As of February 2025, there are over 2,629 companies listed on the National Stock Exchange or NSE and 5,595 companies on the Bombay Stock Exchange or BSE. Besides, there are over 2,500 mutual fund schemes listed in India, across various categories such as equity, debt, hybrid, and others. There are over 250 exchange-traded funds or ETFs listed on the NSE and BSE. Each of these instruments comes with a plethora of information, financial numbers, and data that an investor has to take note of before investing.

Investment research and analysis tools have shifted from being a luxury to an absolute necessity for investors in today’s fast-paced, data-driven markets. The sheer volume and complexity of financial data-spanning real-time market updates, earnings reports, news sentiment, and macroeconomic trends-make it impossible for investors to keep up and make informed decisions without technological support.

In this article, we will review one such stock research and analysis tool, Sharpely, owned and operated by Mintbox Solutions Pvt. Ltd., a SEBI-registered Research Analyst and online investing platform. We will have a look at the different tools, screeners, strategies and features offered by Sharpely, and compare the same with those offered by its peers like Screener.in, Tickertape, and others.

What is Sharpely?

Sharpely is a SEBI-registered investment research platform that’s designed to bridge the gap between retail and professional investors by offering institutional-grade tools and insights. Launched in 2023 and based out of Thane, Maharashtra, Sharpely aims to empower investors with data-driven decision-making tools focused on Indian stocks, mutual funds, and ETFs.

What makes Sharpely stand out is its rich mix of quantitative and qualitative features like advanced screeners, strategy builders, and multi-factor models, all packed into one platform. By 2025, it has grown a solid user base and will have advised over 10,000 clients, providing access to over 5,000 stocks, backed by a vibrant community of investors and analysts. Being SEBI-registered adds a layer of trust and regulatory compliance that many users appreciate.

The company has a stated mission to provide institutional-grade data and research tools and to empower retail investors to make informed investment decisions.

