Introduction

In today’s uncertain markets, investors want returns that are steady, tax-efficient, and not tied to the direction of the market. The Altiva Hybrid Long-Short Fund—a newly designed Special Investment Fund (SIF) from Edelweiss—does exactly that.

By blending the stability of fixed income with the agility of derivatives and special situations, this fund offers an “all-weather” investment solution that aims to generate consistent income with controlled risk.

In this detailed review, we break down the structure, strategy, performance, risk framework, and why this fund might be an attractive option for HNIs and family offices seeking smarter hybrid alternatives.

What Is the Altiva Hybrid Long-Short Fund?

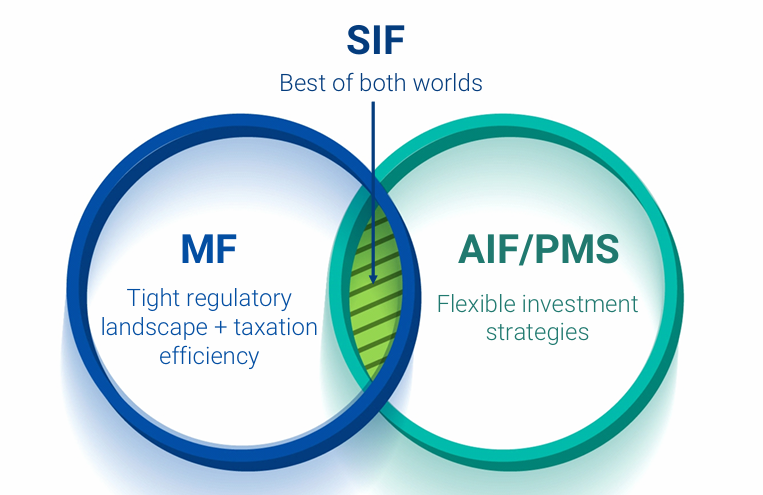

The Altiva Hybrid Long-Short Fund sits at the intersection of three popular investment vehicles—mutual funds, AIFs, and PMSs.

It brings together:

-

The transparency and regulation of a mutual fund,

-

The strategic flexibility of an AIF/PMS, and

-

The tax efficiency of a long-term capital gain structure (LTCG @12.5% after 2 years).

In essence, it’s a hybrid strategy designed for income generation with minimal volatility, giving investors the “best of both worlds.”

Core Investment Philosophy: Income First, Growth Second

Unlike traditional long-short equity funds that chase alpha, Altiva’s core objective is steady income generation.

Its foundation lies in two low-risk components—arbitrage and fixed income—which form the bulk of the portfolio. To enhance returns, the fund selectively deploys capital in special situations and derivative-based strategies.

Portfolio Construction Breakdown

| Strategy | Allocation Range | Role in Portfolio |

|---|---|---|

| Arbitrage | 20–40% | Capture spreads between cash and futures markets |

| Fixed Income | 40–60% | Generate stable accrual and price appreciation |

| Special Situations | 0–10% | Participate in IPOs, buybacks, mergers, or index changes |

| Derivatives | 10–20% | Implement straddles, strangles, and pair trades for alpha |

This design provides a fixed-income-like stability with moderate equity-linked upside — ideal for investors seeking smoother return profiles.

