The landscape of investment in India has significantly evolved over the past decade, with Alternative Investment Funds (AIFs) emerging as a notable segment. AIFs, as regulated by the Securities and Exchange Board of India (SEBI), offer diverse investment opportunities beyond traditional instruments like stocks, bonds, and mutual funds. This blog delves into the evolution of AIFs in India, the different categories, top-performing funds, and why investors gravitate towards these alternative investment vehicles.

The Evolution of Alternative Investment Funds in India

The journey of Alternative Investment Funds in India began with the introduction of the SEBI Regulations in 2012. These regulations were a significant milestone in bringing transparency, standardization, and a regulatory framework to the alternative investment sector. Since then, the AIF industry has grown exponentially, driven by increasing investor interest and the need for more diverse investment options.

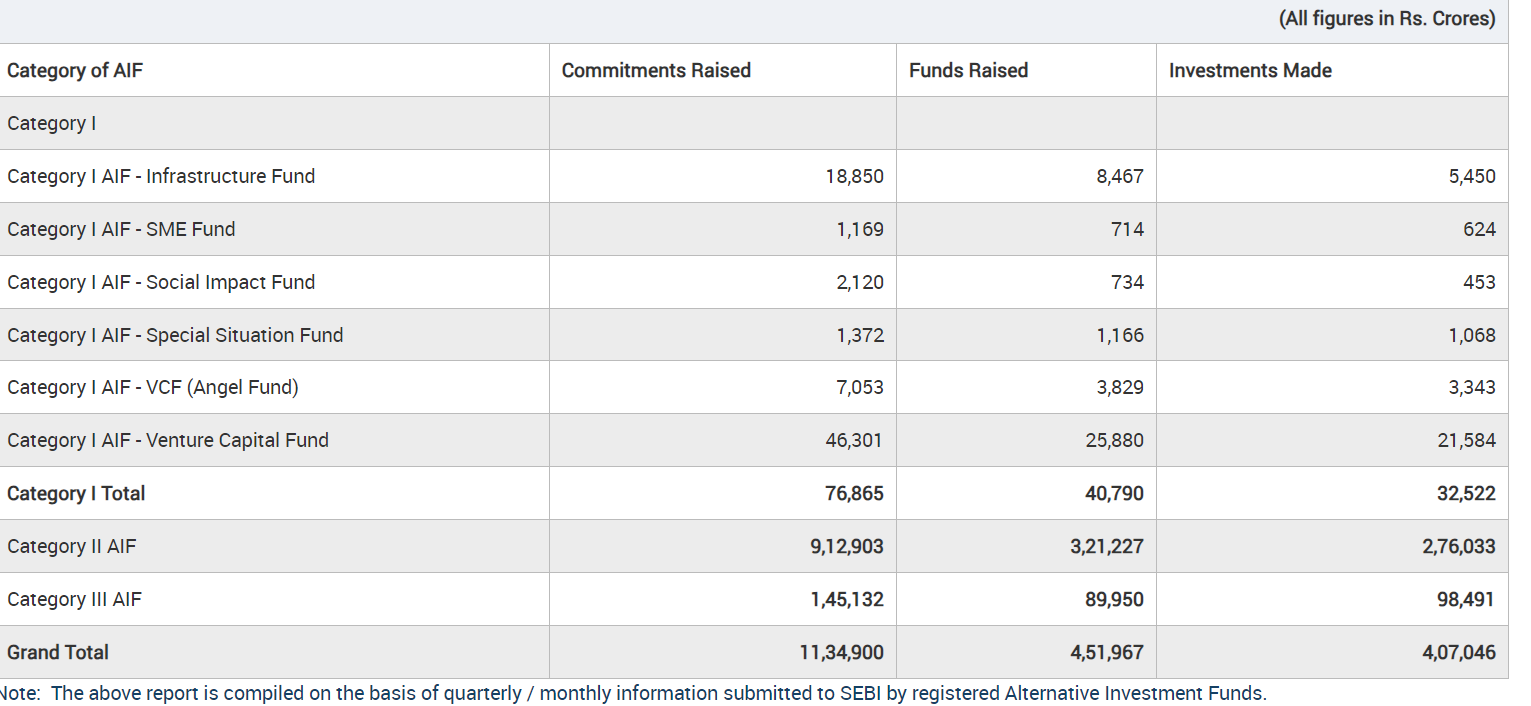

According to the latest data, the AIF in India has witnessed robust growth. The were over 1,200 registered Alternative Investment Funds, managing assets worth more than INR 8.3 trillion in 2022-23. This growth trajectory underscores the increasing acceptance and recognition of AIFs as a viable investment avenue.

