Alternative Investment Funds (AIFs) are booming in India, with Category III AIFs driving most of the growth in 2025. By March 2025, total AIF commitments touched ₹5.38 trillion, up 32% year-on-year. More than half of all incremental flows came into Category III AIFs, largely from HNIs and NRIs.

Unlike Category I and II AIFs, Category III funds adopt hedge-fund-like strategies, often using derivatives, leverage, and quant models. Their appeal lies in their ability to deliver absolute returns and hedge market risks, making them highly attractive in volatile conditions.

This guide explains what Category III AIFs are, their key regulatory aspects, risks, and benefits, and showcases examples of some of the top Category III AIFs in India for 2025.

What are Alternative Investment Funds (AIFs)?

AIFs are privately pooled investment vehicles regulated by SEBI since 2012. They cater to sophisticated investors and allocate across alternative assets such as private equity, venture capital, real estate, hedge funds, private credit, and quant funds.

AIFs are structured into three categories:

- Category I: Early-stage ventures, infrastructure, social impact.

- Category II: Private equity, private debt, credit funds.

- Category III: Hedge-fund style strategies (long-short, arbitrage, quant, absolute return).

Minimum investment: ₹1 crore (with relaxations for accredited investors).

Eligibility: HNIs, NRIs, institutions.

Disclosure: AIFs must provide a Private Placement Memorandum (PPM) detailing strategies, fees, and risks.

Explore Alternative Investments In India

What are Category III AIFs?

We had covered category 2 in detail in the past articles. These include debt, private equity, and real estate-focused funds

Category III AIFs use complex trading strategies, including long-only, long-short, derivatives, and quant models, to deliver market-linked or absolute returns. Unlike Category I/II, they are allowed to use leverage (within SEBI limits), which can amplify both returns and risks.

Why Investors Choose Category III AIFs:

- Wide range of strategies (equity, absolute return, quant, arbitrage, multi-asset).

- Ability to deliver positive returns in both rising and falling markets.

- Strong inflows from NRIs, family offices, and treasuries due to diversification benefits.

- Focus on capital preservation + alpha generation.

In FY25, 47% of all new AIF launches were Category III, up from just 16% in FY23. This underscores their rapid rise as a preferred vehicle for sophisticated investors.

Regulatory Highlights for Category III AIFs

- Minimum investment: ₹1 crore per investor.

- Minimum scheme corpus: ₹20 crore.

- Sponsor/Manager commitment: 5% of the corpus or ₹10 crore, whichever is lower.

- Leverage: Permitted up to 2x NAV, subject to disclosures on risk and margin policies.

- Liquidity: Both open- and closed-ended structures exist; redemption terms vary.

- Risk & concentration: Limits on exposure to single securities, ensuring diversification.

Key Risks

- Market risk: Though hedged, exposure to equities and derivatives remains.

- Leverage risk: Amplifies losses during drawdowns.

- Liquidity risk: Some strategies may struggle in stressed markets.

- Model risk: Particularly in quant AIFs that rely on algorithms.

- Fee structures: Typically higher, with management + performance-linked fees.

Factors to Consider Before Investing

- Strategy clarity: Understand whether the fund is long-only, long-short, quant, or multi-asset.

- Fund manager pedigree: Track record and governance are critical.

- Liquidity & lock-in: Some funds allow periodic redemption; others impose lock-ins.

- Fee transparency: Check for management, performance, and exit fees.

- Risk management: Review the fund’s hedging, leverage, and concentration policies.

Popular Category III AIFs in India (2025)