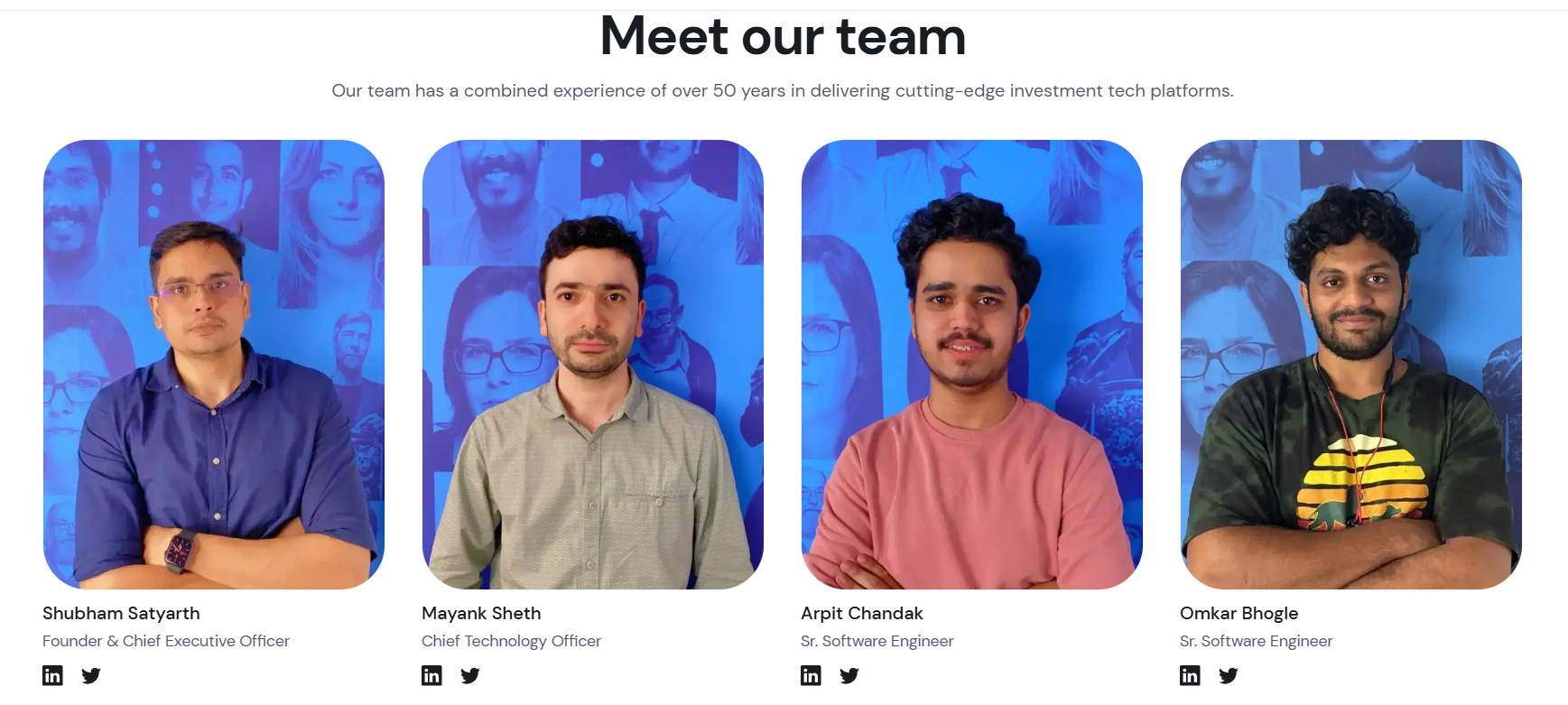

Team Behind the Platform

The brains behind Sharpely include Founder and CEO Shubham Satyarth, who brings a clear vision to democratize access to high-quality financial data. Shubham is an alumnus of the prestigious IIT Kanpur, holding an engineering degree in Computer Science and Engineering and an MBA from the renowned IIM Bangalore. Before starting Sharpely, Shubham managed investment portfolios for reputed financial institutions like Kotak Securities. The tech side is led by CTO Mayank Sheth, who holds a Master’s in Computer Science from the University of Southern California. Mayank ensures the platform runs smoothly and innovates continuously. The team also includes skilled engineers, along with experts in content and customer support.

Together, this compact but experienced team combines decades of expertise in fintech, investment research, and software development with a collective experience of over 50 years and an asset management experience of over INR 5000 Crores.

Key Features of Sharpely

Sharpely offers a wide range of research and analysis tools broadly in the nature of screeners, strategy builders, graphs and charts, models, trackers, etc. for stocks, ETFs, and mutual funds.

