Introduction

In the last few years, India’s alternate investment landscape has exploded — from invoice discounting and P2P lending to unlisted shares and yield products. Yet one model has quietly emerged as both low-risk and steady-yielding: investing in pre-owned life insurance policies.

That’s exactly what The Policy Exchange enables — a platform where investors can buy existing insurance policies from individuals who no longer wish to continue them.

I started using Policy Exchange in mid-2024, and after one full year of active investing, I’ve achieved an average IRR of 14.5% across two policies. In this post, I’ll share my complete experience, how the platform works, key risks, taxation aspects, and whether it deserves a place in your portfolio.

What is Policy Exchange?

The Policy Exchange (operated by Fairvalue Insuretech Pvt. Ltd.) was founded in 2022 and is based in Gurugram, India. The company acts as a three-way marketplace connecting:

-

Policyholders who want liquidity

-

Investors looking for fixed, predictable returns

-

Insurance companies seeking to reduce policy lapses

The founding team brings decades of financial and insurance experience:

-

Tarun Bahri (Co-Founder & CEO) – 27+ years across Max Life, HDFC Bank, Citibank, and ABN Amro.

-

Naveen (Co-Founder & Director) – 25+ years in consumer banking and telecom (Airtel, SBI Cards, Citibank).

-

Safia (Co-Founder & Director) – 25+ years in telecom and social sectors (Koshika Telecom, Bharti Airtel).

As of 2025, Policy Exchange has facilitated ₹100+ crore worth of investments, connecting 2,000 investors with over 20,000 policyholders.

We had done a detailed review of the platform in the past. Here is the link to the article.

