Introduction – Why Choose an Online Tax Filing Service?

The days of standing in long queues at your local income tax office are long gone. In 2025, filing your income tax return (ITR) can be done in under 15 minutes from your laptop or phone.

But the big question is – which platform should you choose?

Among the popular names like ClearTax, Quicko, and myITreturn, TaxBuddy has emerged as a strong contender. Known for combining AI-driven automation with human expert review, TaxBuddy claims to offer the accuracy of a Chartered Accountant with the speed of a tech platform.

In this detailed TaxBuddy review, we’ll cover:

-

How TaxBuddy works

-

Pricing & plans

-

Features & benefits

-

Pros & cons

-

How it compares with competitors

-

Who should use it

-

Final verdict

What is TaxBuddy?

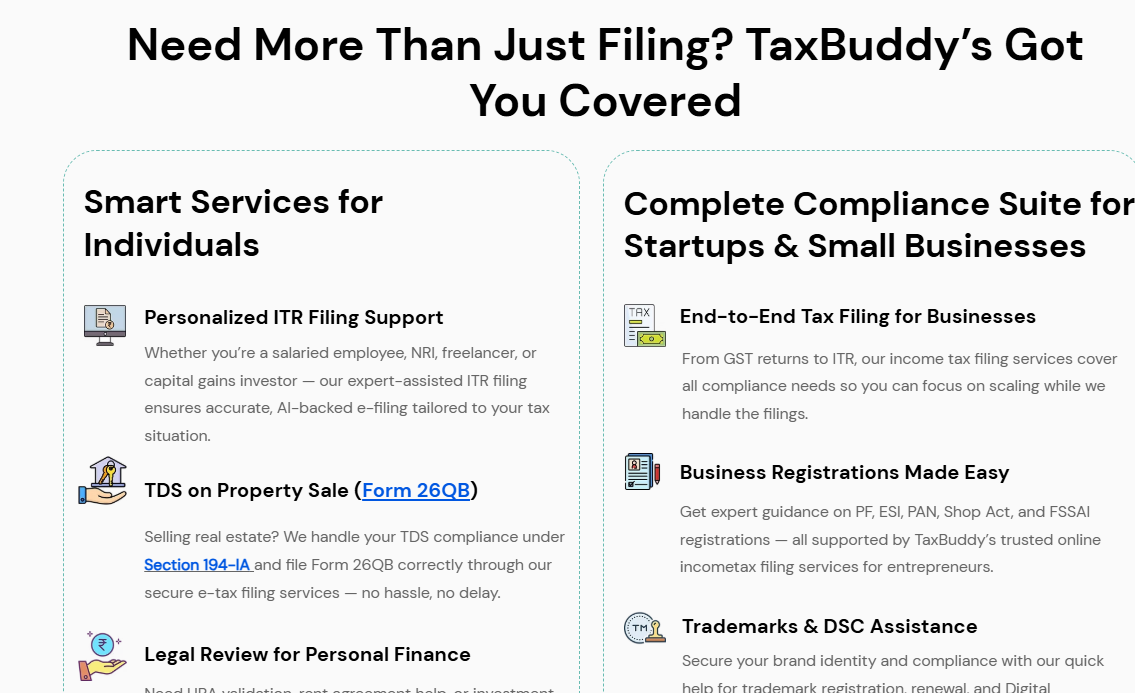

TaxBuddy is an online tax filing and advisory platform that helps individuals, freelancers, businesses, and NRIs with:

-

Income Tax Return (ITR) Filing

-

GST Filing

-

Tax Planning & Advisory

-

TDS & Compliance Services

It was designed to address two common pain points in online tax filing:

-

Automated tools often make mistakes with complex cases.

-

Offline CAs can be slow and expensive.

TaxBuddy’s hybrid model means you upload your details online, but a qualified CA reviews your filing before submission — giving you peace of mind.

How Does TaxBuddy Work?

Filing your taxes with TaxBuddy is a 4-step process:

-

Sign Up & Upload Documents

Create a free account on TaxBuddy.com, choose your service (ITR, GST, etc.), and upload your documents (Form 16, bank statements, capital gains reports, etc.). -

AI + Expert Review

The platform’s AI scans your data, applies relevant deductions, and generates a draft return. A qualified tax expert reviews this draft for accuracy. -

Approval & Payment

You review the prepared return. Once you approve, you pay the fee (depending on the plan) and the CA e-files your return with the IT department. -

Post-Filing Support

TaxBuddy provides follow-up services like refund tracking, rectification requests, and responding to tax notices.

TaxBuddy Features & Benefits

1. CA Review for Every Filing

Unlike DIY platforms, every return is checked by a real CA before submission, reducing the risk of errors.

2. AI-Driven Error Detection

TaxBuddy uses algorithms to detect mismatches, missing deductions, and incorrect tax rates.

3. GST Filing for Businesses

Monthly/quarterly GST returns with reconciliation support.

4. Specialized NRI Services

Helps NRIs manage double taxation issues, income from India, and capital gains.

5. Notice Handling

If you receive a tax notice, TaxBuddy offers support to respond effectively.

