Alternative Investment Funds (AIFs) are becoming the talk of the town in India’s investment landscape, steadily gaining traction among high-net-worth individuals, family offices, and savvy institutional investors. By the end of March 2025, AIF investments rose 32% year-on-year to INR 5.38 trillion, thanks to market volatility, inflation concerns, and a growing desire to diversify beyond stocks and fixed deposits. As investors hunt for better yield and stability, debt AIFs, falling under Category II AIFs, are emerging as a favourite choice.

In this article, we will look at the top-performing debt AIFs in India, the basics of debt AIFs, the private credit market in India, and the things you should keep in mind before investing in debt AIFs.

What Are Debt AIFs?

Debt-based AIFs focus on investing in privately structured debt deals, and include underlying instruments such as corporate bonds, securitised debt instruments, non-convertible debentures (NCDs), commercial papers, asset-backed securities, and direct private credit. Category II Debt AIFs are now allowed to invest in listed debt securities with a credit rating of ‘A’ or below. These debt AIFs fill the credit gap where traditional banks are cautious, often lending to mid-sized companies, MSMEs, real estate ventures, or providing special situation financing to stressed companies.

Most sub-categories of debt AIFs fall under Category II specified in the AIF Regulations. These funds attract investments from HNIs, family offices, institutional investors, and global alternative asset managers. Debt AIFs are pass-through vehicles, meaning that the interest and dividend income is taxed based on the investor’s slab at the hands of the investor, instead of the fund, while capital gains depend on holding periods and structure.

Rise of Private Credit in India

The exponential growth of private credit in India, in the recent past, evidently makes a compelling case towards investing in debt AIFs. As of early 2025, private credit deals hit a USD 10 billion in deal value for FY24, up more than 10x from a decade ago. Private credit assets under management nearly tripled in the past five years, reaching USD 25 billion in 2025, and are projected to soar toward USD 60-70 billion by 2028. A PwC study suggests that the Indian private credit market witnessed 15–16% growth in value and volume in 2024, with a forecasted growth rate of about 25–30%.

Domestic fund managers have begun to dominate the private credit market share. PwC notes that the domestic private credit players trumped global funds by completing around 63% of the total deal value in the second half of FY24. Regulatory support from SEBI and the Reserve Bank of India, coupled with the maturing insolvency framework, continues to drive investor confidence in the private credit asset class.

Top 5 Debt AIFs in India

-

Northern Arc Money Market Alpha Fund (Cat III AIF)

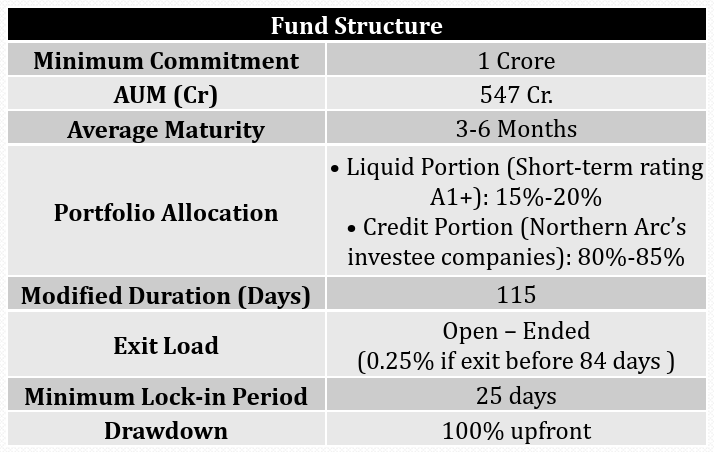

A Category III open-ended AIF from the Northern Arc platform (Northern Arc Capital and Northern Arc Investment Managers) targeting to generate superior risk-adjusted returns by investing in a well-curated mix of credit & liquid allocations over a short-term investment horizon.

The Fund invests in Money market instruments, such as Government Securities, Treasury Bills, Commercial Papers, Certificates of Deposit, Non-Convertible Debentures, and Pass-Through Certificates, that have a residual maturity of less than 1 year. The fund has a yield of over 11% and an AUM value of INR 547 crore, with an average maturity period of 3-6 months and a minimum lock-in period of 25 days. Around 15-20% of the investable funds are allocated into liquid instruments, while 80-85% is allocated in the credit segment.

-

Vivriti Diversified Bond Fund II

Offered by Vivriti Asset Management, Vivriti Diversified Bond Fund II is a Category II SEBI-registered AIF. The Fund aims to generate stable and predictable risk-adjusted returns by investing in debt issued by mid-sized corporates. Vivriti has a strong track record reassuring the team’s credibility in core credit investing across cycles, with strong performance on INR 24,000 crore of total investments.

The fund aims for a target return of around 12.5% to 13.5% and has a fund size of INR 1500 crore and a green-shoe option of INR 500 crore. This close-ended fund has a term of 5 years from the date of first close declared in February 2024.

