Technology has revolutionized the way investing works. From the basics, like opening a trading and demat account online to advanced algorithmic trading strategies, technology has changed the dynamics and scale of traditional investing.

The use of computerized programs to automate trades has recently gained traction due to its ability to execute trades in split seconds and over minute price differences, reducing the chances of human error and capitalizing on factors like suitable time, price, and volume. This is known as algorithmic trading or algo trading. In simple terms, algo trading refers to the process of executing orders utilising automated and preprogrammed trading instructions to account for variables such as price, timing, and volume. Algo trading can execute trades faster and more frequently than a human trader, minimizing the price impact of large trades.

In this review article, we will look at Bigul Algos, an algo-trading platform that allows users to execute automated trades. We will look at what Bigul Algos is, the benefits of using an algo trading platform, the team behind Bigul, how the platform works, opportunities on the platform, and its alternatives.

What is Bigul Algos?

Bigul Algos is an algo-trading platform that allows traders to develop, test, and execute automated trading strategies. The platform offers a comprehensive suite of pre-built, market-tested strategy templates, which can be used to execute trades. The use of algo trading platforms like Bigul Algos reduces the risks of human intervention in trading such as emotional biases and input errors. With pre-built strategies, the platform minimizes manual input errors, enhancing trade accuracy and efficiency. The platform offers pre-built strategies for traders of all kinds- conservative or aggressive, providing tailored strategies to align with the diverse preferences and risk appetites of individual traders.

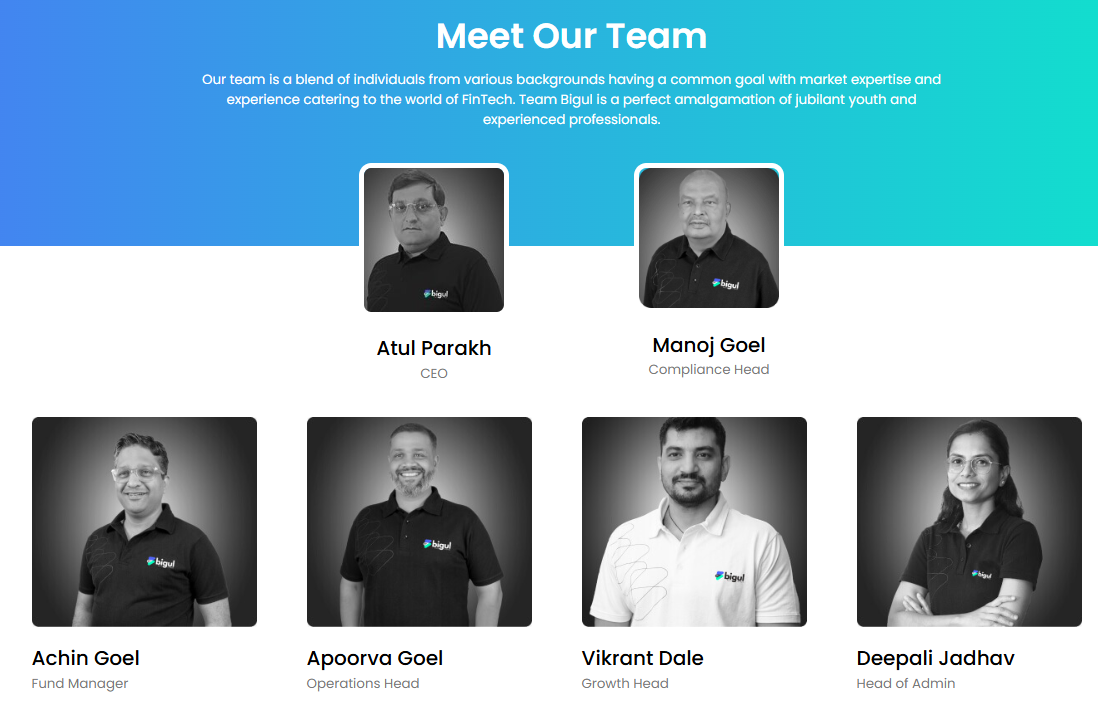

Team Behind Bigul Algos

The Bigul Algos platform is offered by Bonanza Portfolio Limited, a brokerage house based out of Mumbai, India. Bonanza Portfolio Limited is a member of NSE & BSE and is registered with the Securities and Exchange Board of India. The platform was established in 2022, and since then, it claims to have served over 4 lakh clients.

The team behind Bigul Algos comprises both young and energetic professionals as well as seasoned and experienced professionals, bringing years of experience in the field of fintech and trading.