6. Affordable Pricing

Plans start from a few hundred rupees for simple filings.

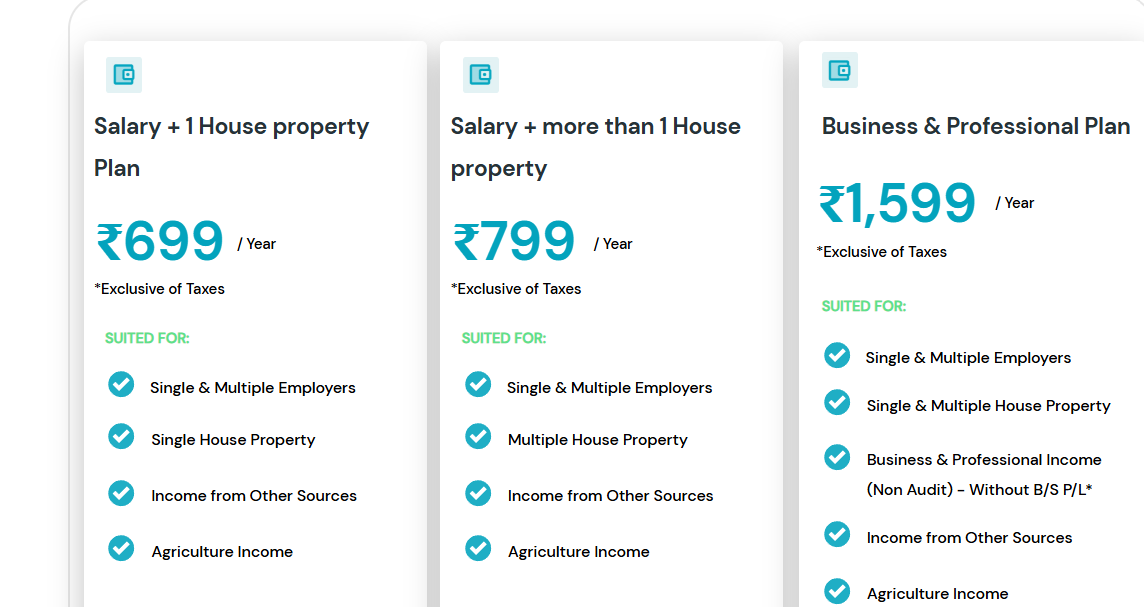

TaxBuddy Pricing (2025)

| Plan | Suitable For | Features | Price Range (₹) |

|---|---|---|---|

| Basic ITR | Salaried individuals | Form 16 filing, CA review | 499–999 |

| Advanced ITR | Freelancers, capital gains | Business income, share trading, and rental | 1,499–2,999 |

| GST Filing | Businesses | Monthly/quarterly returns | 999–4,999 |

| NRI ITR | NRIs with Indian income | DTAA guidance, capital gains | 2,499–4,999 |

(Prices may vary; check TaxBuddy.com for updated rates.)

TaxBuddy vs Competitors

| Feature | TaxBuddy | ClearTax | Quicko |

|---|---|---|---|

| CA Review | ✅ Yes | ❌ Optional | ❌ Optional |

| GST Filing | ✅ Yes | ✅ Yes | ✅ Yes |

| NRI Services | ✅ Yes | ❌ Limited | ❌ Limited |

| AI Error Detection | ✅ Yes | ✅ Yes | ✅ Yes |

| Pricing | Affordable | Mid-range | Low–mid |

| Notice Handling | ✅ Yes | ✅ Yes | ❌ Limited |

Pros & Cons of TaxBuddy

Pros:

-

CA review for every filing

-

Affordable plans

-

Strong support for complex cases (NRI, capital gains, GST)

-

AI error detection

Cons:

-

Interface not as polished as ClearTax

-

No fully free ITR filing option

-

Support response can be slower during peak season

SEO-Friendly FAQ Section

1. Is TaxBuddy safe?

Yes, TaxBuddy uses SSL encryption and complies with Indian IT security standards.

2. Does TaxBuddy handle GST?

Yes, TaxBuddy provides GST registration and filing services for businesses.

3. Can NRIs file taxes with TaxBuddy?

Yes, TaxBuddy specializes in NRI tax returns and DTAA compliance.

4. Is TaxBuddy better than ClearTax?

For simple returns, both are good. For complex cases, TaxBuddy’s CA review gives it an edge.

5. How much does TaxBuddy cost?

Plans start at ₹499 for basic salaried ITR filing.

Who Should Use TaxBuddy?

TaxBuddy is ideal for:

-

Salaried employees want error-free returns

-

Freelancers with multiple income streams

-

Share traders with capital gains reporting

-

NRIs dealing with double taxation

-

Small businesses that need GST filing

Final Verdict – Is TaxBuddy Worth It?

If you want the convenience of online filing but the accuracy of a professional CA, TaxBuddy is an excellent choice. It’s affordable, handles complex cases, and provides post-filing support — something many competitors lack.

For 2025, with the IT department increasing scrutiny on filings, a CA-reviewed online filing service like TaxBuddy offers the perfect balance of safety and speed.

✅ Our Rating: 4.6/5