-

InCred Credit Opportunities Fund II

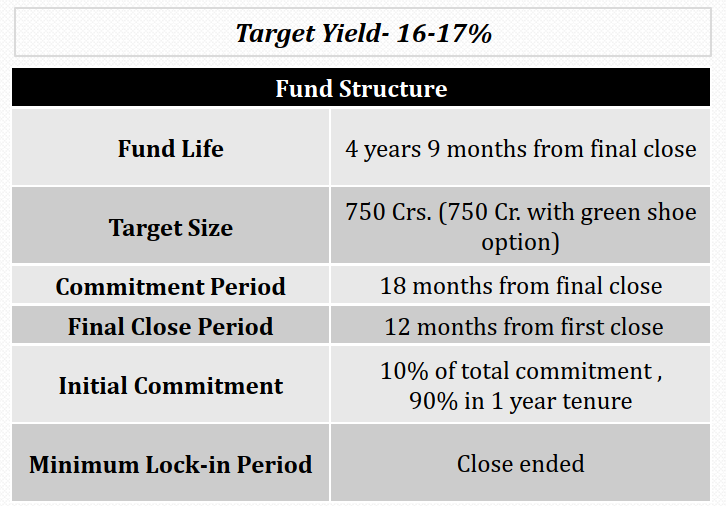

InCred Credit Opportunities Fund II or ICOF–II is a performing credit AIF fund offered by InCred Alternative Investments. It aims to create compelling risk-reward by taking thoughtful secured credit positions in flexible financing transactions to cater to the growth capital requirement of emerging to mid-market Indian companies.

ICOF–II to follow a strict governance structure, under which the oversight of portfolio management is done by a 2-member external committee, resulting in an independent & unbiased review of the portfolio on a regular basis. The fund has a target yield of 16-17% and has a target fund size of INR 750 crores with additional INR 750 Crores in green shoe option. The term is 4 years and 9 months from the date of final close, and the fund has a commitment period of 18 months from the date of final close.

-

Neo Special Credit Opportunities Fund II (NSCOF II)

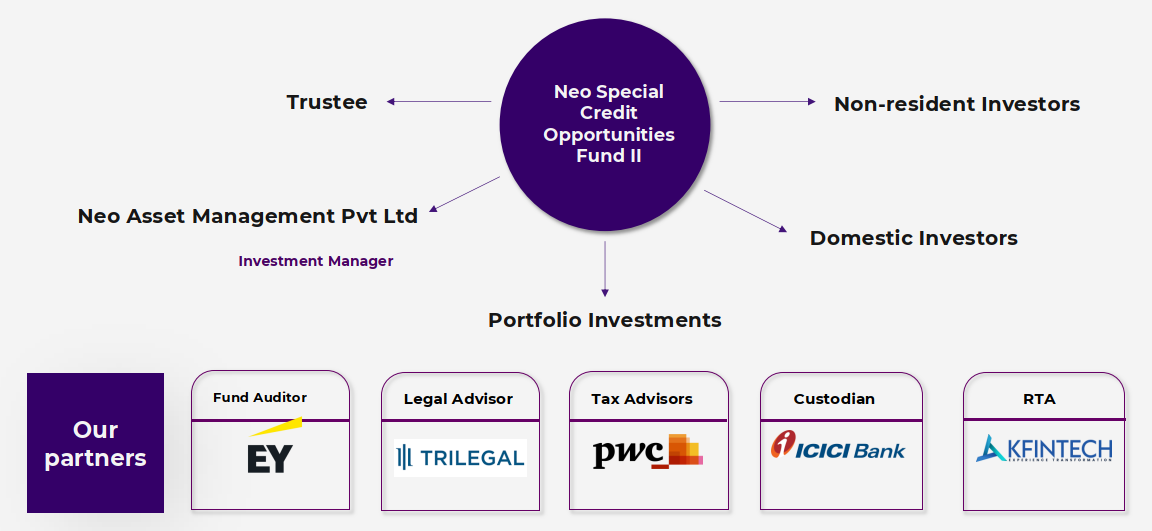

Neo Special Credit Opportunities Fund II, is a SEBI-registered Category II AIF intending to invest in credit opportunities in cash flow generating, collateral-backed companies in well-established industries. The Fund will be managed by Neo Asset Management, a Fund Manager with over INR 9000 Crore in AUM. NSCOF II is a sequel of NSCOF-I, having a similar investment objective and strategy.Learn more about this fund.