Early Access to Policy exchange

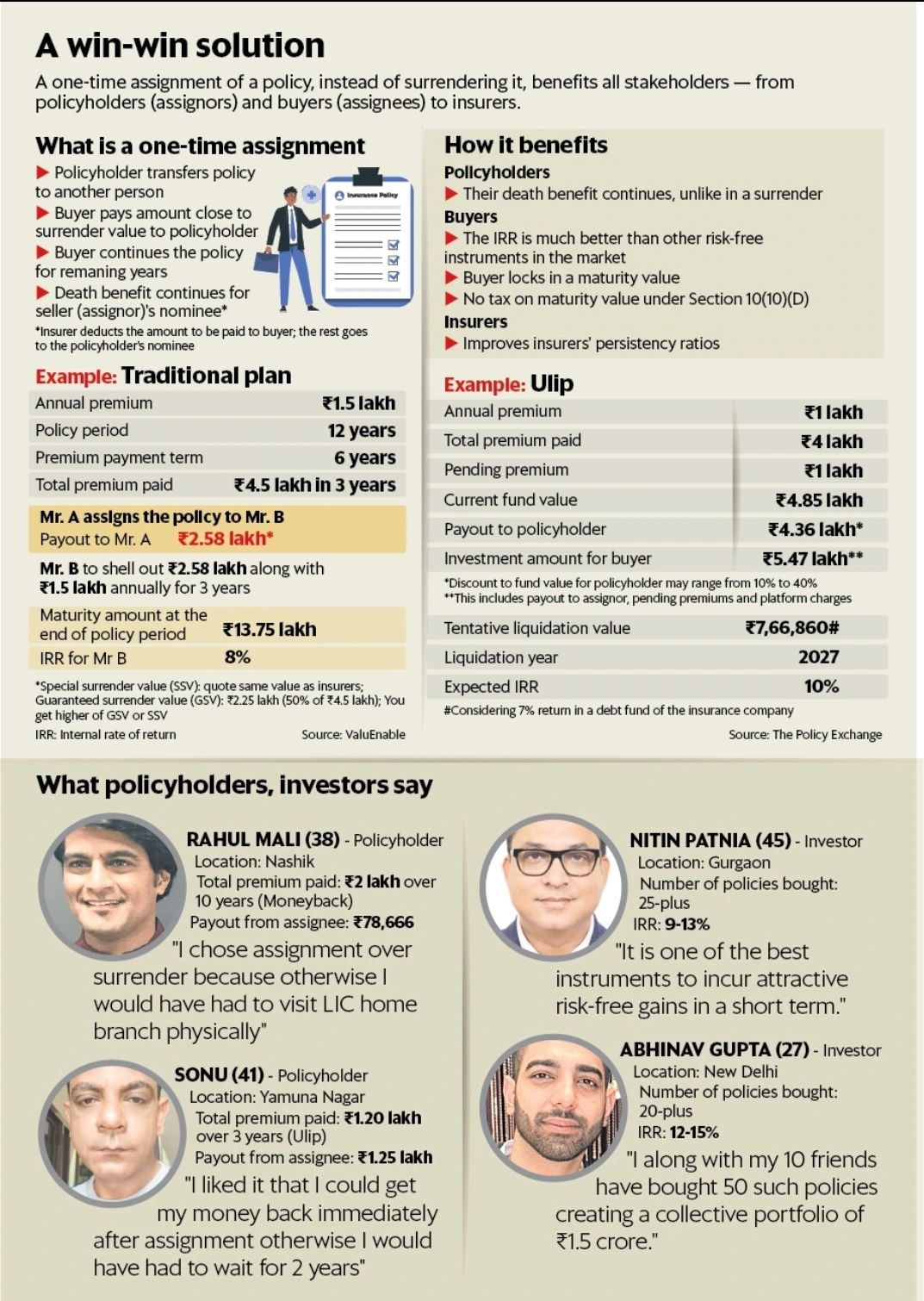

What is Insurance Policy Assignment?

Policy assignment is the legal transfer of rights, title, and interest of a life insurance policy from the original policyholder (assignor) to another person (assignee). Once assigned, the new owner assumes full control of the policy benefits.

In India, policy assignment is governed by Section 38 of the Insurance Act, 1938, which makes it a transparent and regulated process.

Types of Assignment

-

Absolute Assignment

-

The complete transfer of policy rights from assignor to assignee.

-

The new owner gets maturity/surrender value and all rights, except the death benefit (which remains tied to the insured life).

-

-

Collateral Assignment

-

The policy is transferred as security for a loan or obligation.

-

Once the loan is repaid, rights revert back to the original policyholder.

-

Why Assignment Matters for Investors

-

Unlocks value: Policyholders who no longer wish to continue their policies can monetize them instead of surrendering at a loss.

-

Enables secondary market: Investors can step in, take over the policy, and benefit from the maturity payouts.

-

Legal and regulated: Assignments are recorded by the insurance company, and investors get official confirmation of ownership.

Example

Suppose a policyholder has already paid 7 years of premiums on a 15-year plan but wants to exit.

-

If they surrender, they may get just ₹4 lakh back (lower than total paid).

-

Through assignment, an investor can step in, pay the surrender value + future premiums (say ₹7.5 lakh total), and eventually receive the maturity value (say ₹15.3 lakh).

-

This results in an IRR of 12%+ for the investor.

Policy Assignment vs. Surrender

| Aspect | Policy Assignment | Policy Surrender |

|---|---|---|

| Owner | New investor/assignee | Original policyholder |

| Value Received | Full maturity/surrender value at the end | Immediate surrender value (usually lower) |

| Returns | Higher IRR (9–14%) for the investor | Loss compared to premiums paid |

| Legal Backing | Section 38, Insurance Act | Section 35, Insurance Act |

| Use Case | Alternative investment opportunity | Exit option for policyholder |

Why Is This Investment Different?

Unlike traditional FDs or mutual funds tied to interest rates or market risk, Policy Exchange offers:

-

9–12% IRR, sometimes higher.

-

AAA-rated backing and regulated under IRDAI.

-

Direct ownership of the policy with the insurer.

-

Possible tax-free status depending on policy type and date.

This makes it an attractive alternative investment option in India for those seeking high fixed returns with moderate risk.

Early Access to Policy exchangeHow Policy Assignment Works (Step-by-Step)

The Policy Exchange aims to address the above challenge by building a bridge between policyholders in need of liquidity and investors seeking stable, short to medium-term opportunities.

Through the platform, a policyholder can assign/transfer their policy to an investor, who pays them the surrender value (instead of the insurance company) and takes care of all future premiums (if any). In return, the investor secures the policy’s full maturity amount. This arrangement:

- lets the policyholder unlock its monetary value while keeping their life protection partially intact (more on that later)

- gives the investor a decent return opportunity with relatively low risk, and

- keeps insurers and agents happy with policies staying active. Seems like a win-win arrangement for all parties here.

