It is turning out to be a turbulent time for the stock market in India. Trump recently provided a 90-day break in the tariff, which gave the market a breather, but the recent border conflict has again added to the volatility in the market.

Both the Tariff and war can cause a knee-jerk reaction to the market, as many factors can change in the short term due to these, such as –

- FII Inflow

- GDP estimate

- Inflation

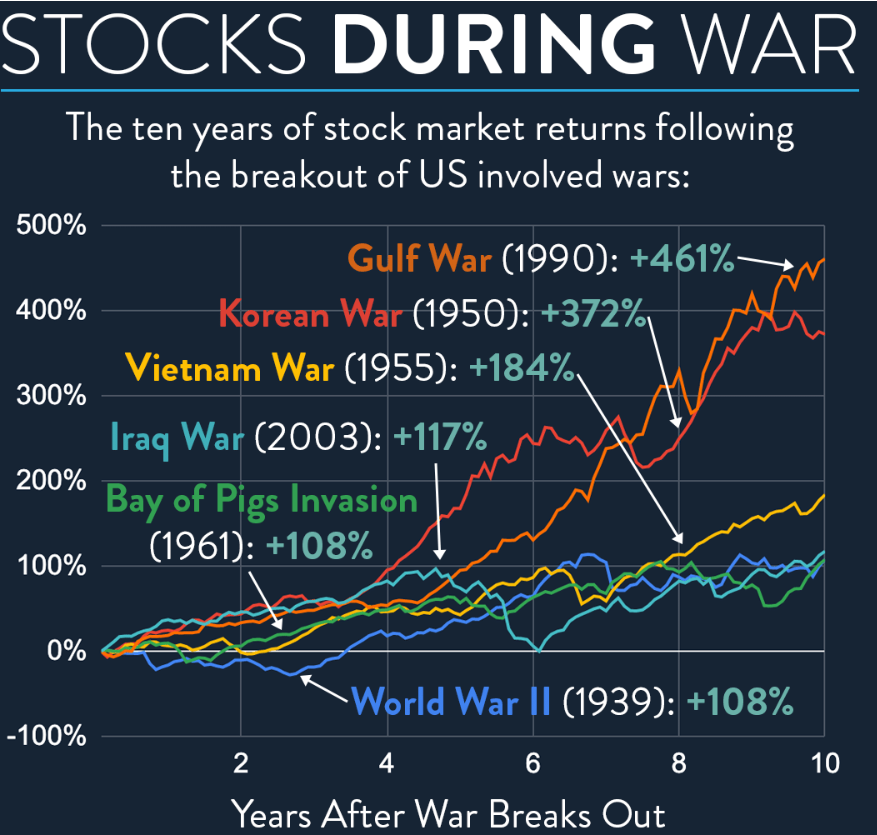

Let’s evaluate how various scenarios of war and military conflict can impact the market and economy based on history.

Markets React to Conflict, but Usually Temporarily

-

Initial Panic: Military conflicts often trigger short-term volatility and drawdowns.

-

Recovery & Growth: Historically, markets have rebounded post-conflict, often delivering strong 1-year returns after initial shocks.

| Conflict | 1-Year Nifty Return Post-Conflict |

|---|---|

| Balakot Airstrike (2019) | 8.9% |

| Uri Surgical Strike (2016) | 11.3% |

| Kargil War (1999) | 29.4% |

Macro-Economic Indicators: Mixed but Manageable

-

GDP Growth: In most cases, GDP growth remained intact or even improved post-conflict (e.g., Kargil War, 1965 war).