Explore Alternative Investments In India

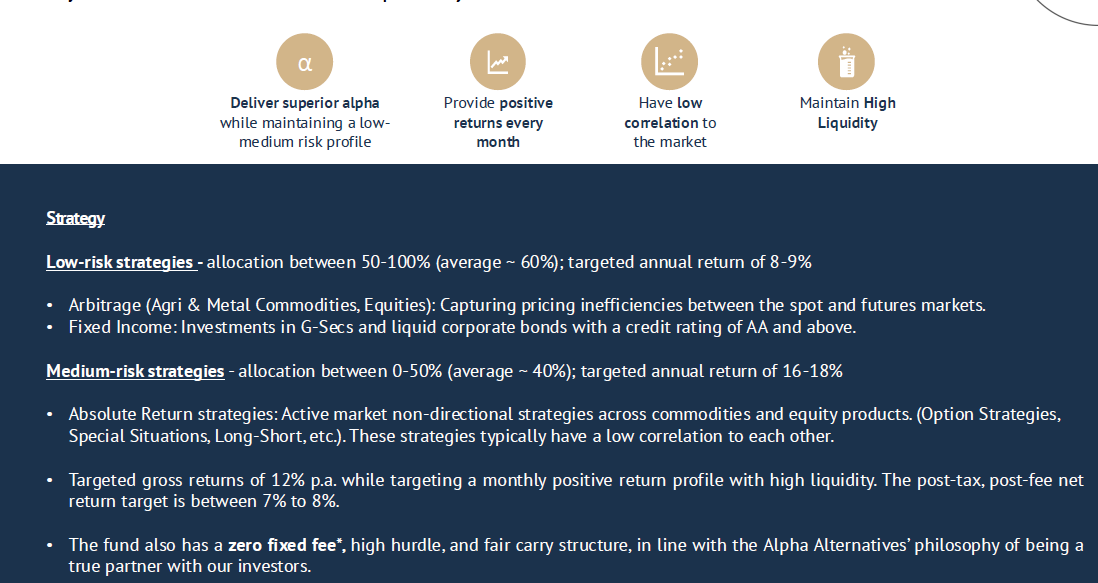

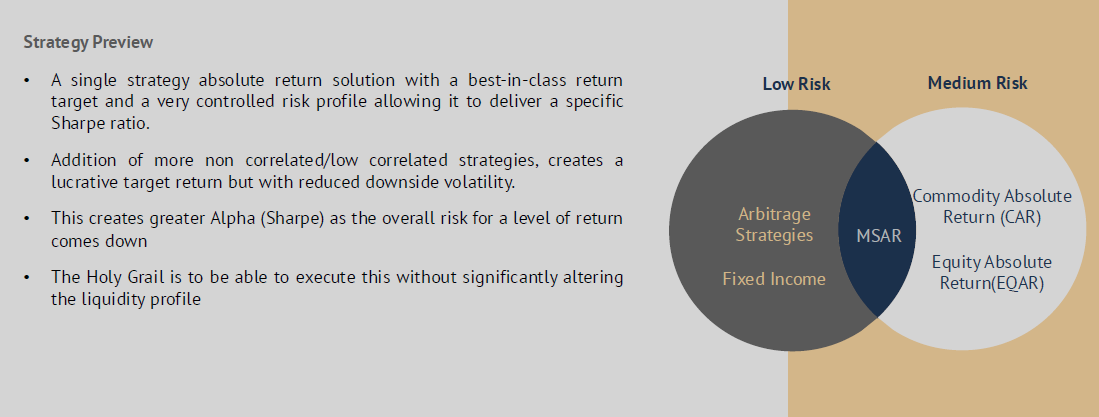

1. Alpha Alternatives – Multi-Strategy Absolute Returns (MSAR)

- Strategy: A multi-strategy design split into low-risk (50–100% allocation) and medium-risk (0–50% allocation) buckets.

- Low-risk: Commodity arbitrage, equity arbitrage, fixed income (G-Secs, AAA corporate bonds). Target 8–9% returns.

- Medium-risk: Absolute return strategies such as long-short equity, option spreads, and special situations. Target 16–18% returns.

- Performance:

- CAGR: 12.6% since inception.

- Sharpe Ratio: 3.0.

- Max Drawdown: –2.3%.

- USP: Structured to provide positive returns every month with high liquidity, appealing to family offices and treasuries.

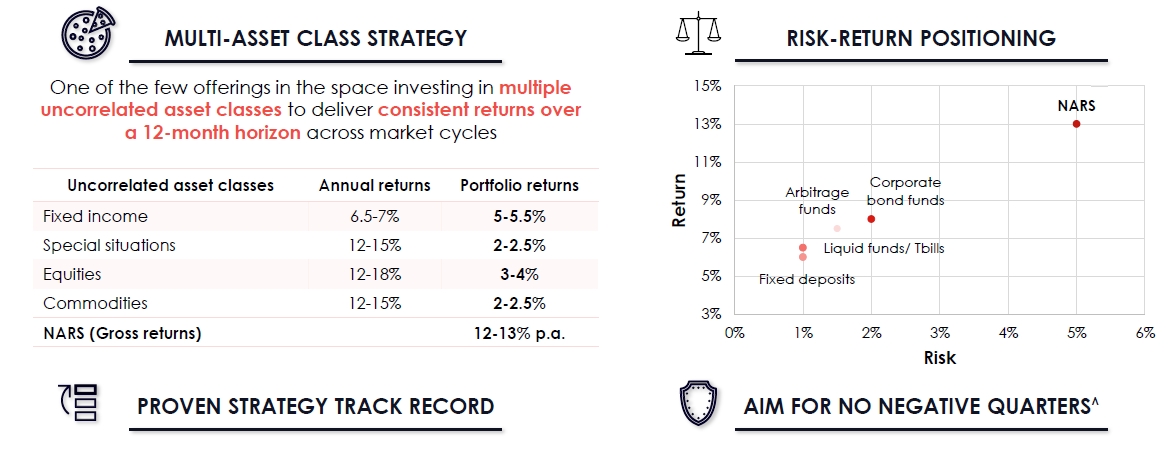

2. Nuvama Absolute Return Strategy

- Strategy: A multi-asset approach balancing 70–80% fixed income exposure with smaller allocations to equities, commodities, and special situations.