Here’s the simplified workflow behind the concept of pre-owned policy investment:

-

A policyholder approaches The Policy Exchange to sell or assign their insurance policy.

-

The platform lists it for investors with details — policy term, expected IRR, and remaining premium (if any).

-

An investor invests an amount roughly equal to the policy’s surrender value.

-

The investor takes over future premiums (if applicable).

-

On maturity, the investor receives the full maturity amount directly from the insurer.

In the unfortunate case of the policyholder’s death before maturity:

-

The insurer pays the sum assured to Policy Exchange’s escrow account.

-

The investor gets the committed IRR, and the balance is paid to the policyholder’s nominee.

This ensures that the investor’s returns remain predictable, while the original policyholder retains partial life cover.

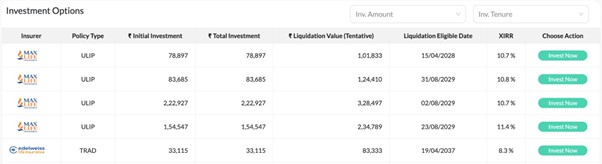

Example of a Policy Investment

Let’s break down an actual sample available on the platform:

-

Investment amount: ₹78,897

-

Maturity value: ₹1,01,833

-

Maturity date: 15 April 2028

-

Effective IRR: ~10.7%

-

Future premiums: None

If the policyholder passes away before maturity, the insurance company still pays out via the escrow. You receive your 10.7% IRR, and any remaining amount goes to the original nominee.

It’s essentially a fixed-income-like product but backed by a regulated life insurance policy.

Security and Transparency

Policy Exchange reduces risk through:

-

IRDAI-regulated framework – assignments are fully legal.

-

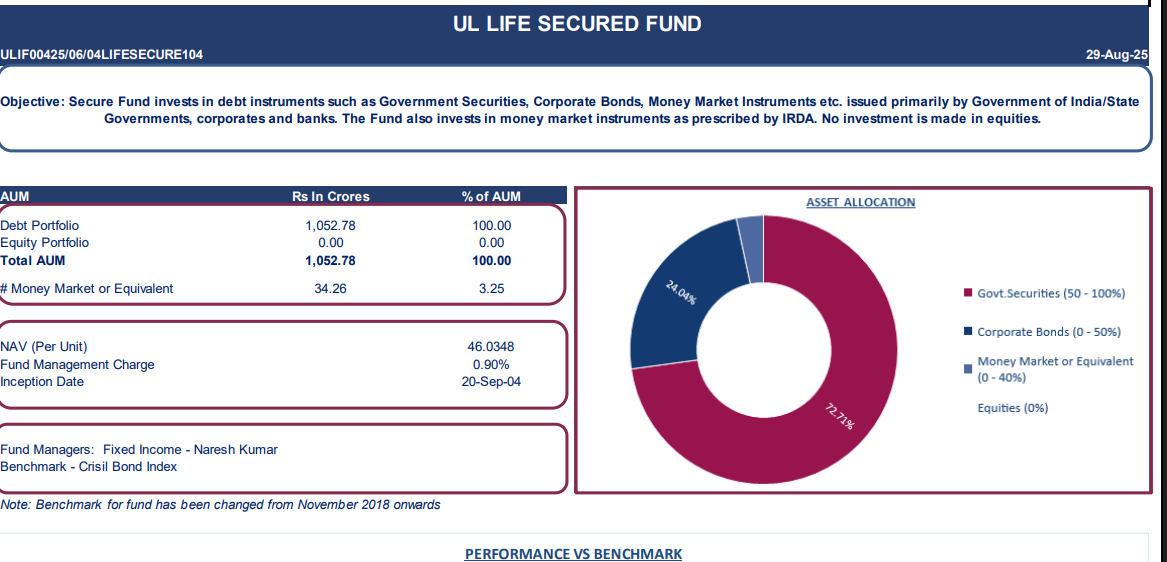

Funds were shifted to fixed-income securities (yielding 7–8%) to protect against market volatility.

-

No hidden charges – investors receive the entire maturity value.