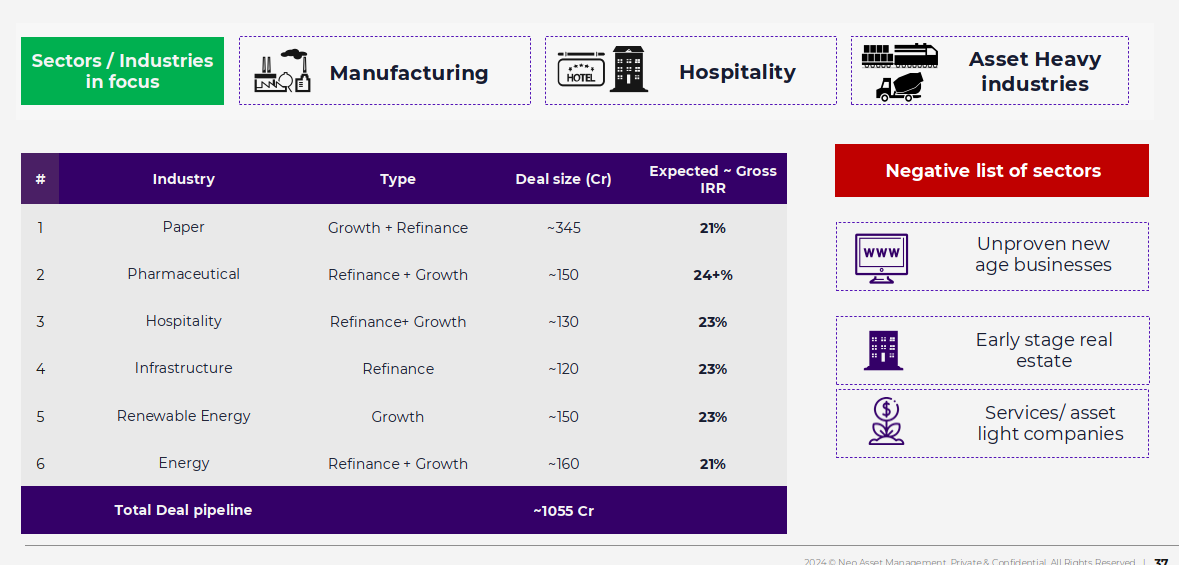

NSCOF II has a target size of INR 5000 Crore, and intends to deploy the funds across 25-30 deals, with each deal size of approximately INR 120 to 300 crores each. The fund intends to make 100% secured lending with a minimum 2X collateral, and aims for target returns of 22-24%. The fund has a deal pipeline of approximately. INR 1055 Crore, across different sectors of manufacturing, hospitality, asset-heavy industries, etc.

-

Sundaram Performing Credit Opportunities Fund I

Sundaram Performing Credit Opportunities Fund I is a 5-year close-end Category II AIF, aiming to invest in high-yielding debentures in addition to mezzanine securities primarily to mid-market companies in India with sales/revenues between INR 250-5000 crore backed by a combination of business cash flows, promoter assets, guarantees share pledges and other security structures as may be relevant.

Sundaram Alternates has a proven private credit track record of over 7 years, with over INR 3100 crores raised across five different Category II AIFs. Sundaram Performing Credit Opportunities Fund I has a fund size of INR 1500 crore, with an additional green shoe option of INR 500 crore, and has a target IRR of 15%. The fund has a tenure of 5 years, extendable by 2 years.

Key Considerations for Investing in Debt AIF

Before investing in Debt AIFs, it’s important to understand the credit risk involved. These funds often lend to mid-sized or emerging companies, and while fund managers perform thorough credit checks, borrower defaults or delayed payments can occur, especially during economic slowdowns.

Liquidity is another critical factor. Debt AIFs usually come with lock-in periods of three years or more, and exiting early can be difficult or costly since secondary markets are limited. So, only invest money you can keep tied up for the medium to long term.

Fees tend to be higher than in mutual funds because of active management and detailed credit analysis. Besides management fees, performance-linked fees may apply, so focus on net returns after all charges. As an investor, you should go through the placement memorandum of the fund to understand all the intricacies of costs and distribution of investment proceeds.

Finally, carefully evaluate the fund manager’s track record and investment process. Strong experience, good credit assessment, and portfolio diversification help manage risks effectively. You can gauge the track record of the fund manager from the placement memorandum, while also carefully going through the terms o the contribution agreement and other fund documents.

Conclusion

Debt AIFs, powered by private credit and regulated structures, offer sophisticated investors a dynamic way to boost yields and diversify portfolios. With the private credit market maturing and attracting robust global and domestic interest, the outlook remains upbeat. For those with patience and a higher risk appetite, top Debt AIFs in India provide unique access to a rapidly growing and diversifying segment of India’s financial ecosystem.

Disclaimer: Debt AIFs are privately placed investment vehicles, and as a result, it is crucial to carefully go through all fund documents before investing in any one specific fund to understand the key terms, costs and investment strategy employed. Especially, the key terms of the fund laid down in the private placement memorandum, as well as the terms of the contribution agreement executed by the investor, are crucial.