Most of us keep shares in our demat account for the long term — hoping they will grow over time.

But what if those same shares could earn you extra income every month, without selling them?

That is exactly what SLBM (Stock Lending & Borrowing Mechanism) allows you to do.

SLBM is one of the safest, easiest, and most underused ways to make extra money from your existing stock portfolio. Yet, hardly anyone in India understands it properly.

This guide explains SLBM in simple, everyday language.

No jargon. No complicated math.

Just clear explanations and examples.

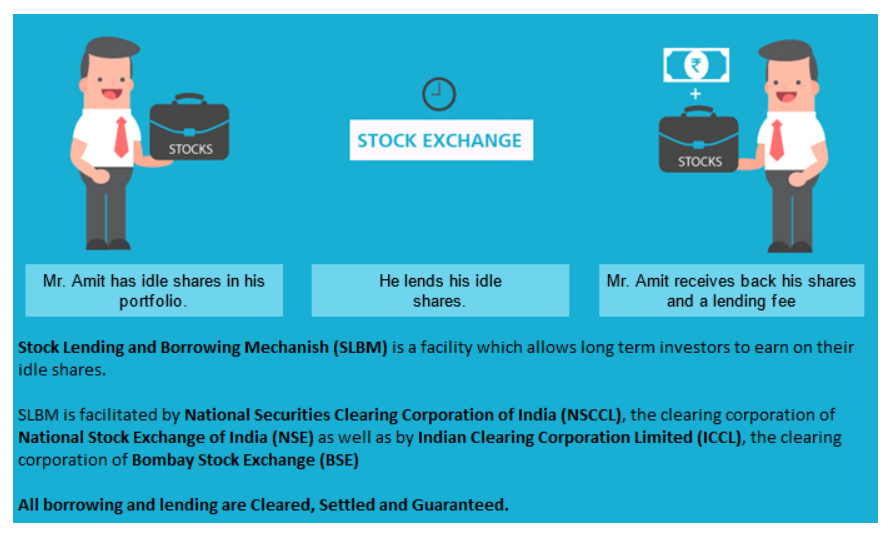

What is SLBM?

SLBM is a system run by the stock exchange (NSE/BSE) where:

- People who own shares can lend them and earn a fee.

- Traders who need shares for short selling can borrow them by paying a fee.

Think of it like renting out your shares, just like renting out a house.

You still own the house (your shares).

You just earn extra money by letting someone use them for a short time.

Why Would Anyone Borrow Shares?

Borrowing is mainly done by:

✔ Traders

✔ Arbitrageurs

✔ Hedge funds

✔ Brokerage firms

They borrow shares for reasons like:

- Short selling (they want to sell shares first and buy later)

- Arbitrage trades (cash–futures difference)

- Delivering shares if they are short in delivery

- Event-based trades like mergers or index changes

You don’t need to understand their strategies.

All you need to know is: they pay money to borrow shares, and you can earn that money.

Why Should YOU Care About SLBM?

Because you can:

- Earn extra income from shares you already own

- Keep full ownership of your shares

- Take almost no extra risk

- Let the exchange guarantee everything (no counterparty risk)

For a normal investor with stocks worth ₹10–50 lakh, SLBM can easily earn ₹10,000 to ₹2,00,000 per year extra completely passively.

How Does SLBM Work?

Here’s the entire process in plain language:

Step 1:

You decide to lend your shares for a month or more.

Step 2:

A trader who needs those shares borrows them.

Step 3:

The exchange blocks your shares temporarily.

Step 4:

At the end of the period, the shares are returned to you.

Step 5:

You get paid a lending fee.

That’s it.

You don’t lose your shares.

You don’t lose dividends.

You don’t lose bonuses or rights.

Everything remains yours.

How Much Can You Earn?

Your income depends on the demand for that stock.

Examples (simple figures):

- HDFC Bank: 3–8% annual income

- Reliance: 2–6%

- Midcap stocks: 6–20%

- Special situations: 20–100%+

Yes, the fees can go very high during:

- Buybacks

- Index changes

- Mergers

- High volatility weeks

- Short squeeze situations

Some stocks temporarily give crazy returns (like 30–80% annualized) during these periods.

Why Do SLBM Rates Sometimes Become Negative? (Simple Answer)

Negative rates simply mean:

- Lenders are willing to pay borrowers

- This happens rarely and only for specific reasons

Why would anyone do that?

Because in some arbitrage trades, the lender benefits elsewhere.

The simplest explanation:

Sometimes, traders need to short stocks badly, but everyone is trying to lend, and no one wants to borrow. To keep the trade going, lenders reduce the fee, and sometimes the fee becomes negative for a day or two.

But for retail users, this doesn’t matter. You can choose which stocks to lend.

You never get stuck paying anyone.

Why Is SLBM Safe?

SLBM is one of the safest mechanisms because:

- The entire system is run by NSE Clearing Corporation

- Counterparty risk = zero

- Settlement is guaranteed

- Your dividends/bonuses are protected

- Shares automatically come back at expiry

This is safer than:

- Pledging

- Margin trading

- Options selling

- Futures trading

It is more like earning rent on your stocks.

What Happens to Dividends When You Lend Shares?

This is a common worry.

✔ You still get the dividend

✔ The exchange makes sure you are compensated

✔ You do NOT lose any corporate benefits

Even if your shares are not in your demat account during the record date, you still receive:

- Dividend

- Bonus

- Rights

- Splits

No loss.

