Introduction

Real estate investing in India is evolving rapidly. Buying property directly—once the only real option—is no longer the most efficient or attractive way for sophisticated investors to gain exposure. High entry costs, management hassles, delayed projects, and illiquidity make direct ownership less appealing.

Today, Alternative Investment Funds (AIFs) are emerging as a preferred channel to invest in real estate. These professionally managed funds pool capital from high-net-worth investors and institutions, offering diversified exposure, transparency, and regulatory oversight. Compared to owning a single property or even fractional real estate, real estate AIFs provide access to institutional-grade assets, stronger governance, and better tax efficiency.

We had prevously covered how debt based AIF work! This guide explains how real estate AIFs work, their benefits, key risks to watch out for, and real-world examples of popular funds in India, including Nuvama–Cushman PRIME Fund, Bharat Bhoomi Fund, WSB Real Estate Debt Fund III, and Axis Prime Real Estate Fund.

What are Alternative Investment Funds (AIFs)?

AIFs are privately pooled investment vehicles that collect money from sophisticated investors to invest in non-traditional assets such as private equity, venture capital, hedge funds, and real estate.

Under SEBI (Alternative Investment Funds) Regulations, 2012, AIFs are divided into three categories:

-

Category I AIFs: Focus on socially/economically beneficial areas such as venture capital, infrastructure, and SME funds.

-

Category II AIFs: Cover private equity, real estate, and debt funds.

-

Category III AIFs: Use complex trading strategies like hedge funds.

Minimum investment: INR 1 crore per investor (INR 50 lakhs for accredited investors).

Minimum corpus per scheme: INR 20 crore.

Fund manager/sponsor must contribute at least 2.5% of corpus or INR 5 crore.

For real estate, Category II AIFs are the most relevant.

Real Estate Investment through AIFs

Unlike REITs (which directly own completed income-generating assets), real estate AIFs invest indirectly in equity, debt, or hybrid securities of developers. This gives investors exposure to large-scale projects while spreading risks across multiple assets.

Key features of real estate AIFs:

-

Close-ended structure: Minimum 3 years, usually 5–7 years.

-

Diversification rules: No more than 25% of the corpus can be invested in a single company.

-

Skin-in-the-game: Managers must contribute a minimum capital.

-

Focus: Category II AIFs often target commercial real estate, residential projects, plotted developments, or debt financing for developers.

This makes them attractive compared to direct property investment, which suffers from delays, liquidity issues, and management hassles.

Benefits of Investing in Real Estate AIFs

-

Professional Management – Expert fund managers backed by research, due diligence, and execution capability.

-

Diversification – Spread across projects, geographies, and asset classes.

-

Access to Institutional Assets – Grade A offices, large plotted developments, and structured debt, which individuals can’t access directly.

-

Better Transparency & Regulation – SEBI oversight ensures disclosure and compliance.

-

Superior Tax Efficiency – Especially in equity-oriented real estate funds (explained in detail below).

Industry Growth: As of Dec 2024, real estate AIFs attracted INR 74,000 crore, ~15% of all AIF investments, growing 8% in just nine months of FY25.

Tax Advantage of Real Estate AIFs

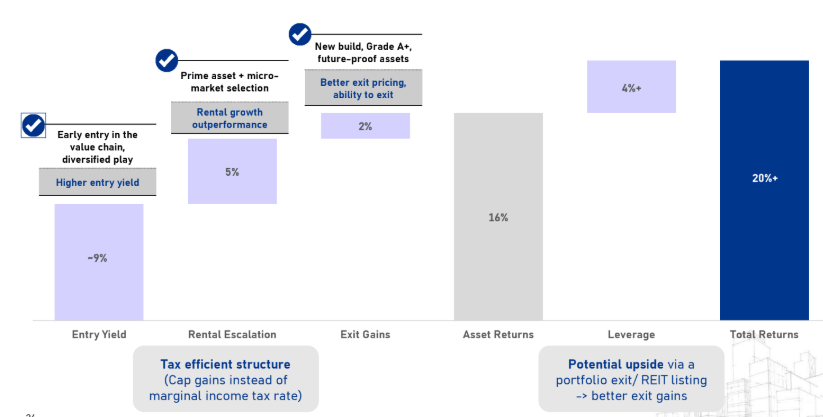

A key reason many investors prefer real estate AIFs (especially equity-oriented ones like PRIME or Axis Prime) is their tax structure compared to debt funds:

-

Equity-oriented AIFs (PRIME, Axis Prime, Bharat Bhoomi)

-

Rental income is used to service loan interest → No yearly tax on rent.

-

Investors are taxed only at exit on capital appreciation.

-

Gains qualify as long-term capital gains (LTCG) @12.5%, offering strong tax efficiency.

-

-

Debt-oriented AIFs (e.g., WSBREDF III)

-

Distributions are treated as interest income, taxed at slab rates (30% for HNIs).

-

Less efficient for high-net-worth individuals in higher tax brackets.

-

Takeaway: For investors seeking long-term capital appreciation with tax efficiency, equity-oriented .PRIME or Axis Commercial RE funds have a clear edge over pure debt AIFs.

Examples of Real Estate AIFs in India

1. PRIME Offices Fund (Nuvama–Cushman & Wakefield)

Focus: Grade A+ commercial real estate across Mumbai, Pune, Bengaluru, NCR, Chennai & Hyderabad.

-

Strategy: Uses leverage—rental income services debt, appreciation taxed as LTCG.

