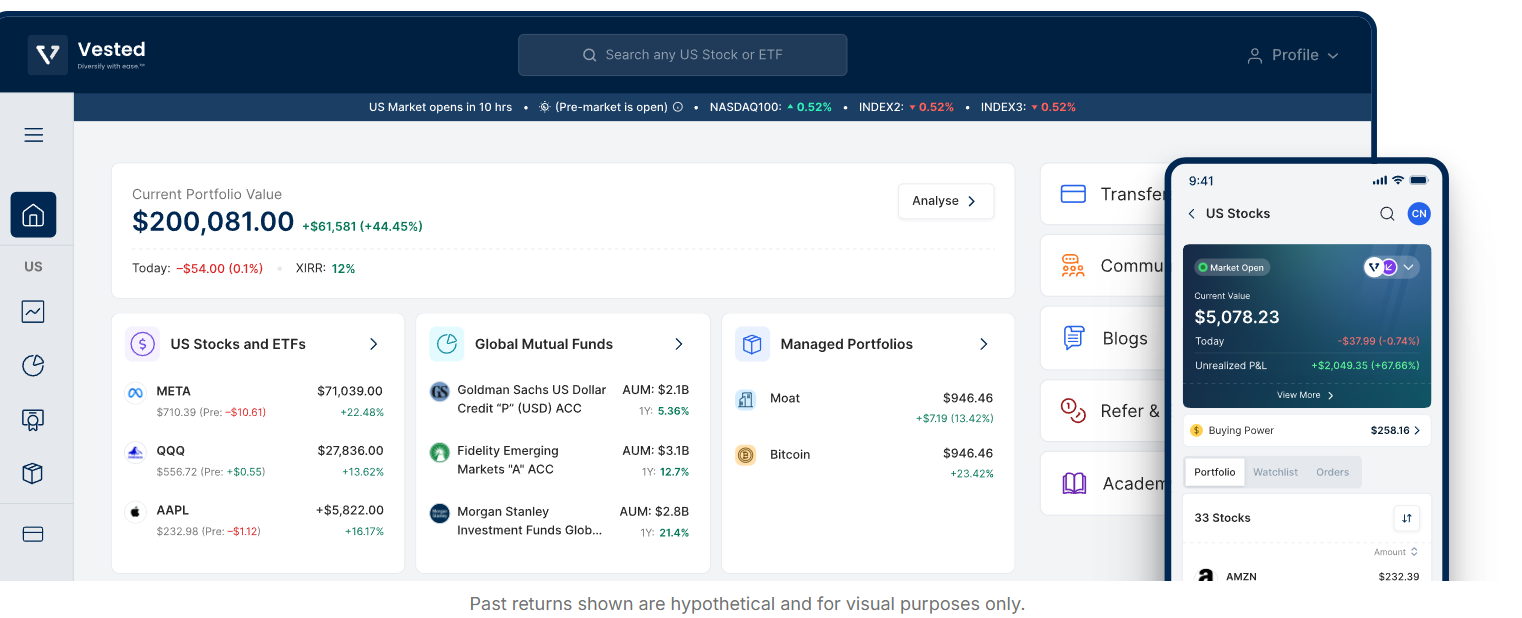

d) Direct US Investing via Platforms (Vested, INDmoney, Groww Global)

Among fintech players, Vested Finance is the most popular.

How Vested Works

-

Onboards Indian investors digitally (PAN-based).

-

Funds transferred via RBI’s Liberalized Remittance Scheme (LRS).

-

Offers fractional US stocks + curated portfolios (“Vests”).

Costs

-

Forex conversion ~0.5–1%.

-

Commission-free trades on the basic plan.

-

Annual LRS cap: $250,000.

Pros

✅ Fractional shares (start small).

✅ Thematic portfolios.

✅ SEBI-compliant.

Cons

❌ US-only exposure.

❌ Forex costs.

