Market haven’t been crazier than now since 2008. Uncertainty, fear and paranoia has gripped people and panic selling of stock has been rampant.

Investors have been fed nothing but copious amounts of volatility in the past few weeks. One interesting trade people can do now is to bet on volatility to go down.

The signal is emanating from the standard volatility index or VIX.

Since 2011, trading inverse volatility was probably the most rewarding investment an investor could make in the markets. Annual returns of between 40% – 100% where possible but when market volatility spiked people got crushed ,hence it is more of a trading instrument than an investment

Why do people buy VIX options and ETF?

In modern markets, the best way to protect capital would be to rotate out of falling assets. This is relatively easy, if you are invested only in a few ETFs, but it is much more difficult, if you are invested in a lot of different shares. In such a situation an easy way to protect capital is to hedge it, going long VIX Futures, VIX call options or VIX ETFs VXX.

If you trade inverse volatility, which means going short VIX, you play the role of an insurer who sells worried investors an insurance policy to protect them from falling stock markets. To hedge a portfolio by 100% an investor needs to buy VXX ETFs for about 20% of the portfolio value. The VXX ETF loses up to 10% of it’s value per month, because of the VIX Futures contango( i.e future premium over current VIX), so this means that scared investors are willing to pay 1.5-2% of the portfolio value per month or around 25% per year for this insurance. Investing in inverse volatility means nothing more, than taking over the risk and collecting this insurance premium from worried investors and you can capitalize on this .

Something seems afoot. Why do investors pay 25% per year to hedge 100% of an S&P 500 portfolio which traditionally has only achieved a return on average of around 8% in the last 10 years? I am sure many investors must have lost more money paying for this insurance than they would have lost from falling stock markets. But I guess, they are paying for their own peace of mind.

Traditionally, it has always been better to hedge a portfolio with Treasury Bonds. These normally have like VIX products a negative correlation of about -0.5 to -0.75 with the US stock market, but unlike VIX volatility products, they can achieve long term positive returns.

However, since few years, US Treasuries have lost their negative correlation to the stock market, and at the moment there is no other choice to hedge a portfolio than to buy these very expensive VIX products or inverse index ETFs.

This is good news for people who like to trade inverse volatility. However, there is something you need to know. You should never ever trade inverse volatility without being 100% clear on your exit strategy!

The risk with Inverse Volatility strategy is that it always work until it stops working!!!

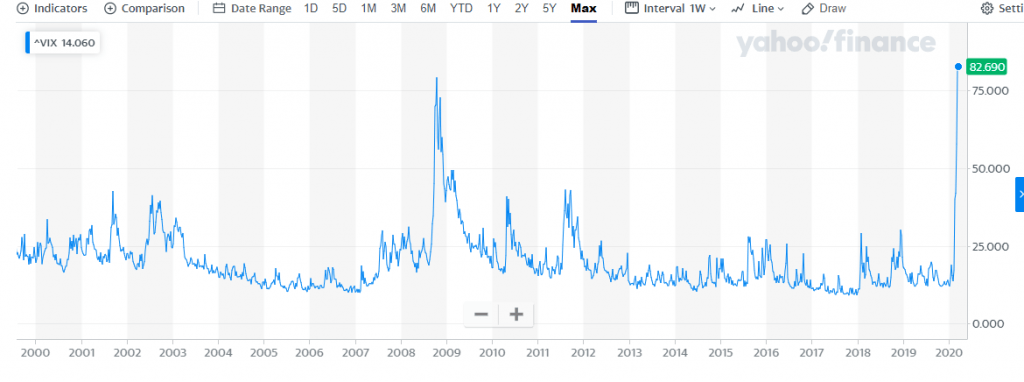

If you see the historical chart of VIX

Somebody who would have been shorting vix would have got killed when VIX jumped from 15 to 75 ,a 500% jump!!!

So never short vix to generate income like what lot of people do !! It’s akin to picking up pennies in front of a steam roller .

Short VIX as a tactical move!

“Last week the VIX spiked into the 80s in a declining market,” “That’s unusual. For much of last year, the VIX traded below 15, and sustained spikes over 30 have historically been rare, occurring about annually in recent years, if at all. The VIX is often referred to as the market’s fear gauge. Technically, that’s not strictly true. What it actually measures is implied volatility on a basket of near-term S&P 500 stock options. Still, the effect is similar when there is a high degree of uncertainty in the market, which is often reflected in elevated option prices. This then shows up as elevated implied volatility. Basically, at times of market stress, people want to pay up for the insurance that options can provide. The recent rapid decline in markets and associated global events due to coronavirus are clearly a source of stress for many market participants.”

Why buy Inverse VIX now??

As it is evident we are at the point of highest VIX ever in history. What’s the downside from here ?

Maybe more volatility because of the current issues which means a spike of 30-40% , but whats the upside : even if volatility reduces by 50% which is still twice of normal volatility you end up making a cool 30-40% returns in next 4-5 months.

How to implement the strategy?

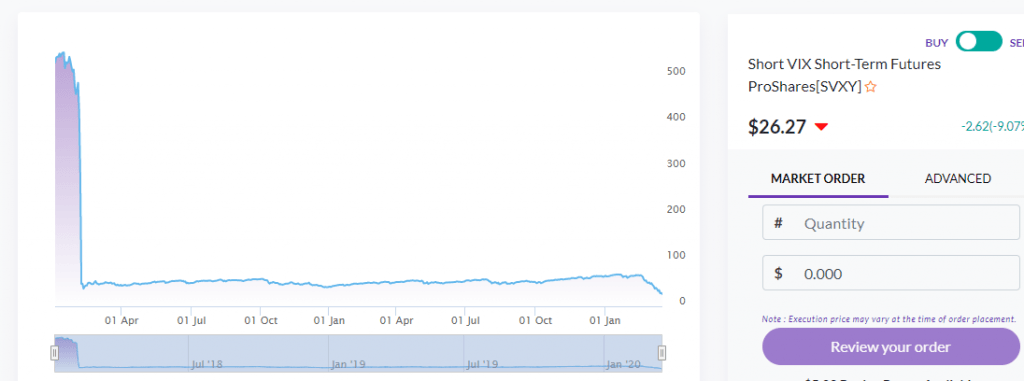

Buying An ETF called SVXY which gives 0.5X leverage to ETF i.e your ETF moves half of the underlying volatility which is a good thing as it lowers the risk!

So if we have to invest 100 bucks, around 80 VIX level,we put 50 and if VIX goes up another 50% ( almost 15% drop in market from current level) so we average it around 100 and hold it for next 3-6 months depending on when market stabilizes. If you hold it long enough you will making decent return

To buy Inverse VIX ETF you can use Stockal : Ticker ID is SVXY

Global Investing Platform Stockal Discount Link

It’s quite evident how it got smashed in last 1 month. The good part is that the ETF gives 0.5X leverage which means it moves only half of vix change hence less volatile.

Bottomline: This is a brave trade which has potential for good profits but short term big losses can overwhelm many people ,hence should be tried with less amount only or by someone who understand the rationale.

If you are not confident then you should stick to buying ETF in dips!

Footnotes:

Global Investing Platform Stockal Discount Link

For global Investing through Vested

Use this to register and get 5$ in your account (https://app.vested.co.in/referrals?code=RORA74993 )

For buying zero cost MF and lowest Derivative Trading

For alternate investment you can use these links

Finzy Referral Code:

https://finzy.com/invest?partner=MAN635

or you can apply the code : MAN635

(First Use the link to register then add the Code “discount50@i2i” while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For specific queries ping me on 9967974993 or mail me on rohanrautela9@gmail.com