-

Inflation & Fiscal Deficit: Typically see a spike during/after conflict periods.

| Conflict | GDP Trend | Inflation Trend |

|---|---|---|

| Kargil War | ↑ from 6.18% to 8.85% | ↑ to 5.9% |

| 1965 War | ↑ from 5.99% to 7.45% | ↑ to 10% |

| 1971 War | ↓ to 1.19% | ↑ stayed >5.5% |

| 1962 War | ↓ slightly | ↑ sharply |

Alternative Investments, Defaults, and Delays

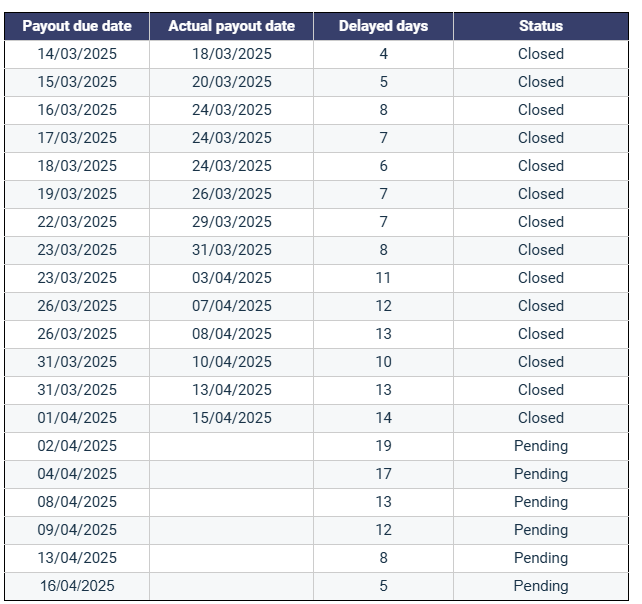

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently, below are the key new updates on the various delays across Alternative Investment platforms.

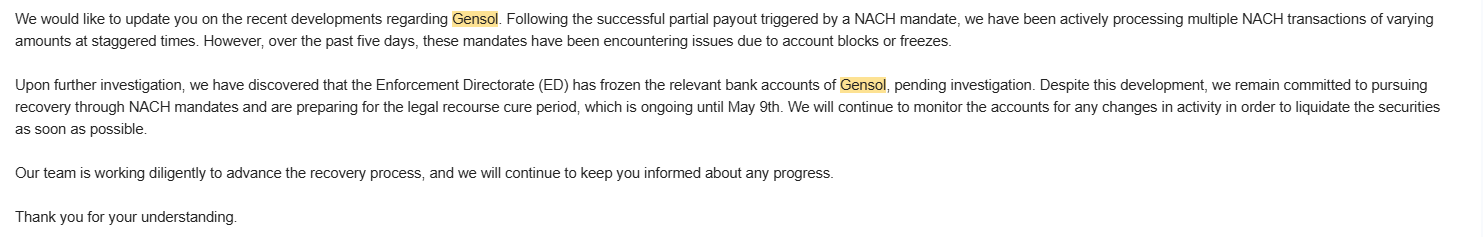

- Tapinvest Gensol Delay

- Kredx Bira Delay

- Midland Microfin Covenant Breach

Tapinvest Gensol Delay

The Gensol Blusmart fiasco has affected the payment of invoices on Tapinvest.

SEBI has issued an interim order against Gensol Engineering Limited, alleging financial mismanagement, fund diversion, and regulatory violations. The order highlights serious lapses in corporate governance, misrepresentation to credit rating agencies, non-disclosure of defaults, and diversion of funds for personal and unrelated business purposes.

Kredx Bira Delay

Few investors have claimed that BIRA has delayed their interest payment on the Kredx platform. It seems BIRA is going through a liquidity crisis and hence looking to raise more capital. Most probably, they should be able to navigate this.

