Iphone is popular,so is Versace ,Chanel and BMW. We only pay premium for products were we perceive higher value.It can be in the form of quality,features and so on.Some people argue that these brands are overpriced because certain similar products cost far less. The argument is quite subjective because for someone the prestige of owning a Prada bag is superfluous but for others it could be a pass to fit in a social circle.

What about Financial Products? Can the brands command a premium .is it justifiable?Well like other products a higher cost must translate into some kind of value.The problem lies in the fallacy that there are ways to achieve higher returns without taking additional risk .So now when I have a cap on the value of return someone can give me , what is the company offering me extra? maybe lesser risk .Again the lowest risk technically is in the sovereign bond .So now when i have both a cap and floor of risk adjusted returns and its a small range to spend a portion of it on products which add no value!

I have worked in Asset Management,Proprietary Trading,AIF ,Structured Products and one thing has been common if someone can make money they will do it for themselves not sell it for small commission!

Lets take an example:

A fund X gives its client 10% return on a average.

It charges 2% fees.

what is the client left with ,8% and that too offcourse with higher risk than a government security.

If a low cost debt fund is paying 8.5% for that tenure and it has indexation benefit you will get close to 8% Returns.Its better to take a known risk for a given return than an unkown risk.

So our high flying company X is a rip off for the client.Took more risk and gave inferior returns .That sucks! The Company charged me 25% fees(2%/8%) for nothing.

This is no anomaly! The amount of money people trust on such institutions is mind boggling! No wonder finance industry is a coveted place to be in.

One should only use an investment product or service if it provides a payoff or exposure to asset classes which can not be feasibly achieved through replication at a lower cost.Examples of it would be PE firms investing in growing startups or P2P lending platform

Let’s see what kind of money management services are there in the market and how they have fared and then we will figure out ways make our money grow ourselves!

AIF/Hedge Fund: Indian hedge Fund Market stands at 3.5Bn Dollars.Most structures charge investor a 2% management fees and 20% of profit generate over a given hurdle rate. They are available only for high networth people.Strategies like Long Short stock baskets ,Derivative trading are used to generate Return.

If a firm generates 20% and hurdle rate is 10%.Net return would be 20%-(20%*10%)-2% = 16%

Over that you might end up paying more if you go through an Investment advisor or RM .So after tax you will be making around 10%.Looks good standalone but when we compare it to the benchmarks results seem dismal.

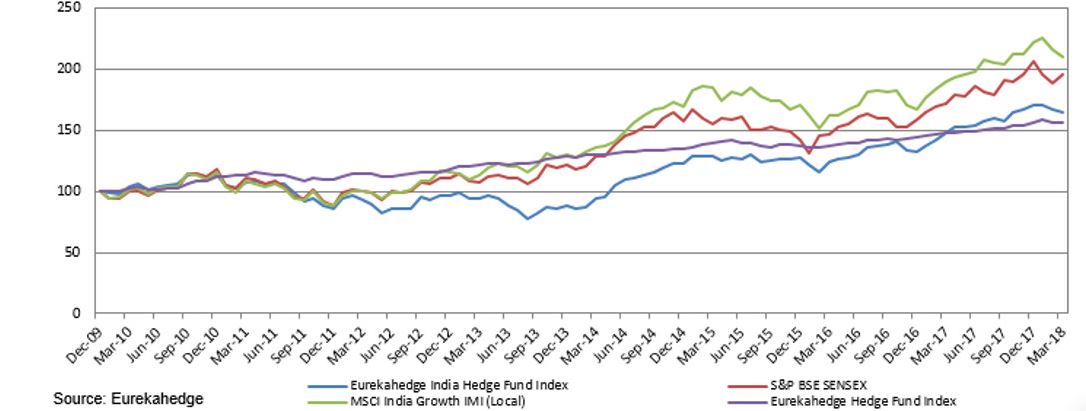

Report generated by EurekaHedge shows the comparative Analysis:

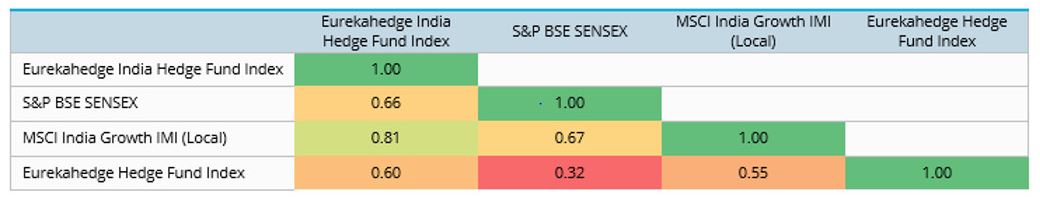

The Returns have been less compared to the equity market but if they provide hedge against a bad time then it might be good deal.The correlation figure show that results are highly correlated to Indian Equity Market.