The company’s CEO, Atul Parakh, holds an MBA in Finance and Financial Management Services. Prior to becoming the CEO of Bigul, Atul held the positions of AVP and Regional Head at Bonanza Portfolio Limited. Manoj Goel heads the compliances of Bigul Algos. Achin Goel, the Portfolio Manager of Bonanza Portfolio Limited, heads Bigul’s fund management operations, is a Certified Financial Planner, and holds a CFA charter.

Opportunities on Bigul Algos

Bigul Algos offers a wide range of products and services. Let’s have a look at some of the most prominent features of the platform:

-

Portfolio Evaluator

It is a comprehensive tool that gives a score to your portfolio based on technical & fundamental analysis. The Evaluator can be used to assess the performance and risk of your investment portfolio. The Portfolio Evaluator tool uses AI and ML technologies to analyze your portfolio and suggest improvements based on deviations and findings. The tool offers real-time monitoring of your portfolio’s position in light of market trends. Based on its AI-driven analysis, the tool suggests personalized investment strategies tailored to your unique financial profile and offers automatic rebalancing of your investments to obtain optimal asset allocation.

-

Bigul Algos pre-built trading strategies

The Algo trading tool offers users pre-built, market-tested strategy templates, providing traders with a reliable and methodical framework.

-

Bigul Execution Algos

Bigul Execution Algs is a sophisticated, served-based algorithmic trading application that supports multiple markets and assets. It is a comprehensive platform specifically for options traders, offering all necessary options and trading tools in one place. The tool allows orders to be automated based on specific conditions. Some of the key features of Bigul Execution Algos are:

-

- Scalping

- Automation based on individual parameters

- Readymade strategies

- Averaging Algo: Navigates market volatility in bull markets and reduces costs in bear markets, tailored to your portfolio.

- Algo Ideas: Identifies the best algo strategy tailored to your trading style.

-

Bigul Algo Ideas

The Bigul Algo Ideas offers a learning mechanism for someone who is just starting algorithmic trading. The tool offers chart-based, easy-to-follow recommendations and breaks down trading strategies into accessible blueprints. Some of the key features of Bigul Algo Ideas include:

-

- Algo Strategy Templates: Predefined back-tested strategy templates.

- Chart-Based Recommendations: Easy-to-understand chart-based recommendations based on AI-driven insights.

- Real-Time Market Data: Bigul Algos utilizes real-time market data and continuous monitoring of data to offer updated algorithmic strategies.

-

One-Click Strategy

This trading feature offered by Bigul Algos is designed for traders who frequently trade in the Futures & Options segment. This feature allows traders to execute prebuilt strategies with just one click or even automate their own strategy based on their own findings and parameters. The One-Click strategy features offers a range of back-tested trading strategies to choose from based on a year’s worth of historical data. Additionally, it offers real-time risk-reward assessment, allowing you to quickly evaluate the risk-reward dynamics of each strategy before making a decision.

-

Bigul’s AI-Powered Stock Advisor

Bigul offers a Powered Stock Advisor powered by Jarvis that utilizes cutting-edge algorithms to help traders optimize their investments in the stock market.

Some other key features of Bigul Algos that merit a mention are as follows:

- Order Slicer: Bigul Algos divides large quantity orders into smaller and more manageable parts and executes them gradually over a specified period. This helps in minimizing market impact and reduces the risk of unfavorable price movements.

- Multi-Leg Strategy: Allows you to execute more than one leg in one go, letting you hedge your position or manage your orders.

- Master Scalping: The Scalping tool quickly buys and sells from price fluctuations, ensuring no missed opportunities. This tool helps you convert market fluctuations into opportunities by allowing you to place orders automatically in the running markets while you are away.

- Trend Trading: This feature identifies a current trend in the market and then executes trades in the direction of that trend.

How Bigul Algos Works?

To get started on Bigul Algos, you need to open your account using your mobile number on the platform’s link given below Once you register with your mobile number, you are required to provide your PAN, Aadhar, and Bank Account details for onboarding.