Categories of Alternative Investment Funds

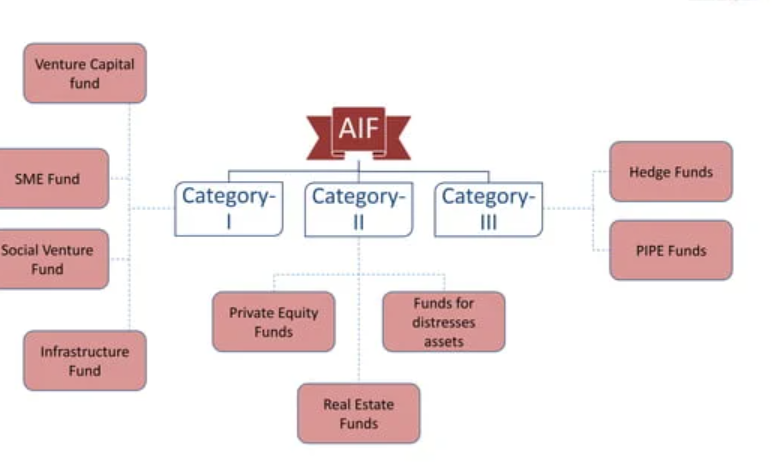

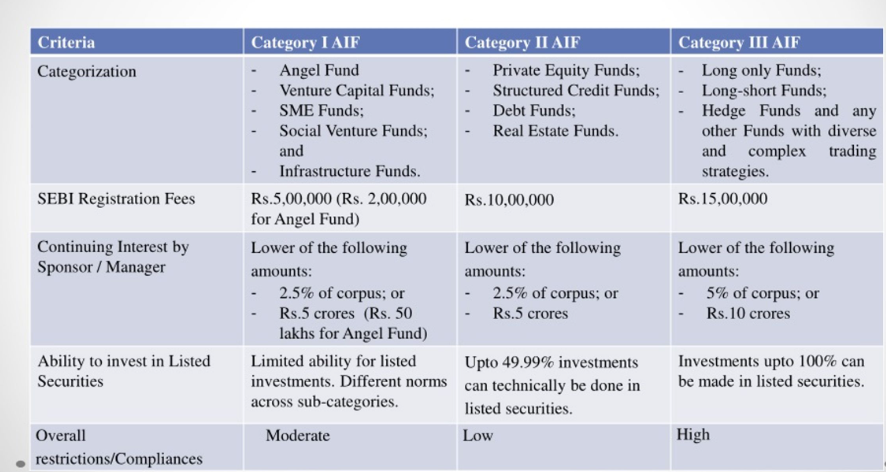

SEBI classifies Alternative Investment Funds into three categories:

Category I Alternative Investment Funds

Category I Alternative Investment Funds are those that invest in startups, early-stage ventures, social ventures, small and medium enterprises (SMEs), infrastructure, and other sectors that are considered socially or economically desirable. The objective is to enhance growth and development in these sectors. Sub-categories under Category I include:

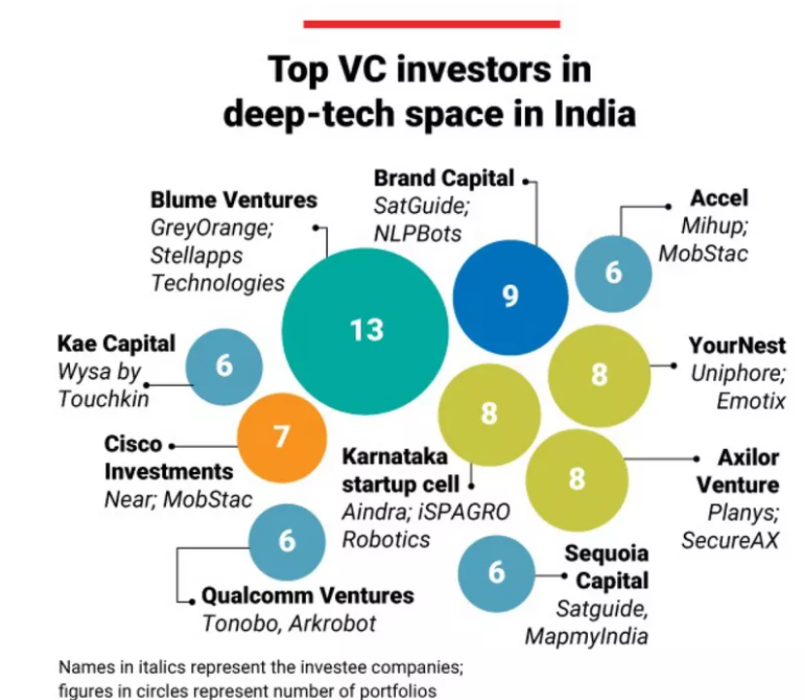

– Venture Capital Funds (VCFs)

– Social Venture Funds

– SME Funds

– Infrastructure Funds

Return Expectation : 15-25% IRR

Top Funds in Category I:

- Sequoia Capital: AUM of INR 10,000 crore approximately.

- Accel India: AUM of INR 7,000 crores

- Matrix Partners: AUM of approximately INR 8,000 crores.