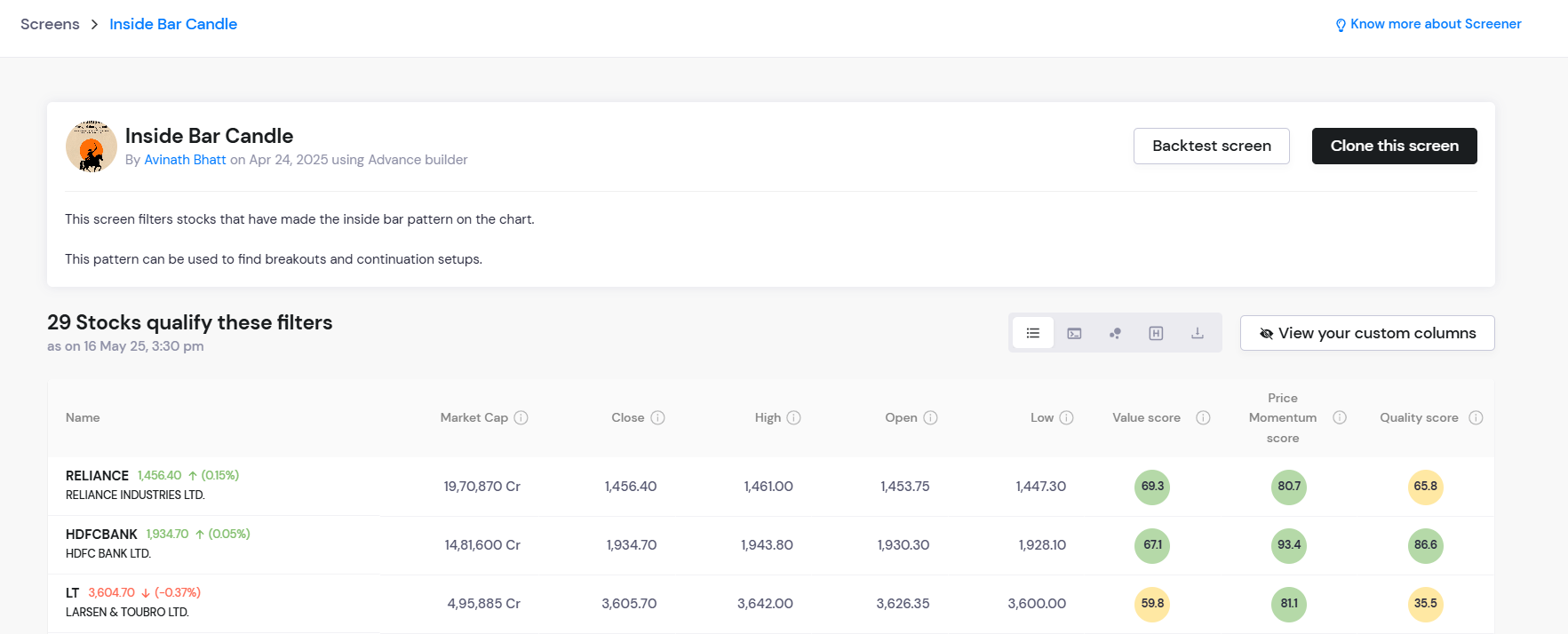

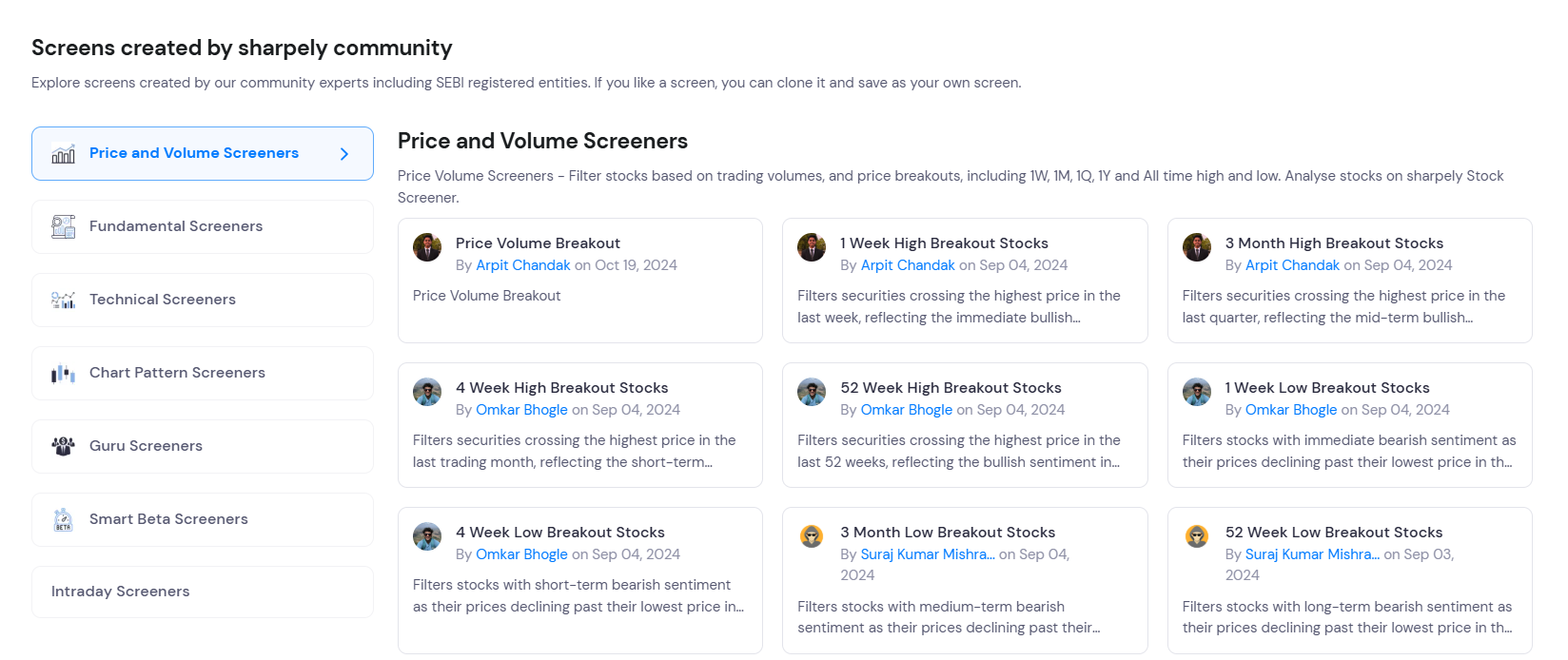

At the heart of it is the Super Stock Screener, which lets you build your own stock screen using a range of fundamental and technical indicators, ratios, etc.. You can customise timeframes, check historical data, and even backtest your screens to see how they would have performed in the past. Screeners are also available for ETFs and Mutual Funds. If you would like to take advantage of readymade screeners, Sharpely gives you access to screens created by the community.