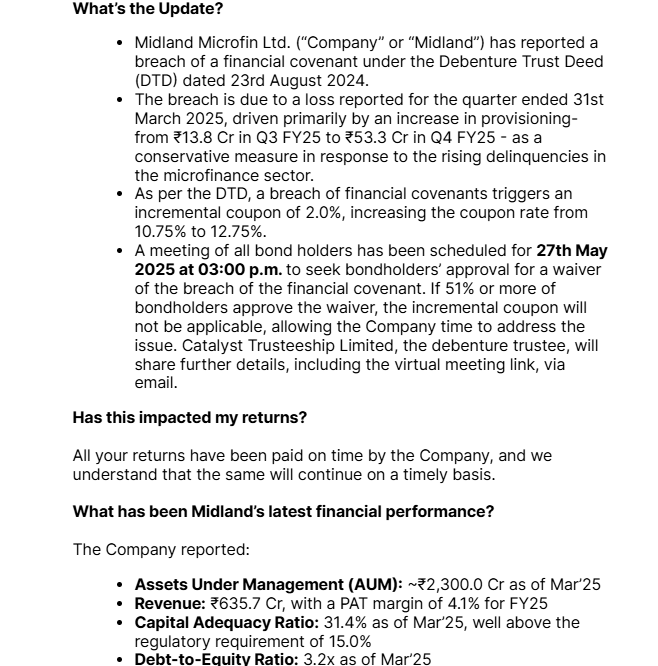

Midland Microfin Covenant Breach

Microfinance-focused Midland suffered a loss this quarter due to stress in the overall sector and the high NPA. This has caused a covenant breach, and the coupon rate has gone up by 2%