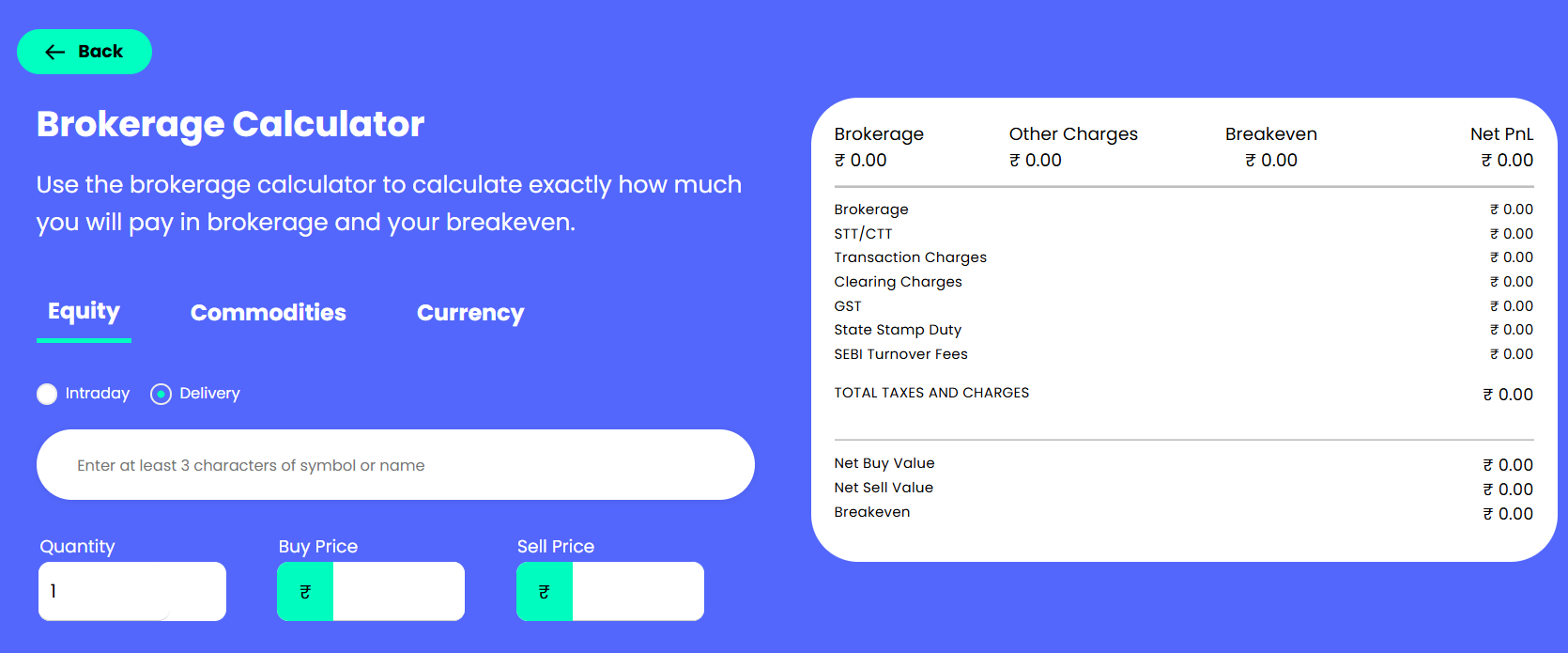

Some of the key pricing figures you need to be aware of before using the Bigul Algos trading platform are as follows:

- Flat INR 18 brokerage charge per order.

- No cost algo trading.

- No cost account opening.

You can read the detailed pricing elements for different kinds of trading and investment activities on the Equity, Futures and Options, Commodity, and Currency segments on the platform here. You can also use Bigul’s brokerage calculator to determine brokerage charges for a specific order.

Bigul Algos Alternatives

With more and more people becoming aware of the benefits of algo trading and how it can capitalize on split-second movements in key variables like price and volume, different fintech companies have come up with their own algo trading platforms. Even though most of these platforms are fairly new, I have listed down some of the key alternatives to Bigul Algos for your reference. For fundamental analysis, you can check our article on best platforms for stock analysis.

- Zerodha algoZ: Offered by Zerodha, is a technical analysis-based algo suite for Zerodha’s retail clients. The tool allows users to write a strategy, backtest it, and take the strategy live semi-automated. Fully automated trades are also allowed, provided you sign up for a Dealer Terminal.

- TradingView: TradingView is a prominent charting platform and social network used by 90M+ traders and investors worldwide. The platform offers multiple algo trading tools and features.

- SpeedBot: Founded in 2019, SpeedBot is a platform focusing on algorithmic trading that allows you to automate your trades much like Bigul Algos by choosing a strategy and setting specific margins. It has a bot builder feature that enables traders to build a variety of strategies to place orders of trades with 120+ technical indicators and trade rules.

Conclusion

While algo trading is a fairly new and evolving concept in the Indian trading landscape, platforms like Bigul Algos offer some promising features for using computerized programs to specify variables and automate trade executions. This can allow users to avoid human errors, especially when executing time-sensitive trades. Bigul has something to offer for both beginners looking to explore algo trading who can use its pre-built strategies and also ideas, as well as advanced traders who can customize their own strategies.