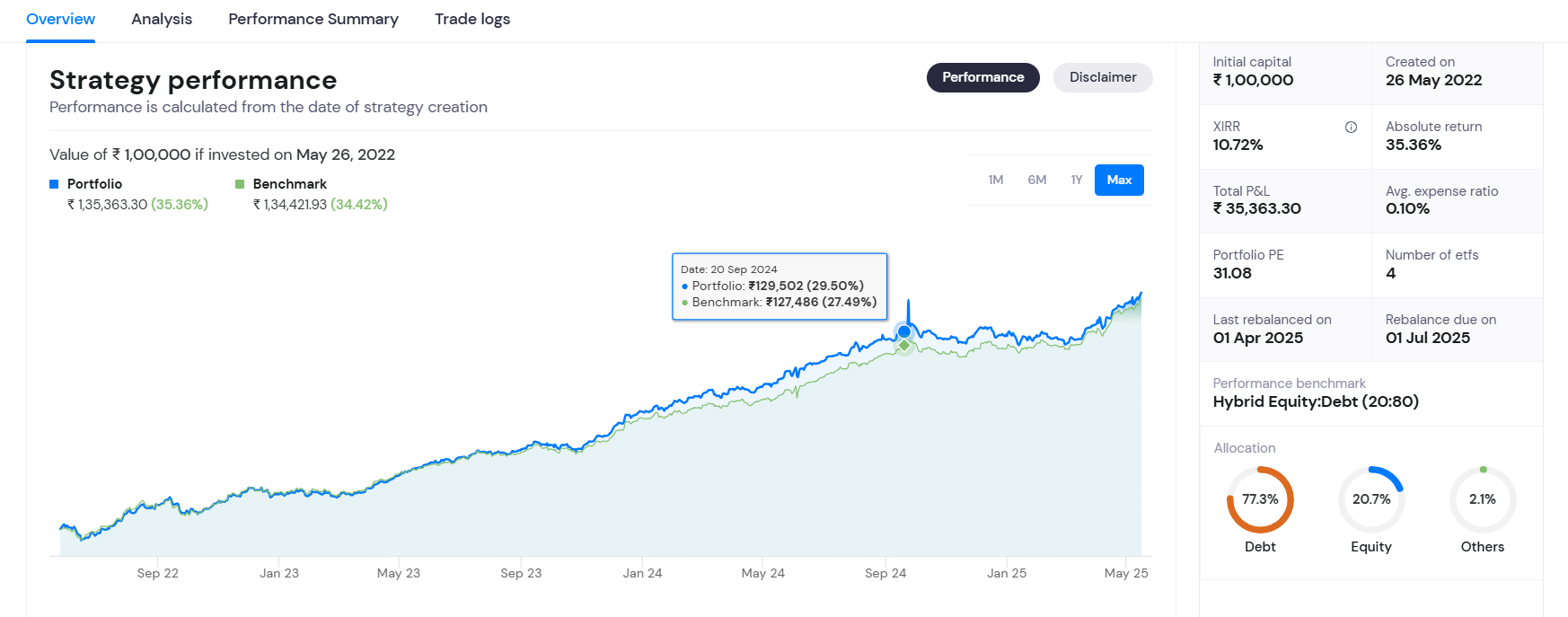

Then there’s the Strategy Builder, a powerful tool that lets you create, backtest, and paper trade your own automated stock strategies. You can build stock baskets, assign weights, set rebalancing schedules, and test dynamic strategies using either screeners or factor models. The backtesting engine simulates real market conditions, giving you a realistic feel for your strategy’s potential.