Alternative Investment Portfolio Updates

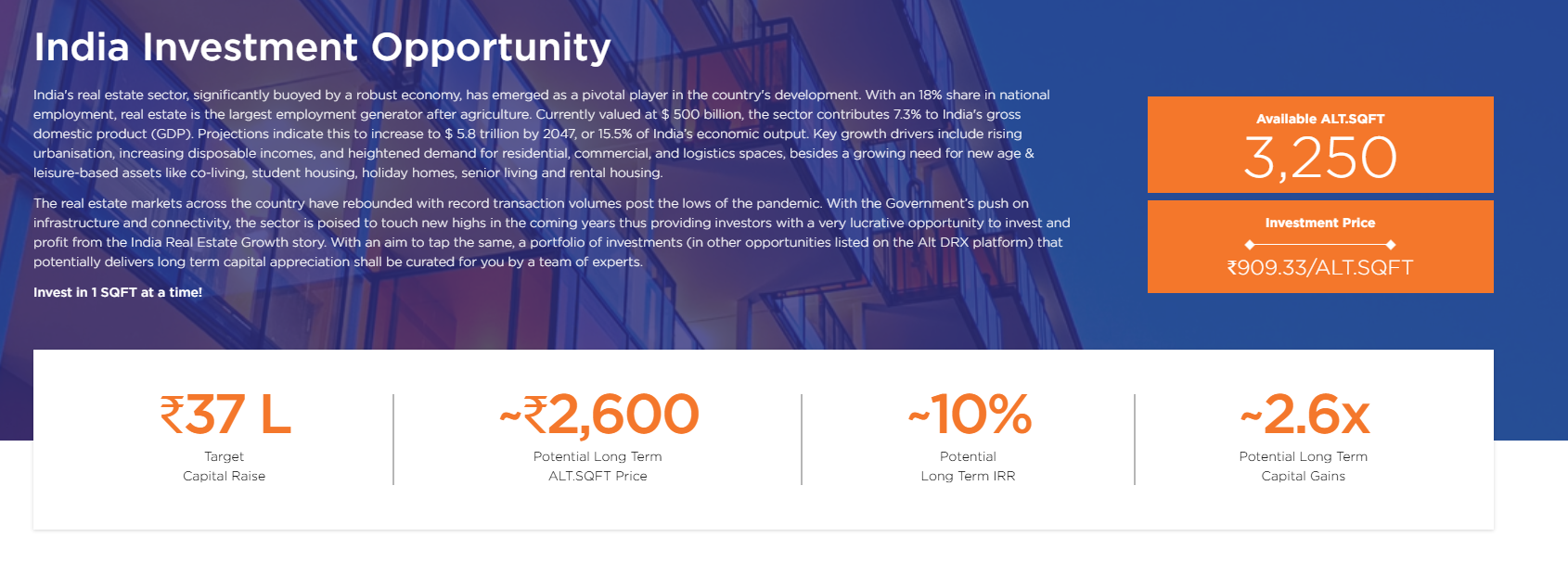

This month, we explored a new opportunity by Pern Annum called Estates

This is a platform that allows you to have fractional ownership of luxury flats before they are sold to buyers at launch. This can help you to take advantage of capital appreciation during the sale.

We did a detailed article on Estates – How does Estate work?

We keep exploring good, high-yield bond opportunities in the market. We are also exploring some AIF CAT II funds focused on Credit. Will cover those details in the future.

If someone is interested, they can ping us, and we can share more details.

For listed bonds, you can check Randomdimes<> Aspero collaboration . You can use the randomdimes registration link to avail the best prices.

Telegram channel for *the Latest Alternative Investment News

Real Estate Investments

Fundbezzie is the new addition to our alternative investment portfolio. Few units of the Ayodhya opportunity are available currently.

Alt DRX Private Opportunity reduced Ticket

AltDRX has reduced the minimum investment to INR 2.5 Lakh for Private opportunity or all Randomdimes investors. This can help people diversify across multiple land opportunities and reduce risk.

They have recently listed a new opportunity that will cover the entire India for choosing the property, hence can give better diversification.

Medium Term Investment

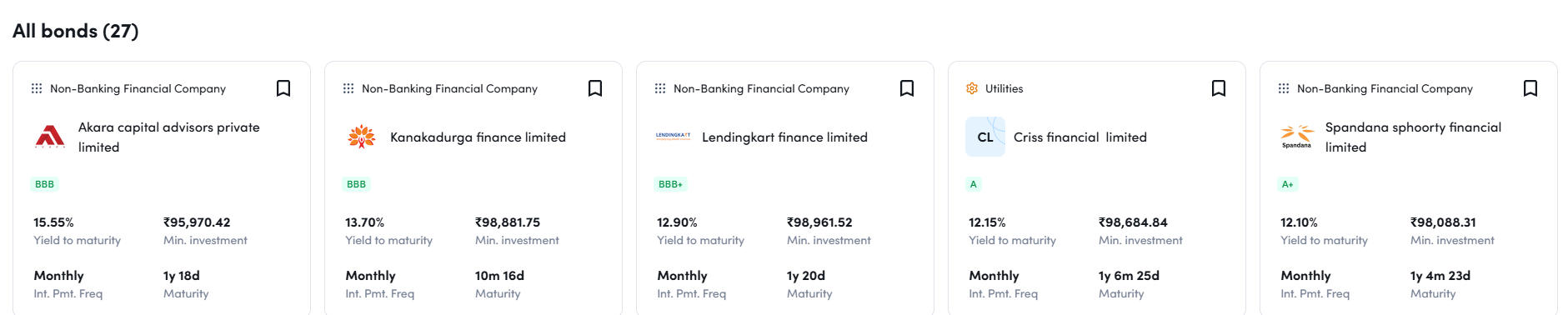

Policy Exchange new listing has been deferred to May as they are currently onboarding new partners. Some of the top high-yield opportunities for this month

- Randomdimes<>Aspero – 15.55% Akara

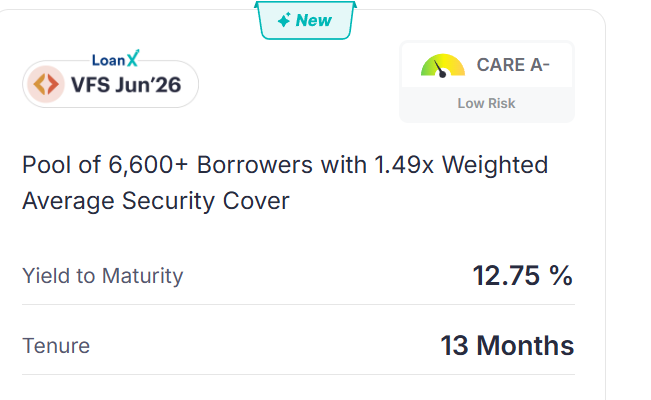

- Grip Invest – VFS 12.75% IRR

- True Credit – 18% IRR (Fund Selling)

Below is the list of bonds currently offered on Randomdimes<>Aspero.