- Fixed income anchors the portfolio with a stable 6–7% yield.

- Special situations: corporate actions (open offers, mergers, demergers, buybacks).

- Equities: short-term directional calls.

- Commodities: opportunistic trades to smooth volatility.

- Performance:

- Net returns of 13%+ p.a. since inception (Jun 2023).

- 12M return: ~10.9%.

- Volatility: ~6%.

- USP: Seeks to avoid negative quarters; weekly liquidity makes it attractive to NRIs and corporates.

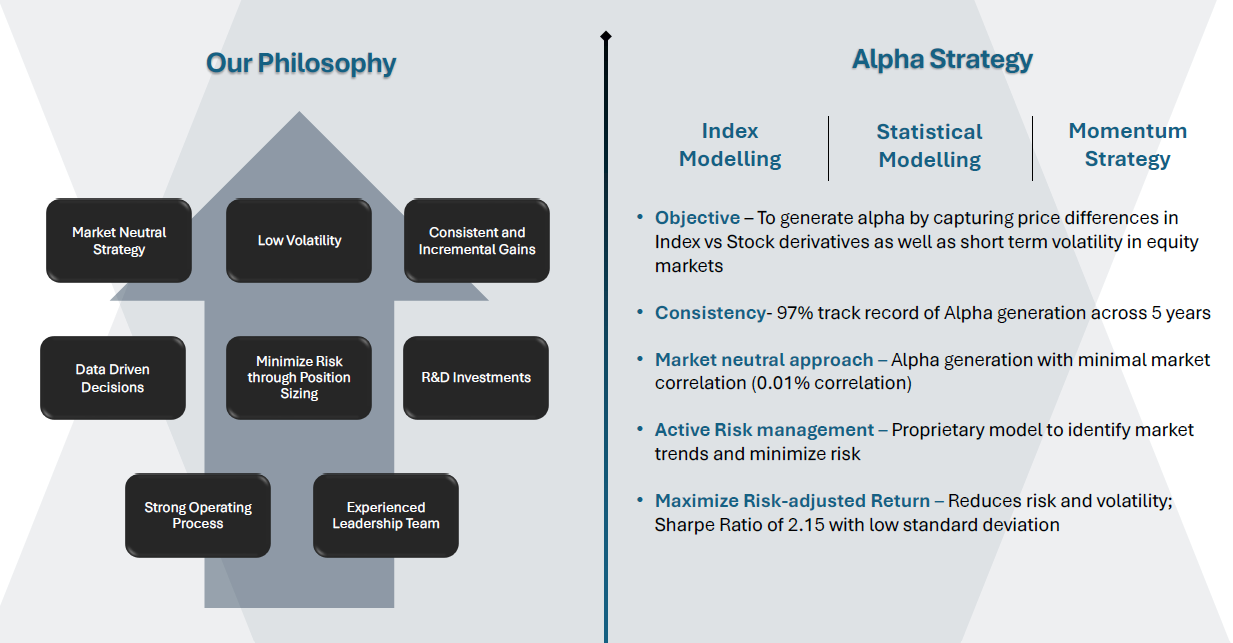

3. Whitespace Alpha – Equity Plus & Debt Plus

- Strategy: Pure quant-driven, market-neutral approach.

- Equity Plus: Captures price differences between index futures and stock futures. Uses statistical and momentum models with <0.01 correlation to markets.

- Debt Plus: Combines a debt base (AAA-rated bonds, liquid assets) with the same alpha overlay.

- Performance:

- Equity Plus: Consistent ~11–12% annual alpha

- Debt Plus: Delivers ~14–15% pre-tax by blending fixed income (7%) with quant alpha (~12%).

- USP: Extremely low volatility, high Sharpe ratio (~2.15). Designed for corporates and HNIs seeking predictability.