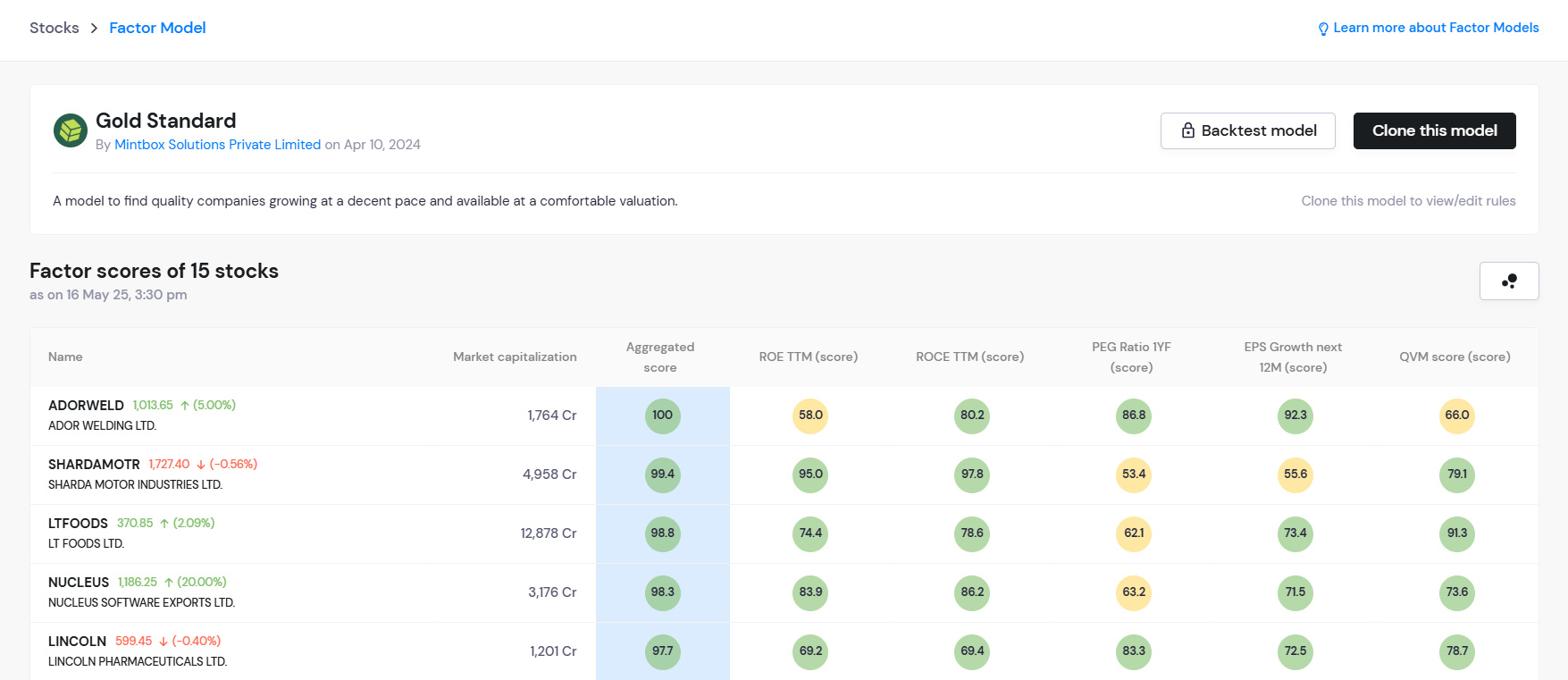

Sharpely’s Factor Models is a great feature for quant trading. You can create your own factor-based models using value, quality, and momentum factors. You can also explore Factor Models shared by community members, and can also share your own model with others.