Category II Alternative Investment Funds

Category II AIFs are those funds that do not fall under Category I or III and do not undertake leverage or borrowing other than to meet day-to-day operational requirements. This category typically includes private equity funds and debt funds. These funds invest in other private companies in the mid to late stage.

Private Equity and Debt in Category II AIFs

Category II Alternative Investment Funds include both private equity and debt funds, each offering unique benefits:

Private Equity

Private equity funds in Category II Alternative Investment Funds invest in unlisted companies, aiming for long-term capital appreciation. These funds typically provide growth capital to companies, helping them scale operations, expand into new markets, or pursue strategic acquisitions.

Benefits:

– Potential for High Returns: Investing in growth-stage companies can yield substantial returns.

– Active Management: Fund managers often take an active role in the companies they invest in, providing strategic guidance and support.

Return Expectation : 15-25% IRR

Debt Funds

Debt funds in Category II Alternative Investment Funds focus on providing private credit to companies, including mezzanine finance, structured credit, and distressed assets. These funds are an alternative to traditional bank financing, offering customized credit solutions.

Benefits:

– Steady Income: Debt funds can provide regular income through interest payments.

– Lower Risk: Compared to equity investments, debt investments generally carry lower risk, although they are not without their own set of risks.

Return Expectation : 15-17% IRR

Top Funds in Category II:

Private Equity:

IIFL Special Opportunity Fund: AUM 10,000 Crores

Kotak Pre IPO Opportunity Fund: AUM 5,000 Crores

Credit Funds:

Edelweiss Special Opportunities Fund: AUM of INR 40,000 crores

KKR India Alternate Credit Opportunities Fund: Assets Under Management (AUM) of INR 6,000 crores

Piramal Alternative Investment Fund: AUM of INR 4,000 crores

Kotak Special Situations Fund: AUM of INR 2,800 crores

Category III Alternative Investment Funds

Category III Alternative Investment Funds employ diverse or complex trading strategies and may employ leverage, including through investment in listed or unlisted derivatives. Hedge funds fall under this category.

Top Funds in Category III:

- Avendus Absolute Return Fund

- Tata Absolute Return Fund

Return Expectation : 13% 16% IRR

Apart from these, there are some long-only funds in CAT III like Abakkus, Carnelian, etc

Why Investors are Turning to Alternative Investment Funds

Several factors are driving the increasing interest in AIF among investors:

Diversification

Alternative Investment Funds offer an opportunity to diversify investment portfolios. By investing in AIFs, investors can gain exposure to asset classes and strategies that are not available through traditional investment vehicles.

Higher Returns

AIF, particularly private equity and venture capital funds, have the potential to deliver higher returns compared to conventional investments. The ability to invest in early-stage companies or niche sectors often translates to significant gains.

Access to Expertise

Alternative Investment Funds are managed by professional fund managers with expertise in specific sectors or strategies. This professional management can enhance the likelihood of achieving superior returns.

Innovation and Growth Potential

Investing in AIF allows investors to participate in the growth of innovative companies and sectors. For instance, venture capital funds often invest in cutting-edge startups with the potential to disrupt industries and create substantial value.

Requirements for Investing in AIFs

Investing in Alternative Investment Funds requires meeting specific criteria set by SEBI:

Minimum Investment

The minimum investment amount for Alternative Investment Funds is INR 1 crore for individual investors. For employees or directors of the AIF or its manager, the minimum investment amount is INR 25 lakhs. For the AIF category I minimum investment is INR 25 Lakhs

Accredited Investor Status

To invest in AIFs, investors must qualify as accredited investors, which typically include high-net-worth individuals (HNIs), institutional investors, and family offices.

Lock-in Period

AIF investments often come with a lock-in period, varying based on the fund’s strategy and structure. For instance, private equity funds may have a lock-in period of 7-10 years, whereas hedge funds might have shorter lock-in periods.

Alternative Investments Risk

One of the biggest risks in investing in such funds is that the minimum investment is generally high for most investors hence diversification is tough and large capital loss is possible. These investments suit people who have high networth and can allocate 10-20% of their networth to such products.

A normal investor can explore other options like bonds, mutual funds, ETFs, and alternative investments that require a lower threshold to invest. A list of some of these platforms is below

Conclusion

AIFs have become an integral part of the Indian investment landscape, offering investors a broad spectrum of opportunities beyond conventional investment avenues. With the regulatory framework provided by SEBI, Alternative Investment Funds have grown in both number and size, attracting a diverse set of investors seeking higher returns, diversification, and exposure to innovative sectors.

As the AIF industry continues to evolve, it presents a compelling case for investors looking to diversify their portfolios and capitalize on the growth potential of various sectors within the Indian economy. Whether through venture capital, private equity, or debt funds, Alternative Investment Funds offer a unique avenue for achieving financial growth and success.

However, these come with their own risk and have a high minimum investment requirement that makes it unsuitable for retail investors.