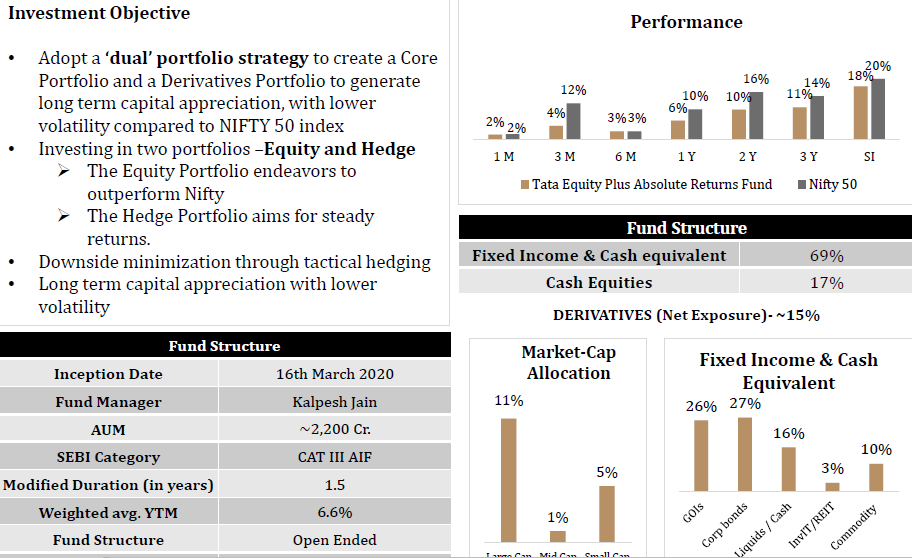

4. Tata Equity Plus Absolute Returns Fund

- Strategy: Dual portfolio model:

- Core equity portfolio: Invests in listed stocks aiming to outperform Nifty 50.

- Hedge portfolio: Uses futures and options to protect downside and manage volatility.

- USP: Long-short style that provides smoother returns compared to long-only equity PMS/AIFs.

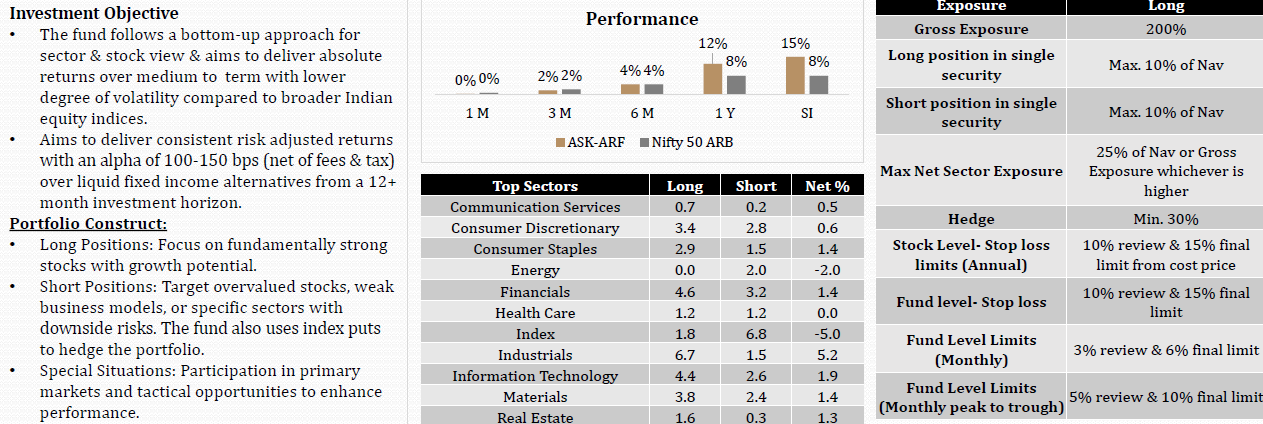

5. ASK Absolute Return Fund

- ASK Absolute Return Fund: Focuses on long-short equity and hedging, aiming for low drawdowns and consistent alpha over benchmarks.

Conclusion

Explore Alternative Investments In India

Category III AIFs are the fastest-growing segment of India’s alternatives market in 2025, attracting significant flows from HNIs and NRIs. With strategies ranging from multi-asset absolute return (MSAR, Nuvama MARS) to quant-driven alpha models (Whitespace Alpha, Alphaalternative), investors now have access to sophisticated hedge-fund-like vehicles within SEBI’s regulatory framework.

While they offer higher-return potential and diversification, their complexity and use of leverage demand careful due diligence. For investors seeking innovation, downside protection, and consistent alpha, Category III AIFs are emerging as a powerful addition to Indian portfolios.

Disclaimer: This article is for information and educational purposes only and should not be considered financial or investment advice. Investments in AIFs are subject to market risks, regulatory changes, and liquidity constraints. Past performance is not indicative of future results. Please consult a SEBI-registered financial advisor before making any investment decisions.