Aspero Randomdimes Page

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks (stopped) | 20%+ | 0.15% | 1.25% |

| WintWealth (paused) | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest(defunct) | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.4% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

Randomdimes Youtube

Short-Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

| Faircent (paused) | 11% | 0% | 0% |

| KredX (Stopped) | 10% | 0% | 3% |

| 13 Karat (Paused) | 13% | 0% | 0% |

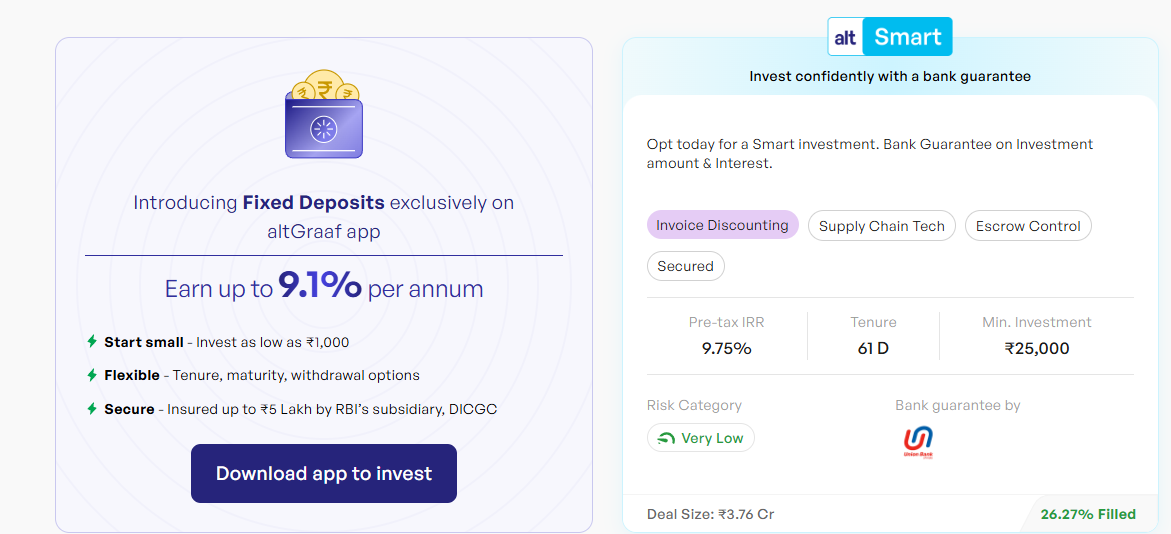

- Currently invested in 2 Invoice deals on Tapinvest

- Invested in 1 deal on Amplio

- Invested in Altsmart (bank Guarantee deal) on Altgraaf

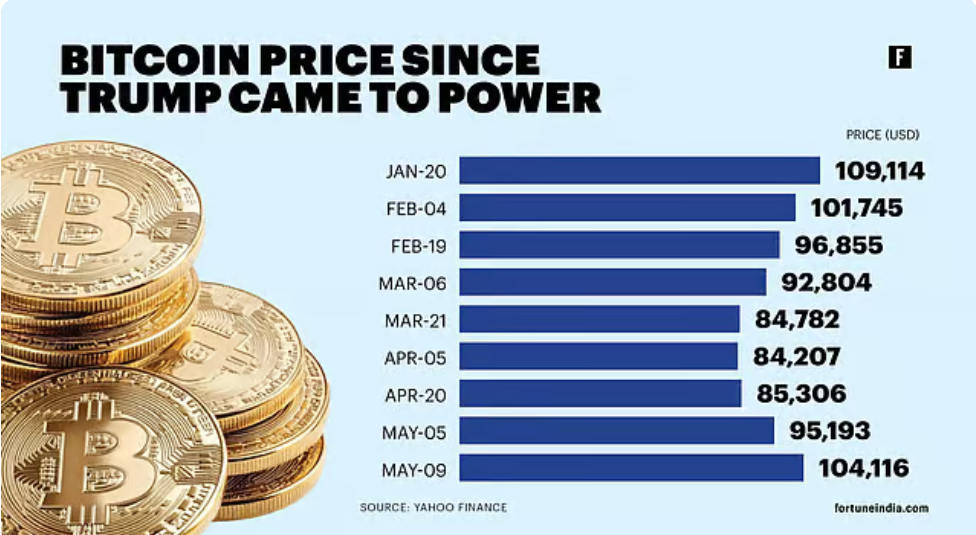

Crypto Investing

Bitcoin held up surprisingly well during the recent stock market declines; while some of its outperformance was undoubtedly driven by a sharp fall in the dollar, its safe-haven status has shone. But, even as tariff-based market jitters calmed recently, driven by a US-UK trade deal, BTC has jumped higher alongside the dollar.