❌ Tax reporting required (Schedule FA).

e) Overseas Brokers (IBKR, Schwab)

-

For sophisticated investors wanting Europe, Japan, or broader markets.

-

✅ Advanced tools, global access.

-

❌ Higher entry, compliance-heavy.

Comparison of Routes (2025)

| Route | Min Investment | Markets Covered | Pros | Cons | Example |

|---|---|---|---|---|---|

| Mutual Funds (FoFs) | ₹500 | US (Nasdaq 100, S&P 500) | Easy, INR-based | Double expenses, limited choice | Motilal Oswal Nasdaq 100 FoF |

| International ETFs | ₹1,000 | US indices | Low cost, NSE/BSE listed | Low liquidity | Motilal Nasdaq 100 ETF |

| PMS / AIFs | ₹10 lakh+ | Global Large Caps (US + others) | Active mgmt, curated | High ticket, fees | BayFort Global Leaders PMS |

| Direct Platforms | ₹1,000 (fractional) | US only | Direct ownership, themes | Forex costs, tax reporting | Vested Finance |

| Overseas Brokers | $25,000+ | US, Europe, Asia | Full global access | Complex compliance | Interactive Brokers |

Popular International Mutual Funds & ETFs for Indian Investors (2025)

| Fund / ETF | Type | Market Focus | Min Investment | Key Features | Suitable For |

|---|---|---|---|---|---|

| Motilal Oswal Nasdaq 100 FoF | Mutual Fund (FoF) | US Tech-heavy (Nasdaq 100) | ₹500 | INR-based, SIP option, invests in MO Nasdaq 100 ETF | Retail investors starting small |

| Franklin US Opportunities Fund | Mutual Fund | Broad US equities (large & mid-cap) | ₹5,000 | Diversified US exposure, active management | Investors wanting US-focused MF |

| ICICI Prudential Global Stable Equity Fund | Mutual Fund (FoF) | Global developed markets | ₹5,000 | Defensive global equities, lower volatility | Conservative investors |

| Motilal Oswal Nasdaq 100 ETF | ETF (NSE/BSE) | US Nasdaq 100 | 1 unit (~₹100+) | Low cost, transparent, listed in India | ETF-savvy investors |

| Nippon India Hang Seng BeES ETF | ETF (NSE/BSE) | Hong Kong / China (Hang Seng) | 1 unit (~₹150) | Exposure to Chinese & HK companies | Investors wanting China play |

| Edelweiss MSCI World Index FoF | Mutual Fund (FoF) | Global (MSCI World Index) | ₹500 | Diversified across 23 developed countries | Investors seeking broad global mix |

| Mirae Asset NYSE FANG+ ETF FoF | Mutual Fund (FoF) | US Tech Giants (FANG+) | ₹500 | Focused on 10 high-growth tech names | Aggressive tech-focused investors |

| Kotak NASDAQ 100 FoF | Mutual Fund (FoF) | US Nasdaq 100 | ₹500 | Alternate to Motilal, INR-based | Beginners in US tech exposure |

| Edelweiss Greater China Equity Offshore FoF | Mutual Fund (FoF) | Greater China (China, HK, Taiwan) | ₹5,000 | Exposure to Chinese growth sectors | High-risk, aggressive investors |

| Motilal Oswal MSCI EAFE Top 100 ETF FoF | Mutual Fund (FoF) | Europe, Australia, Japan (ex-US) | ₹500 | Diversified EAFE exposure | Investors wanting developed market mix |

| Edelweiss Europe Dynamic Equity Offshore FoF | Mutual Fund (FoF) | Europe (Euro Stoxx) | ₹5,000 | European equities, diversified sectors | Investors seeking Eurozone exposure |

| Kotak Japan Equity Fund FoF | Mutual Fund (FoF) | Japan equities (Nikkei, Topix) | ₹5,000 | Japan-focused, innovation-led sectors | Long-term investors in Asia developed mkts |

| Edelweiss ASEAN Equity Offshore FoF | Mutual Fund (FoF) | ASEAN (Singapore, Thailand, Indonesia, Malaysia, Philippines) | ₹5,000 | Captures ASEAN growth & demographics | Investors wanting SE Asia diversification |

| HSBC Brazil-focused FoF | Mutual Fund (FoF) | Brazil equities (commodities, banks, energy) | ₹5,000+ | Exposure to LatAm commodity cycle | Risk-tolerant EM inv |