SLBM vs Pledging vs Mutual Funds vs FDs

| Feature | SLBM | Pledging | Mutual Funds | FDs |

|---|---|---|---|---|

| Extra income | Yes | No | Depends on market | Yes |

| Ownership stays? | Yes | Yes | No | Yes |

| Risk | Very Low | Medium | Market | Low |

| Liquidity | High | High | Medium | High |

| Ideal for | Long-term investors | Traders | All | Conservative investors |

SLBM is almost free income on top of your long-term investing.

Real-Life Examples to Understand SLBM

Example 1: Simple Monthly Income

You own:

- 500 shares of HDFC Bank

- Worth ₹8 lakh

SLBM fee = ~4% per year

You earn = ₹32,000 per year

Without selling anything.

Example 2: High-Demand Period

You own:

- 200 shares of a midcap stock

- Worth ₹4 lakh

SLBM fee during event = 20% annualized

For a 1-month contract:

Income = ~₹6,600 for 1 month

That’s almost two months of rent for a 1BHK in many cities.

Who Should Use SLBM?

SLBM is perfect for:

✔ Long-term investors

✔ People who hold large-cap or mid-cap stocks

✔ Retirement-focused investors

✔ People who don’t trade daily

✔ HNIs and family offices

✔ Corporate treasuries

✔ Anyone who wants extra yield from idle shares

If you have at least ₹5 lakh+ in stocks, SLBM becomes meaningful.

Who Should Avoid SLBM?

Avoid only if:

✘ You trade your stocks very frequently

✘ You want to sell the stock urgently

✘ You hold very illiquid stocks with no borrowing demand

Otherwise, SLBM works for almost everyone.

How to Start Using SLBM (Simple Step-by-Step)

Step 1: Ensure Your Broker Supports SLBM

Popular brokers that support it:

- ICICI Direct

- Kotak

- HDFC Securities

- Motilal Oswal

Small brokers may not support it.

Step 2: Activate the SLB Segment

This is usually free.

Step 3: Check Which of Your Shares Are in Demand

Your broker will show the list with fees (e.g., 3%, 5%, 12%, etc.)

Step 4: Choose How Long You Want to Lend

Common periods:

- 1 month

- 3 months

- 6 months

- 12 months

Step 5: Lend and Earn

Your shares get blocked, and you earn the lending fee.

Step 6: Shares Return Automatically

At expiry, shares return to your demat.

You don’t need to do anything manually.

When Do SLBM Fees Go Up? (Simple Indicators)

SLBM fees shoot up during:

1. Buybacks

Companies buying back shares cause a temporary shortage → fees rise.

2. MSCI / Nifty Rebalancing

Traders short stocks expected to be removed → demand spikes.

3. Futures Trading at Discount

When futures are at a large discount to cash, short-sellers borrow heavily.

4. Mergers

Arbitrage funds need to hedge positions.

5. Results Season

High volatility increases demand.

If you lend during these times, your returns can be very high.

A Simple Analogy to Understand SLBM

Imagine you have a car you don’t use every day.

Someone wants to rent it for 2 days.

You rent it out, earn money, and the car comes back exactly as before.

You still own it.

You can still use it after the period.

You still earn extra income.

The rental agency ensures safety.

SLBM works exactly like this with your shares.

Future of SLBM in India (2025 and Beyond)

SLBM is expected to grow massively because:

- More stocks are being added

- Big institutions (mutual funds, insurance companies) are participating

- Brokers are making SLBM easier

- SEBI is promoting securities lending

- Yields are becoming attractive

- Algo trading and arbitrage demand is rising

Within the next 2–3 years, SLBM could become as common as pledging and F&O trading.

Conclusion: SLBM Is the Easiest Passive Income Tool Most Investors Ignore

If you own stocks, you should seriously consider SLBM.

It offers:

- Extra income

- Low risk

- No loss of ownership

- Exchange guarantee

- Zero effort

Even a ₹10–20 lakh portfolio can earn a few thousand rupees every month just by lending shares.

In a world where returns matter, SLBM is one of the simplest tools to boost your overall portfolio income.

FAQs on SLBM in India

1. What is SLBM in simple words?

SLBM (Stock Lending & Borrowing Mechanism) allows investors to lend their shares for a fee, just like renting them out. You keep ownership and earn extra income.

2. Is SLBM safe for retail investors?

Yes. SLBM is very safe because the entire process is guaranteed by the stock exchange clearing corporation. Your shares are always returned on expiry.

3. Do I lose dividends or bonuses if I lend my shares?

No. You still receive all dividends, bonuses, splits, and rights. The exchange ensures all corporate benefits reach you even if shares are lent out.

4. How much money can I earn through SLBM?

Depending on the stock, you may earn between 2–20% annualized. During events like buybacks or index rebalancing, returns can temporarily go above 30–80%.

5. How long can I lend my shares in SLBM?

You can lend shares for 1 month to 12 months. Most investors choose 1-month or 3-month periods for flexibility.

6. What happens if the borrower doesn’t return the shares?

The exchange guarantees the return of your shares. If the borrower defaults, the exchange steps in and delivers them to you automatically.

7. Can I sell my shares while they are lent out?

Yes, but the shares will be recalled before the sale. However, if you plan to sell soon, it’s better not to lend those shares.

8. Why do SLBM rates go up or down?

Rates depend on demand and supply. Rates rise during events like buybacks, high volatility, futures discounts, mergers, or index changes.

9. Which brokers offer SLBM in India?

Major brokers like ICICI Direct, HDFC Securities, Kotak, and Motilal Oswal support SLBM.

10. Is SLBM better than pledging or margin funding?

For long-term investors, SLBM is usually better because it generates passive income without adding leverage or risking your portfolio.

Subscribe to Randomdimes.com for more interesting alternative investment information.