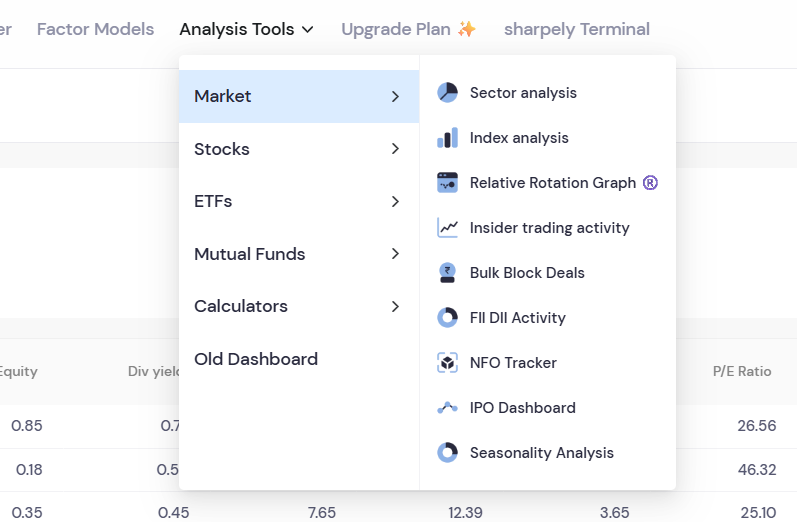

For deep dives into individual stocks, Sharpely offers institutional-grade stock reports covering everything from fundamentals and technicals to analyst forecasts and peer comparisons. The StyleBox classification helps you filter stocks by investment style, while the Relative Rotation Graph (RRG) visualises sector and stock momentum trends.

Beyond stocks, Sharpely provides robust tools for sector and index analysis, helping you understand broader market dynamics. Mutual fund and ETF investors aren’t left out either. The platform features advanced screeners with over 40 metrics to compare funds on performance, risk, and portfolio composition.

Additional features include customizable stock checklists, real-time alerts, and a community where you can publish your research and strategies.

How to Use Sharpely?

Getting started with Sharpely is pretty straightforward. Once you log in, you land on a clean, user-friendly dashboard where you can jump right into screening stocks or exploring pre-built screens from the community. You can personalise your dashboard featuring tools that you find most useful.

The dashboard makes it easy to build and backtest strategies, letting you see how they might perform using historical data and real market conditions. For more detailed research, you can generate comprehensive stock reports, compare multiple stocks side-by-side, or analyze sectors and indices to spot trends.

The StyleBox and RRG tools help you identify which investment styles and sectors are currently in favor. If you’re into mutual funds or ETFs, Sharpely’s advanced screeners let you filter and compare options based on a wide range of metrics.

You can also set up alerts to get notified about specific stock movements or criteria in near real-time. Plus, the platform encourages community engagement, so you can publish your own screens, models, or strategies, and interact with others to learn and practice.

Whether on the web or mobile app, Sharpely’s intuitive interface helps both beginners and seasoned investors make the most of its powerful tools.