Top Platforms for International Shares

-

BayFort Capital – Global PMS for Indian HNIs

BayFort Capital is a SEBI-registered investment management firm specializing in global equity portfolios. Established in 2021, BayFort focuses on building a concentrated portfolio of 15–20 of the world’s top companies, with a strong tilt toward innovation-driven sectors like AI, healthcare, biotech, renewables, and cloud infrastructure.

Philosophy

BayFort’s Global Leaders Portfolio follows three principles:

-

Hard Science Moats – Investing in companies with strong technological or scientific advantages (e.g., Microsoft, Novo Nordisk).

-

Forensic Financial Analysis – Deep dissection of company accounts to avoid accounting red flags.

-

Inflection Point Investing – Identifying moments where Wall Street underestimates a company’s growth trajectory.

This results in a concentrated, high-conviction portfolio targeting secular global trends.

Performance (as of Aug 2025)

-

1 Year (INR terms): +19.6%

-

Since Inception (July 2022): +127.9% cumulative (~29.7% annualized)

-

Benchmark (S&P 500 in INR): +90.9% cumulative (~22.7% annualized)

-

Nifty 50 (INR): +54.8% cumulative (~14.8% annualized)

BayFort has significantly outperformed both Indian equities and the US benchmark, thanks to its focus on innovation-led large caps.

Portfolio Characteristics (2025 Snapshot)

BayFort Capital

-

Holdings: 21 stocks

-

Examples: Microsoft, Intuit, KLAC (semiconductors), Novo Nordisk (healthcare), Sea Limited (tech/commerce).

-

Metrics:

-

Weighted Avg. ROE: ~50%

-

EPS CAGR (CY24–26): ~22%

-

PE multiple: ~37x

-

Key Details

-

Minimum Investment: ₹10 lakh (Indian residents), $25,000 (others).

-

Structure: PMS / Separately Managed Account.

-

Benchmark: S&P 500.

-

Fees: ~2.5% including GST

-

Custody: Interactive Brokers (US DTC system).

-

Liquidity: No lock-in, daily liquidity.

Why BayFort Stands Out

-

Founder-led expertise: Ketul Sakhpara (ex-Franklin Templeton NY, ex-Tudor Pickering Hedge Fund).

-

Global scope: Up to 30% non-US holdings for added diversification.

-

Concentrated strategy: 15–20 stocks vs. 100+ in typical global funds.

-

Focus on innovation themes: AI, cloud, biotech, healthcare, renewables – sectors often underrepresented in Indian markets.

Vested Finance – Overview, Features & Considerations

Vested Finance is a fintech platform that enables Indian residents to invest directly in US-listed stocks, ETFs, and curated portfolios (“Vests”). It simplifies the cross-border investment process under India’s Liberalised Remittance Scheme (LRS) and handles many of the operational complexities for users.

Key Features & How It Works

| Feature | Details |

|---|---|

| Account Opening / KYC | Fully digital onboarding tied to Indian PAN & bank account. |

| Markets Covered | Primarily US stocks and ETFs. Also, OTC securities (for certain non-US companies) via the over-the-counter route. |

| Fractional Shares | You can invest as little as $1 in portions of a share. |

| Curated Portfolios (“Vests”) | Pre-built themed portfolios (e.g. “Moat”, “SaaS”, multi-asset classes) that users can invest in with one click. |

| Fund Transfer & Remittance | Vested partners with Indian banks to facilitate remittance with zero fixed fees (vs ₹500–₹1,500 typical bank fees) and improved FX exchange rates. |