-

Independent ownership – investors deal directly with insurers, so even if Policy Exchange ceases, rights remain intact.

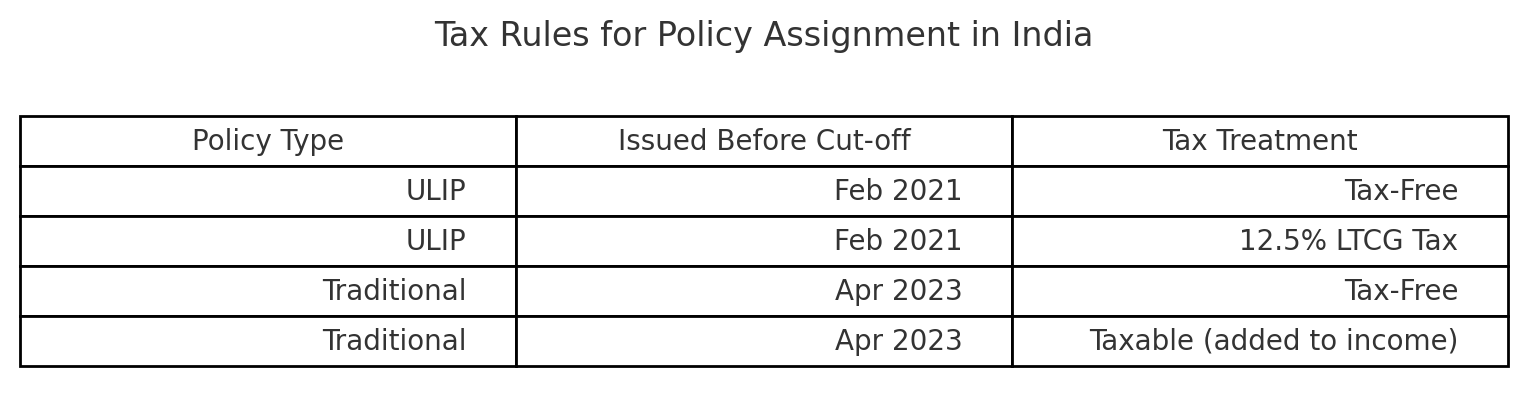

Tax Treatment of Returns

One of the biggest attractions is tax efficiency. Here’s how it works:

-

ULIPs before Feb 2021 → Tax-free.

-

ULIPs after Feb 2021 → 12.5% LTCG tax.

-

Traditional policies before Apr 2023 → Tax-free.

-

Traditional policies after Apr 2023 → Maturity value added to taxable income.

For investors in the 30% tax slab, this difference is huge. A tax-free IRR of 12% is equivalent to a 16–17% pre-tax return.

Early Access to Policy exchangeExample Return Calculation

Suppose you invest ₹7.5 lakh in a pre-owned policy with 8 years left:

-

Investment (including future premiums): ₹7,53,000

-

Maturity Value: ₹15,31,000

-

IRR: ~12% (tax-free, if conditions met)

This is significantly better than an FD or bond yielding 6–7% taxable returns.

Why Consider Policy Exchange vs. FDs or Debt Funds?

| Investment Type | Average Return (2025) | Risk | Liquidity | Taxation | Comments |

|---|---|---|---|---|---|

| Policy Exchange | 8–14% | Low-Moderate | Locked till maturity | Mixed (depends on 10(10D)) | Unique alternative, fixed IRR |

| Fixed Deposit (Bank) | 6.5–7.5% | Very Low | High | Taxed as per slab | Stable but lower returns |

| Debt Mutual Funds | 7–9% | Low | Moderate | LTCG @12.5% (after 3 yrs) | Market exposure |

| Corporate Bonds/NCDs | 9–11% | Moderate | Medium | Taxed as per slab | Credit & liquidity risk |

Key takeaway:

Policy Exchange offers a superior risk-reward ratio versus FDs and short-term bonds, especially when policies have <5 years to maturity.