Performance in Different Market Conditions

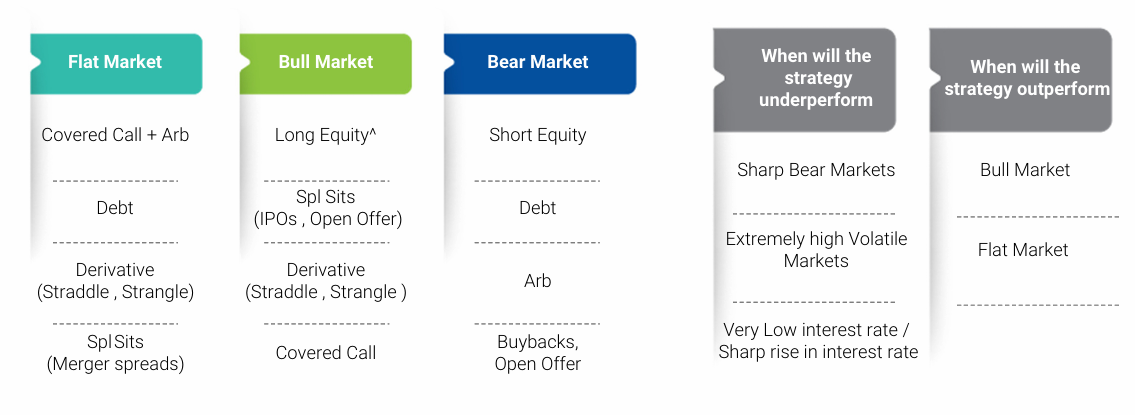

The Altiva Hybrid Long-Short Fund is constructed as an “all-weather” portfolio capable of adjusting across market phases:

| Market Scenario | Primary Strategy Drivers | Expected Outcome |

|---|---|---|

| Bull Market | Covered calls, long bias from special situations | Moderate participation in equity upside |

| Flat Market | Arbitrage, derivatives (straddle/strangle) | Stable income with low volatility |

| Bear Market | Short equity, debt allocation | Strong capital protection |

| High Volatility | Hedged derivatives | Controlled drawdowns |

This makes it particularly suitable for investors who dislike sharp equity swings but still want returns above fixed deposit or short-term debt yields.

Back-Tested Strategy Returns

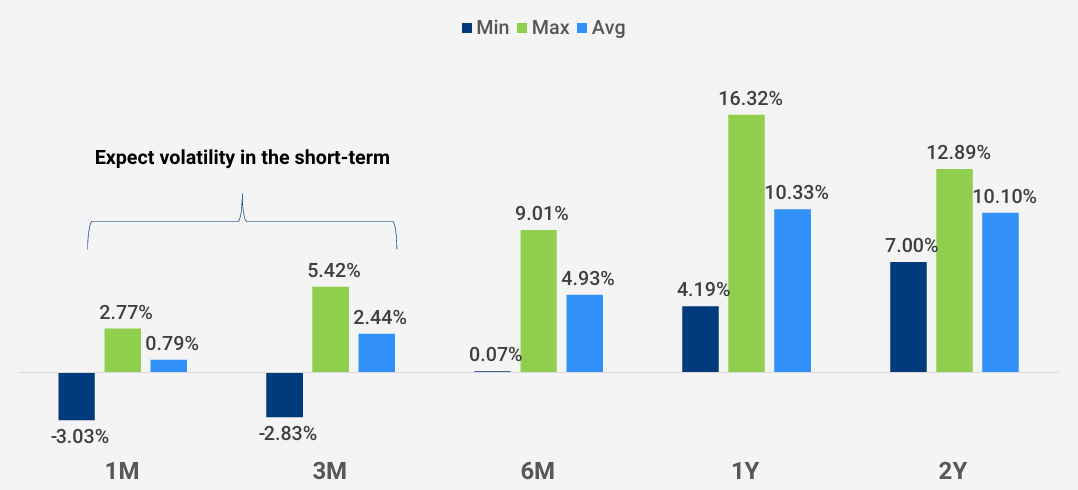

Based on back-tested data from June 2019 to August 2025, the fund’s model performance shows encouraging stability and consistency.

| Period | Minimum | Maximum | Average |

|---|---|---|---|

| 1 Month | -3.03% | 4.19% | 0.79% |

| 3 Months | -2.83% | 7.00% | 2.44% |

| 6 Months | 0.07% | 9.01% | 4.93% |

| 1 Year | 2.77% | 16.32% | 10.33% |

| 2 Years | 5.42% | 12.89% | 10.10% |

The results suggest low short-term volatility and strong 1–2 year CAGR potential, outperforming typical short-duration and arbitrage mutual funds after adjusting for risk.

Risk Management: Multi-Layered and Disciplined

Risk control is central to Altiva’s design. The fund uses quantitative hedging, exposure limits, and active stop-loss monitoring to ensure drawdowns remain limited.

Key Risk Control Measures

-

Stop-Loss Rule: 5% per strategy level.

-

Delta-Hedging: Neutralizes directional exposure.

-

Diversification: Minimum 20-stock portfolio.