| Fee Structure & Brokerage | – For Basic Plan: ~0.25% trade commission (capped at $35) – For Premium Plan: Lower trade commission (0.15%) with added perks like free withdrawals and advanced features. – Withdrawal fee: $5 per withdrawal; 2 free withdrawals per year (in premium) – FX Markups: ~1.5% over interbank rate via Vested vs higher markups if bank transfers are used directly. |

| Security & Custody | Securities are held with regulated U.S. custodians. Vested is a registered broker-dealer (VF Securities Inc.) under U.S. regulations (FINRA/SIPC). Accounts have SIPC protection up to $500,000. |

| Tax / Reports / Compliance | Vested provides tax reports to help with Indian ITR filings. Users must declare foreign holdings (Schedule FA) and deal with capital gains and dividend taxation as per Indian law. |

Advantages of Vested

-

Low barrier to entry — fractional investing allows starting small.

-

Ease of remittance — avoids fixed bank remittance charges, saves time, and offers better FX rates via the platform’s banking partnerships.

-

Curated portfolios — for investors who don’t want to pick individual stocks.

-

Transparency & tracking — fund transfer status and holdings are visible in real time.

-

Security & regulatory compliance — holdings are with U.S. custodians; regulated broker structure.

Risks / Limitations / Things to Watch

-

Market coverage is U.S.-centric — exposure to Europe, Japan, and ASEAN is limited (except via OTC or ADR routes).

-

FX and conversion costs — Though better than banks, markups are still ~1.5%.

-

Withdrawal costs — $5 for withdrawals; the premium plan gives limited free withdrawals.

-

Regulatory / tax complexity — Indian investors must comply with foreign asset reporting, capital gains rules, and dividend withholding.

-

Custody risk & platform risk — If the platform had issues, you would need to rely on custodians or brokers to access your holdings. (Some users have asked about this in forums)

Taxation of International Investments

-

Capital Gains:

-

LTCG (>24 months): 20% with indexation.

-

STCG (<24 months): Slab rate.

-

-

Dividends: Taxed abroad (e.g., 25% in US), eligible for DTAA credit in India.

-

Compliance: Must disclose foreign holdings in ITR Schedule FA.

Key Takeaways

-

Allocate 10–20% of equity portfolio internationally.

-

Use Mutual Funds/ETFs for simplicity.

-

Use Vested/INDmoney for direct US stocks.

-

HNIs can use PMS (like BayFort) for global curation.

-

Expect INR depreciation to work in your favor long-term.

7. FAQs

Q1. What’s the minimum amount to start international investing?

With platforms like Vested, you can begin with as little as ₹1,000 (fractional shares).

Q2. Is it better to use Mutual Funds or Vested?

Mutual Funds are simpler, INR-based, and regulated locally. Vested offers direct ownership and flexibility. Both can complement each other.

Q3. Can I invest in markets beyond the US?

Yes. PMS/AIFs and brokers like IBKR allow exposure to Europe, Japan, and emerging markets.

Q4. What is the LRS limit for Indians?

$250,000 per person annually.

Q5. Do I need to pay double tax on dividends?

No. Taxes paid abroad can be adjusted in India under the DTAA treaty.

Final Thoughts

In 2025, global diversification isn’t optional—it’s essential. India’s growth story remains strong, but other markets like the US, Korea, and Brazil are delivering outsized returns.

With easy routes like Mutual Funds, ETFs, PMS (BayFort), and platforms like Vested, international investing is accessible to every Indian investor today.

Start small, diversify smartly, and think long term.

is byfort expense of 2.5% incl. GST are covered the expenses of brokerage, forex markup etc… or this expense are excluding this ? and byfort charge their 2.5% fee and brokerage and forex mark up are extra expenses ?

i hope you understand my point.

Hikalpesh,

this does not include one time forex markup which varies depending on your bank.

The broking is negligible for this portfolio hence 2.5% would be the major expense for investor!