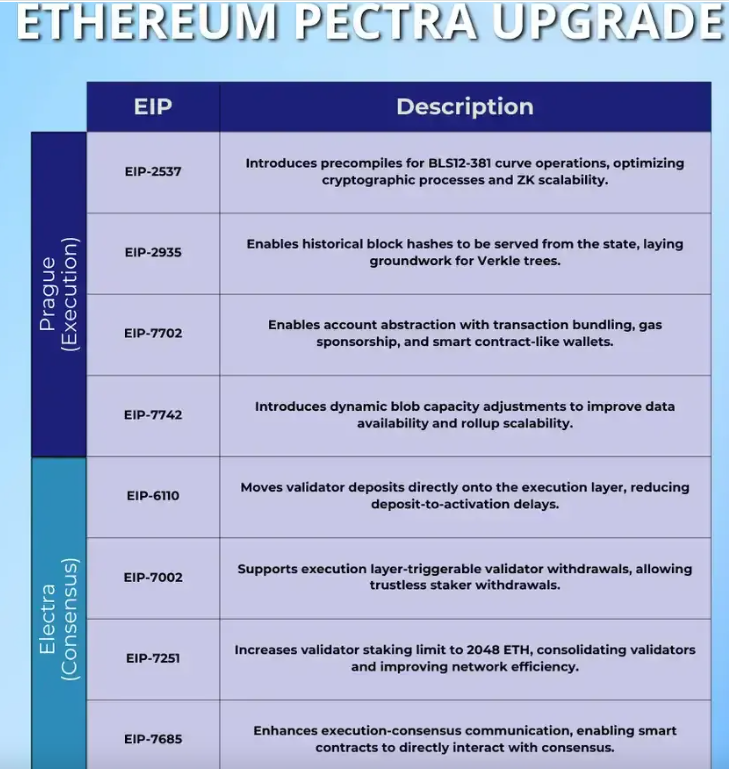

Ethereum has jumped more than 70% to trade above $2,400 following the major Pectra upgrade, driven by renewed risk-on sentiment that spurred investor buying.

ETH is finally catching up after lagging behind $BTC for most of the year. The recent Pectra upgrade has helped restore some confidence, and with ETH/BTC down nearly 40% year-to-date at 0.02, it’s not surprising to see buyers stepping in at these levels

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 35%

- I2IFunding- 45%

- Lendbox -20%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 13% | 5.5% |

| Lendbox Per Annum | Paused | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category i.e, Urban Clap Loans

Equity Market

Pre-IPO Stocks

)

The price of NSE shares has come down a bit due to the impact of current market volatility. The latest price available for NSE is around 1550 INR.