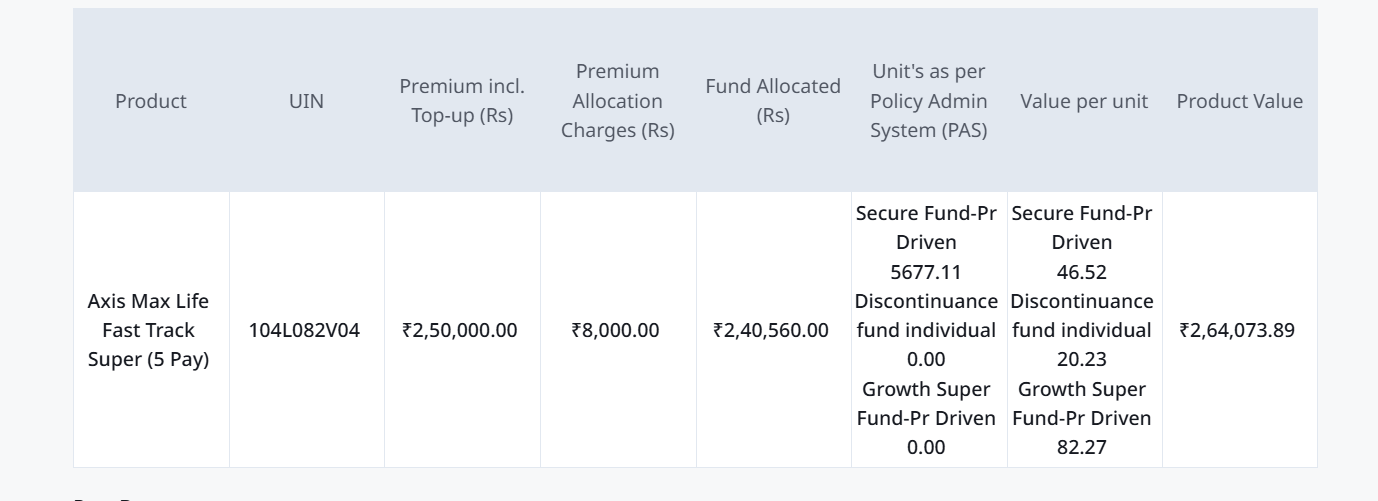

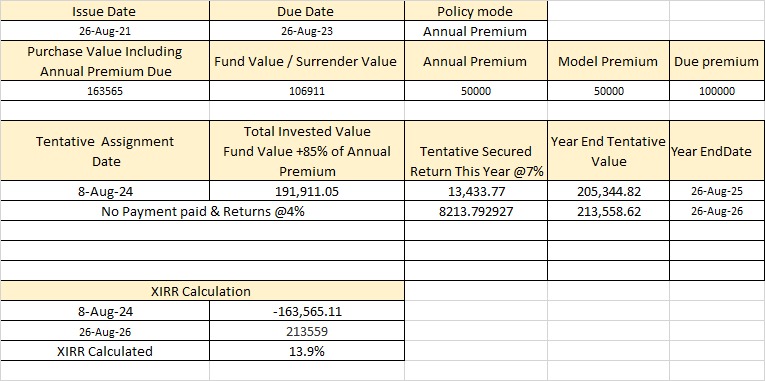

Personal Experience and Performance

I first discovered Policy Exchange in mid-2024 while exploring short-duration fixed-return investments. Over the past year:

-

I’ve invested in two policies, both endowment-type.

-

My average IRR stands at 14%, comfortably above FD or bond yields.

-

All payouts and documentation were handled smoothly through the platform’s dashboard.

-

Customer support was responsive, explaining assignment and claim processes clearly.

The biggest positive? Transparency. Every policy comes with an indicative IRR, maturity date, and insurer name — no hidden clauses or unpredictable market exposure.

As the policy is transferred from another individual, transferring money to that person’s account is a manual step that can be automated in the future.