-

Sector Limits:

-

Non-Nifty50: Max 10% per sector

-

Nifty50: ±7.5% exposure band

-

-

Position Caps:

-

Large caps <3% per stock

-

Mid-caps <2% per stock

-

Special Situations Risk Filters

-

Participates only in main board IPOs (min issue size ₹1,000 crore).

-

Max exposure: 10% (F&O stock) / 5% (non-F&O stock).

-

Sector-neutral positioning avoids concentration risk.

The result is a granular, event-driven portfolio that captures yield and alpha without taking large directional bets.

Comparative Return and Tax Perspective

Here’s how Altiva compares to other income-oriented categories:

| Category | Typical Returns | Taxation | Holding Period |

|---|---|---|---|

| Debt Funds | Repo + small spread | Slab rate | 12 months |

| Arbitrage Funds | 6–7% | LTCG 12.5%, STCG 20% | 12 months |

| Equity Savings Funds | 7–9% | Same as above | 12 months |

| Altiva Hybrid Long-Short Fund | 8–11% (target range) | LTCG 12.5% (after 2 yrs) | 24 months |

The 2-year LTCG period ensures long-term tax efficiency—making Altiva a better post-tax performer than most Category III AIFs, which often suffer from full slab-rate taxation.

Why Altiva Hybrid Long-Short Fund Stands Out

✅ 1. Consistent Income, Low Volatility

High allocation to fixed income and arbitrage ensures regular accrual-based returns.

⚖️ 2. All-Weather Structure

A blend of uncorrelated strategies helps smoothen outcomes across cycles.

3. Superior Tax Efficiency

LTCG at just 12.5% after two years gives investors a strong post-tax edge.

4. Risk-Managed Portfolio

Tight stop-losses, delta-neutral positioning, and diversification minimize drawdowns.

5. Experienced Fund Managers

Led by:

-

Equity: Bharat Lahoti & Bhavesh Jain

-

Debt: Dhawal Dalal & Pranavi Kulkarni

-

Overseas: Amit Vora

Their deep expertise across derivatives, arbitrage, and special situations enhances execution precision.

Fund Features and Key Details

| Parameter | Details |

|---|---|

| Category | Hybrid Long-Short (SIF) |

| Benchmark | NIFTY 50 Hybrid Composite Debt 50:50 Index |

| Type | Interval Structure |

| Subscription | Daily |

| Redemption | Twice a week (Mon & Wed) |

| Exit Load | 0.5% (within 180 days), Nil thereafter |

| Minimum Investment | ₹10 lakh |

| SIP/STP/SWP | ₹1,000 after base investment |

| Risk Level | Moderate (Level 3/5) |

This structure makes it accessible to HNI and institutional investors looking for steady yield alternatives with bi-weekly liquidity.

When It May Underperform

While the fund’s diversification provides resilience, there are periods where relative underperformance may occur:

-

Strong bull markets (fully long equity strategies outperform).

-

Sharp bear markets with a sudden liquidity crunch.

-

Extremely volatile periods (high option costs).

-

Low or sharply rising interest rates affect fixed income carry.

However, such periods are typically short-term and often followed by reversion-driven recovery.

Who Should Invest in This Fund?

The Altiva Hybrid Long-Short Fund is ideal for:

-

HNIs and Family Offices seeking consistent, low-volatility returns.

-

Corporate treasuries exploring alternatives to low-yield fixed income.

-

Investors with 2–3 year horizons aiming for tax-efficient compounding.

-

Conservative investors want stability with some growth participation.

It can serve as a core allocation for conservative portfolios or a stabilizer in an overall diversified investment mix.

Key Takeaways

-

Multi-strategy hybrid structure combining arbitrage, debt, derivatives, and special situations.

-

Consistent income focus with lower volatility versus traditional equity funds.

-

Attractive post-tax efficiency under the SIF framework (LTCG @12.5%).

-

Robust governance and risk controls at every level.

-

Professional management team with cross-asset expertise.

Conclusion

In a market where returns are unpredictable and volatility is the new normal, the Altiva Hybrid Long-Short Fund offers something investors genuinely value—stability with sophistication.

It’s not about chasing high returns but about preserving and compounding wealth efficiently. By combining the discipline of fixed income, the agility of derivatives, and the edge of event-driven investing, Altiva positions itself as a modern, tax-smart alternative for discerning investors.