Listed Stocks

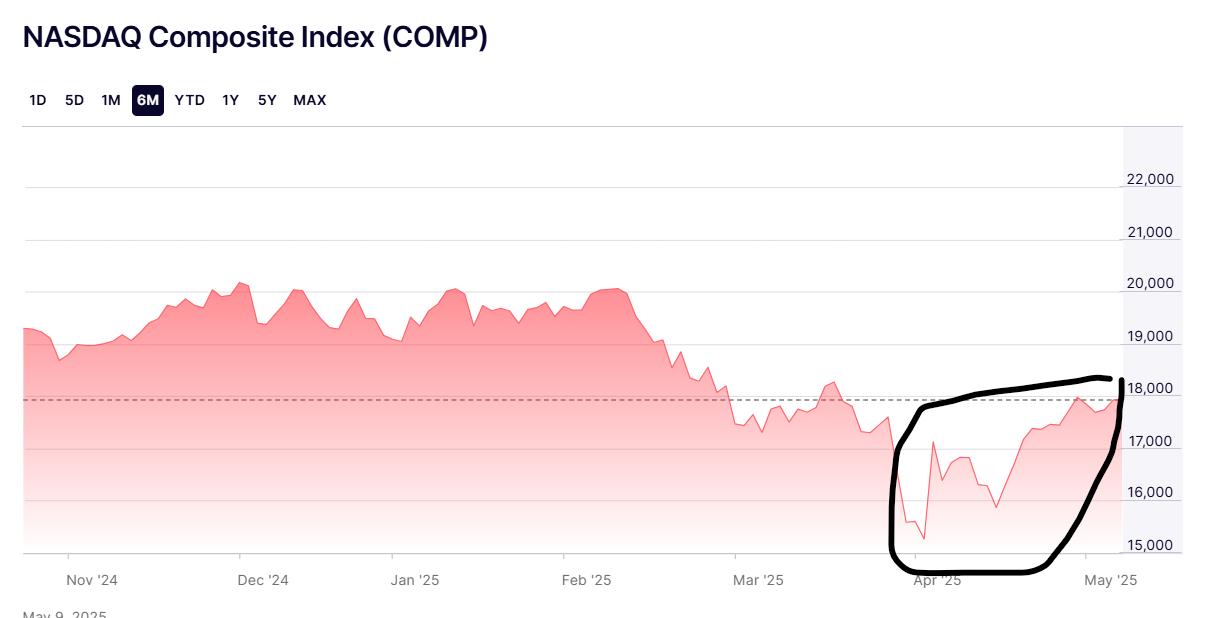

Investing in global markets, along with India, proved to be a good decision.

After falling out of favor in the first quarter, the megacap tech stocks that make up the “Magnificent Seven” have fueled the market’s recovery from sharp losses posted after President Donald Trump’s tariff announcement. Stocks have climbed nearly 14% since bottoming out on April 8 (the day before Trump announced a 90-day pause on many of his new tariffs).

OptionTrading

April was a tough month as the market had a sharp rally after the Trump tariff pause. When the market looked stable, the Pakistan issue caused a sudden reversal, making it difficult to manage. We were able to close the month almost flat.

Below is the new video as a part of the series on top traders.

We covered Quantinsti one of the top quant trading course providers in India. It is really helpful for someone looking to enter this field.

Starters can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.

Hi,

from all above investment which one u feel safer(low probablity of default). because most of platform are defaults/delayed. is polixyexchange or drx which is one safer ?

thanks in advance if, u could share any other input or guidence for investing ?

Hi,

In terms of credit risk it is quite low as per my opinion. They have not listed opportunities for some time.

Will do a follow up article once new policies are listed.