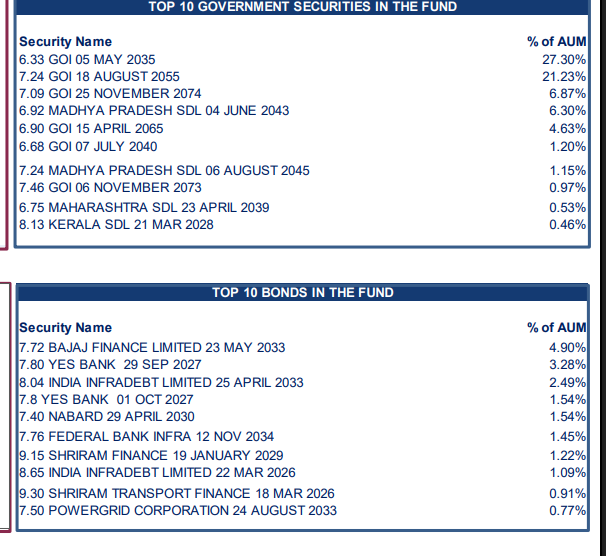

| Date | Amount |

| 08-10-2024 | -1,63,565 |

| 26-10-2025 | -50,000 |

| 26-10-2026 | 2,79,840 |

| IRR | 16% |

Early Access to Policy exchange

FAQs About Policy Exchange

Q. What is Policy Exchange?

Policy Exchange is an Indian insure-tech platform that allows investors to buy pre-owned life insurance policies via assignment, offering ~9–14% returns.

Q. Is Policy Exchange legal in India?

Yes. It works under Section 38 of the Insurance Act, 1938, and all transactions follow IRDAI regulations.

Q. How much return can investors expect?

Typical IRR is 9–12%, and in some cases up to 14%, depending on the policy and tax treatment.

Q. Are returns tax-free?

Yes, for policies issued before certain cut-off dates (ULIPs before Feb 2021, traditional before Apr 2023). Otherwise, LTCG or income tax applies.

Q. Is my investment safe if Policy Exchange shuts down?

Yes. Ownership is directly with the insurer, so your rights remain intact.

Q. Who should invest in Policy Exchange?

Investors seeking safe, long-term, inflation-beating returns, with the ability to commit to future premiums.

Q. Do investors get a death benefit too?

No, only maturity/surrender value. The death benefit stays with the original insured.

Q. Can policies be liquidated early?

Yes, via surrender, although the IRR may be reduced.

Q. Are all policies eligible?

Yes, assignments are standardized across insurers.

Q.How does the original policyholder still keep their life cover?

As mentioned in the example earlier, the XIRR committed to the investor is calculated based on the money coming in at the time of maturity. Since the investor is paying a discounted value at the time of assignment, they make a decent return. If, however, the original policyholder dies before the maturity date, the money comes in earlier, which increases the XIRR for the investor. In this case, the entire amount is not paid to the investor. They are paid an amount that gives them the committed return (IRR), and the rest is paid out to the original policyholder as life cover.

Q.How are claims managed? What happens in case of the original policyholder’s death?

The investor doesn’t need to do anything. The respective insurance company handles the fund flows. It gives the investor the principal + committed IRR, and the balance to the nominee of the original policyholder.

Q.Is it a regulated product?

The base product is an insurance policy, which is regulated by IRDAI. The process of policy assignment is also legally governed by rules under Section 38 of the Insurance Act, 1938. However, The Policy Exchange is a platform, and not an insurance provider – and therefore not regulated.

Risks to Consider

While promising, some risks remain:

-

Premium Commitment – missing future premiums could harm returns.

-

Liquidity – policies are long-term; early exit reduces IRR.

-

Tax Rules Can Change – future budgets may alter exemptions.

-

Startup Risk – Policy Exchange is a young company.

Verdict: Is 14% Return Real?

Yes, double-digit tax-free returns are possible, but only under the right conditions:

-

Policy meets tax-exemption rules.

-

The investor holds till maturity.

-

Premiums are paid on time.

-

The chosen insurer is strong and reliable.

For long-term, fixed-income investors, Policy Exchange could be a smart diversifier in a portfolio, offering returns far better than FDs or bonds.

Early Access to Policy exchange

Should You Invest?

Consider Policy Exchange if you are:

-

Looking for safe, inflation-beating returns.

-

Comfortable with a long-term horizon.

-

Aware of tax rules and risks.

-

Diversifying into alternative investments in India.

✅ Final Take: Policy Exchange introduces a unique, regulated way to earn 9–14% tax-efficient returns through insurance policy assignment. With transparency, fixed returns, and direct ownership, it’s an option worth exploring for savvy investors.

when are you publishing AIF update? want to see about grip LoanX noney SDI still not paid updates

Updated status of Grip LoanX delay in latest report.