Sharpely Pricing

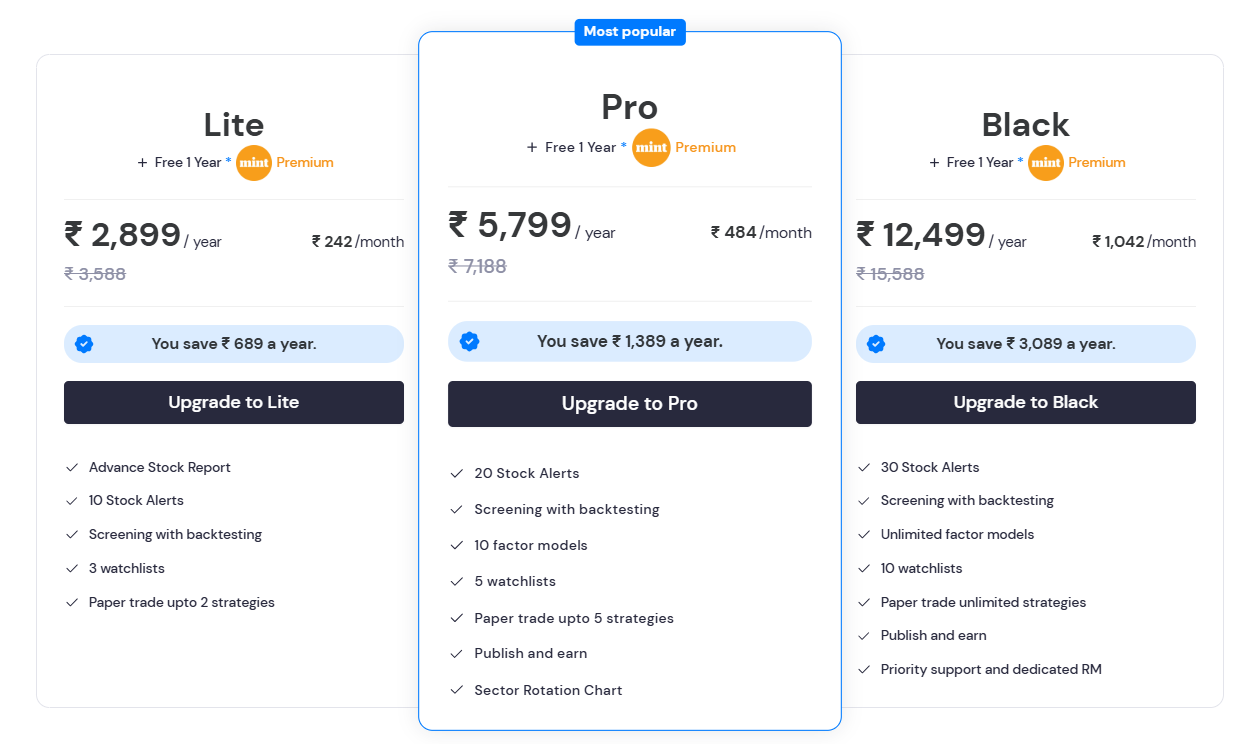

Sharpely offers a tiered pricing structure to suit different investor needs.

There’s a free plan that gives you access to basic stock screening, some research features, and community screens – a good way to test the waters.

For those wanting more, paid plans unlock advanced screeners, full backtesting capabilities, the premium strategy builder, and in-depth analytics. These plans are available monthly or annually, with competitive pricing and occasional discounts. Premium subscribers also get priority support and exclusive content from expert analysts, making it a solid value for serious investors.

Sharpely’s premium plans are categorised as Lite, Pro, and Black, with Black being the most advanced option. The premium features enable you to share your strategies and research with the Sharpely community and monetise the same.

Sharpely Alternatives

Sharpely isn’t the only player in the Indian investment research space, and it’s worth checking out some alternatives before deciding.