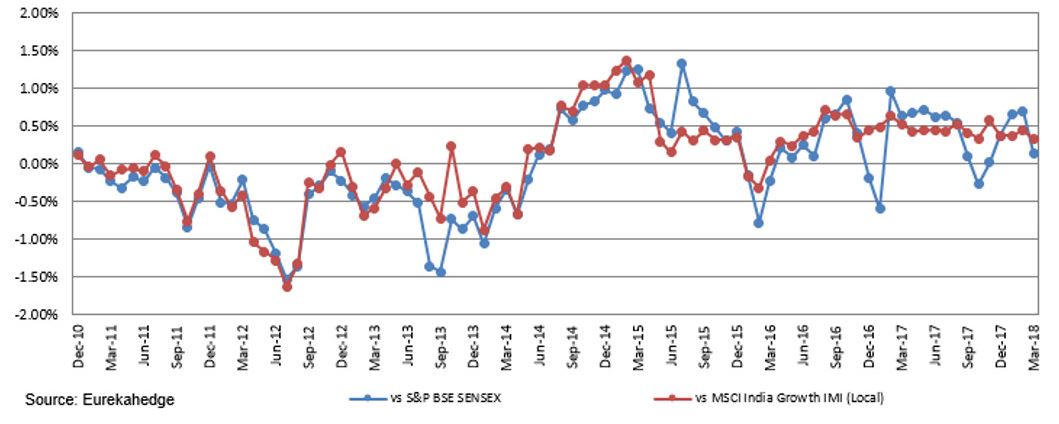

Below is 12 month rolling alpha considering zero risk free rate.

Had we considered risk free rate at 7% our alpha numbers would have dipped in negative territory.

There is no denial that some funds give good return during some year but to find those funds and be in those funds at the right time is no easier than picking a multibagge r. Then why do so many people flock to put money in these products.Good marketing,Shiny Prospectus with big numbers, Fancy strategies

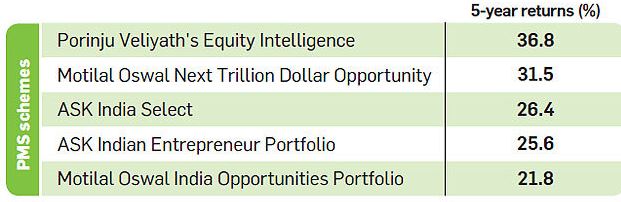

PMS: The case for PMS is that they are more customized than mutual fund and can provide returns and risk profile as per the investor demand.The drawback is higher tax implication ,management fees.Minimum investment is 2.5 million INR so you need to have a big portfolio to put in a part in PMS.Again fees structure can vary but generally includes 2- 2.5% fees plus profit sharing .It doesn’t leave much if returns are low.

The performance of PMS has been very diverse.On hand some PMS have generated 40% CAGR while some couldn’t even get through 2 digit returns.

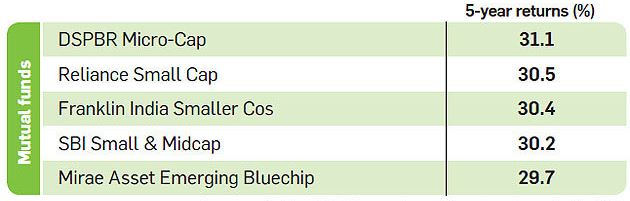

The correlation with broad market is high as investment is in long equity position. Comparative Analysis of top PMS with Mutual Funds:

A couple of PMS might have given better return than the small cap Mutual funds but an average PMS with management fees,commission etc which could be close to 6% will be losing bet.These performance are in a bull market and we should not mix bull with brain!!

Mutual fund investment any day provide better risk reward ratio because:

- PMS in not tax efficient .Dividend are taxed at higher rate as you own the stocks

- Mutual Fund offers to invest through SIP(systematic Investment Plan).You can average your cost which is very helpful in a falling market

- Higher Fees in PMS offset any alpha they can create in the portfolio

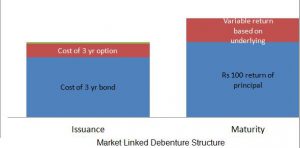

Structured Product:Structured products offer investors the potential to earn returns tied to the performance of an index or basket of securities. Rates of return vary and are generally paid at maturity, along with the face amount of the investment, subject to the credit risk of the issuer.

Structure of the product comprises a zero coupon bond with an option:

Some of these provide principal protection and give a comfort to the investor that they can participate in the market while protecting the capital.In essence they are trading their market risk for credit risk of the bond.

I have worked in Structured Products and the cost embedded in these products are huge.Most of these products can be replicated at lower cost by people with some understanding of derivatives. I will dwell upon details to create various structures in my future posts.

Mutual Funds: Mutual funds market has grown immensely in the last few years ,thanks to the raging bull market and it has been a great well creator for many.It definitely has cost attached to it called expense ratio(TER) .If you buy a regular plan through broker you end up paying even more.

So is mutual fund the most optimized solution. Most mutual funds are not actually how they market themselves to be.Lot of so called Large Cap Funds have mid cap holding etc .So we need to understand in totality what kind of portfolio we want and then use combination of low cost ETF ,Debt Funds and small cap funds to replicate our desired portfolio.The difference in alpha between ETF and mutual fund have diminished over the years as market have become more efficient

Another factor is that lot a of MF keep around 7-8% money in cash.Replicating using ETF we are able to get higher leverage with same volatility.Using equity options in conjunction can further enhance returns.I will post my replication of a mutual fund portfolio using ETF ,Index Fund and small cap which is able to generate higher return at same volatility!

Life Insurance:Life Insurance is something which is not possible to replicate for a normal person but it comes with a caveat.A term insurance is not possible to replicate but whole life Insurance and ULIP can easily be replicated using combination of Term insurance ,mutual funds(Debt,Equity) and ETF .Not only they can be replicated but also provide better return.So if somebody wants to create a retirement corpus its wise to buy a term insurance and based on the corpus he wants to create invest in various assets which can provide that return in that tenor.I will provide a comparative analysis of various insurance products with do it yourself superior strategy!

I like this internet site becauze so muuch useful material on here :D.