-

Size: INR 3,000 Cr (with green shoe option).

-

Tenure: 6 years + extensions.

-

Minimum Investment: INR 1 Cr (INR 50 lakh for accredited investors).

-

Hurdle Rate: 10% p.a.

-

Target Returns: 16–21% pre-tax.

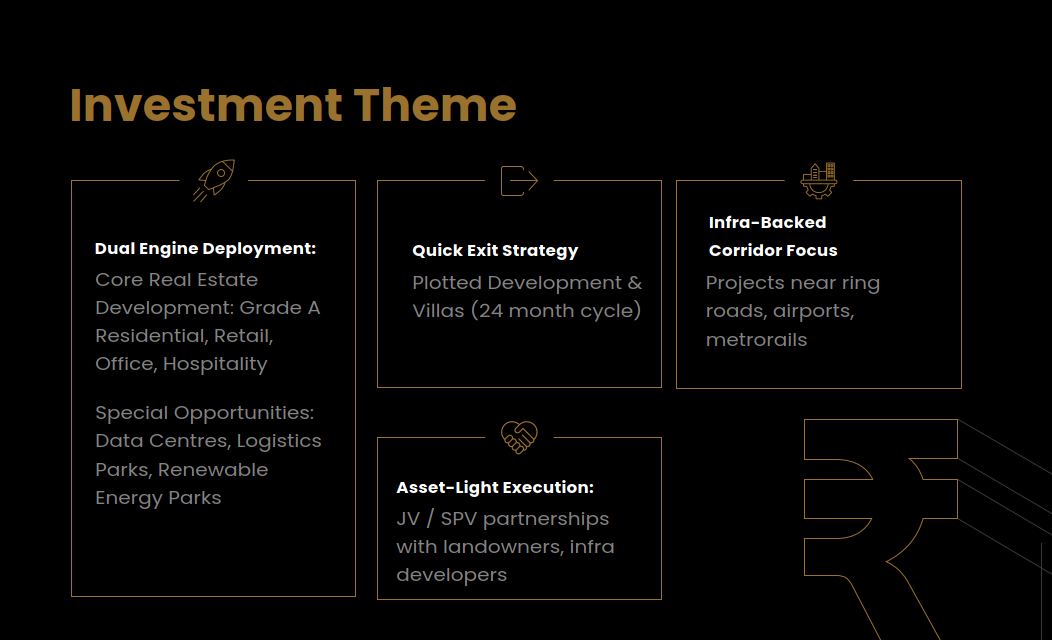

2. Bharat Bhoomi Fund

-

Focus: Plotted developments & villas (70–100%) + residential, warehousing, hospitality, renewable parks.

-

Size: INR 1,000 Cr (green shoe INR 1,000 Cr).

-

Tenure: 5.5 years + extensions.

-

Minimum Commitment: INR 1 Cr.

-

Drawdown: 20% upfront, balance in tranches.

-

Target Returns: ~22% annual IRR (pre-tax).

3. WSB Real Estate Debt Fund III (WSBREDF III)

-

Focus: Debt financing via debentures (secured by collateral).

-

Size: INR 1,000 Cr + green shoe INR 1,000 Cr.

-

Tenure: 6 years.

-

Typical Loan Tenure: 36–54 months.

-

Security Cover: 2X principal loan amount.

-

Target Returns: ~20% Gross IRR, with fixed repayment schedule.

4. Axis Commercial Real Estate Fund

-

Managed by Axis AMC, one of India’s most trusted asset managers.

-

The fund targets early-stage or greenfield investments in commercial real estate, primarily in Tier I cities.

- The fund’s first investment is a 1.5-acre land parcel at Fintech City, Nandambakkam, Chennai, acquired via a bid-cum-e-auction conducted by the Tamil Nadu Industrial Development Corporation (TIDCO).

-

Structure: Category II AIF with a strategy similar to PRIME—targeting equity exposure with tax efficiency.

-

Differentiator: Axis AMC brings the credibility and distribution reach of a leading mutual fund house, appealing to HNIs seeking regulated exposure with a strong brand.

-

Returns: Targets ~21–25% pre-tax IRR, leveraging capital appreciation while minimizing yearly taxation.

Comparative Snapshot of Funds

| Fund | Strategy | Asset Focus | Target Returns | Tax Efficiency | Risk Profile |

|---|---|---|---|---|---|

| PRIME | Equity + Leverage | Grade A Offices | 15–21% | High (LTCG) | Moderate (asset-backed) |

| Bharat Bhoomi | Equity Development | Plotted & Villas | ~22% IRR | High (LTCG) | Higher (development risk) |

| WSBREDF III | Debt | Structured Debt to Developers | ~20% | Low (interest taxed at slab) | Lower (secured debt) |

| Axis Commercial | Equity | Greenshoe Infra Projects | 21–25% | High (LTCG) | Higher (development risk) |

Conclusion

Real estate AIFs provide investors with a modern, tax-efficient, and professionally managed way to tap into India’s booming property sector. They combine the benefits of diversification, institutional-quality assets, and regulatory protection with higher transparency than direct property ownership.

-

For long-term wealth creation with tax efficiency, funds like PRIME and Axis CRE stand out.

-

For high-risk, high-return bets on development, Bharat Bhoomi Fund is attractive.

-

For secured, fixed-income-like exposure, WSB Debt Fund III is suitable.

As the Indian real estate market expands and regulations tighten, real estate AIFs are set to play an even bigger role in bridging the funding gap while delivering attractive returns to sophisticated investors.