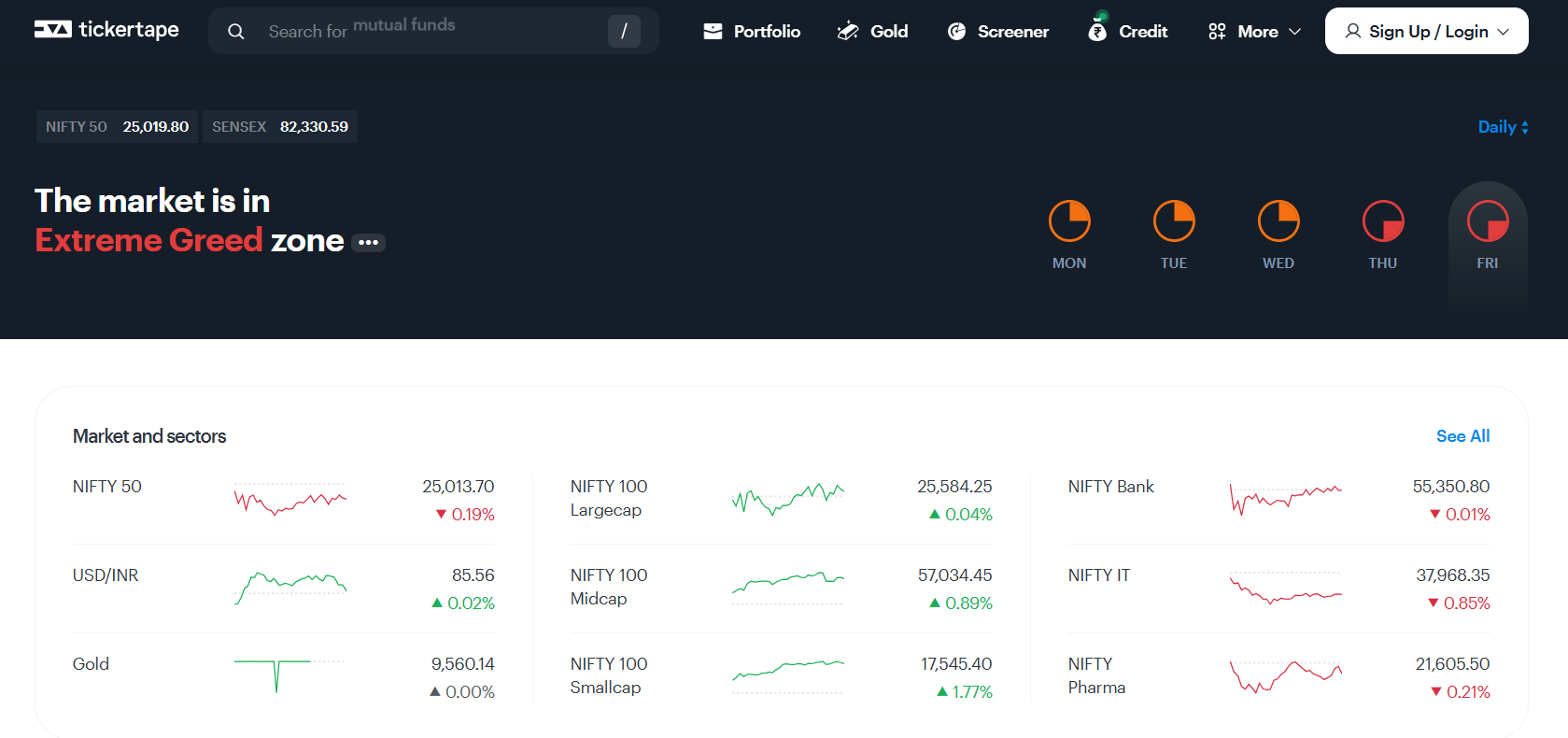

Tickertape offers a sleek interface and strong stock screening with lots of financial ratios and curated ideas across stocks, mutual funds, ETFs, and even gold. Tickertape is well-known for its financial indicators and charts, which can be integrated with Brokers such as Zerodha. However, it doesn’t quite match Sharpely’s depth in backtesting or automated strategy building.

Screener.in is a favorite among retail investors for its customizable screens and easy data exports. Screener.in has a wide range of financial ratios and indicators to help you build robust screens. But it lacks Sharpely’s advanced quant tools and community-driven strategy sharing features.

Trade Brains focuses more on education and basic screening, making it great for beginners. Still, it doesn’t provide institutional-grade analytics or multi-factor modelling tools like Sharpely.

Investing.com shines with global market coverage and real-time data, but its tools are more generic and less tailored to the Indian market compared to Sharpely’s localised, SEBI-registered platform.

Most of these stock research platforms offer a free version. As an investor, you can try out the free versions first and decide for yourself which tools suit your investing needs better.

Conclusion

Sharpely offers a powerful, SEBI-registered platform that brings institutional-grade research and quant tools to Indian investors. Its combination of advanced screeners, strategy builders, and community-driven features makes it a strong contender in the market. While alternatives like Tickertape, Screener.in, Tradebrains and Investing.com each have their own appeal. Sharpely’s focus on deep analytics and strategy automation tailored for India makes it a compelling choice for investors who want to go beyond basic research. That said, those looking for global coverage or simpler interfaces might find other platforms more suitable.