Lot of People ask the question what is the right number of mutual funds in the portfolio.How to choose a mutual fund?

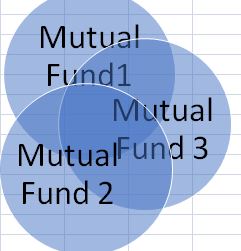

There is no universal answer to it but we need to take a step back and think what we are doing when we buy a mutual fund. We are basically choosing a fund manager to buy stocks on our behalf.If we put everything in one then we are giving one manager too much control and we we invest in too many then we end up holding a new portfolio which has many overlapping stocks and portfolio weights totally different from the base funds.

The steps to choose a mutual fund start from first deciding the asset allocation. We need to decide how much we wish to put in equity , debt and alternatives before even picking a mutual fund

Step 1) Decide Asset Allocation

I have covered this many times how adding alternatives can improve our risk/ return ratio favourably. Low correlated assets is the only free lunch in finance! The various options available these days are:

Step 2) Now let’s say we have decided how much we wish to put in Equity Mutual funds. I always recommend we should have atleast 20-25% wealth in assets which can be liquidated within a year without risk .Otherwise in an adverse situation we might have to liquidate our equity at loss.

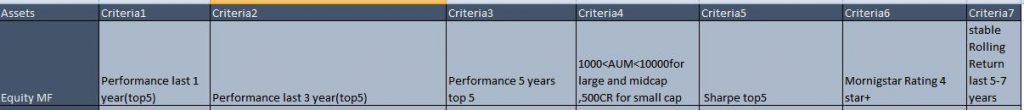

Now we set Criteria for our Equity MF. We have more than 500 Mutual funds ,how do we short list and how many?

First we decide how many Mutual funds we need. For that we need to see how big the stock universe they are covering in each category.

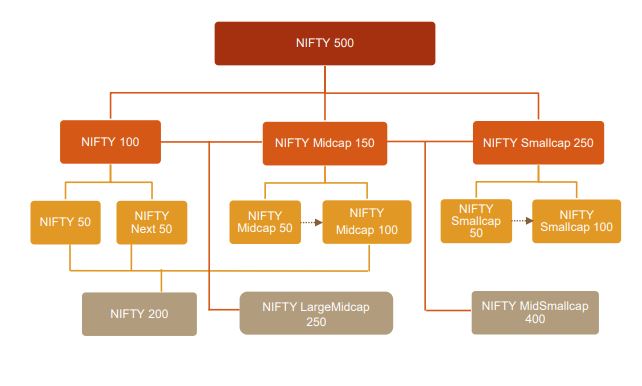

This chart represent the nifty top 500 stocks segregation. There are more stocks beyond these which have very small market capitalization

The Large Cap Mutual Funds cover 1st 100 Stocks i.e. Nifty 100

Mid Cap Mutual Funds cover 101st -250th stock i.e Nifty MidCap 250

Small Cap Mutual Funds cover beyond 250 to 1000+ stocks

Interestingly the first 100 stocks are most researched stocks and generating alpha is very tough. Think about it. Everything about HDFC and INFY is tracked by multiple research firms. There is not much insights you can generate. In small cap its the opposite . Not much is available to oustside world and fund manager who can hustle will get the real insights!

That’s why small cap can offer highest alpha but also highest risk as a bad economy can easily wipe out a smaller company.

Now coming to the number of funds we need. For large and midcap 1 fund for each category is enough as Fund manager can easily research these stocks.(small universe and lot of public data)

For small Cap you need atleast 2 Funds with minimum overlaps as you don’y want to concentrate the portfolio and also take away alpha.

We also need one global fund . What is so special about buying stocks in India? Just because we are born here does not mean it’s the best stock market. We will buy one international fund to diversify. It will also act as a hedge when rupee weakens as our returns will be in dollars

We have decided we will buy

1 Large Cap

1 Mid Cap

2 Small Cap

1 International Fund

Note: When market corrects a lot i.e say 10% or so ,you may add one more small cap mutual fund, as when market rise again 1) it’s easier for funds to pick up alpha 2) you want to be more diversified as you don’t know which sector will add the maximum return in a bounce back!

Step 3) Picking the Mutual Funds

I have made a broad filter to pick up mutual funds. People are free to add their own criteria and choose a different mutual Fund.

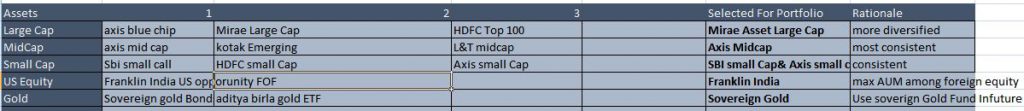

Based on these criteria I have shortlisted these Mutual Funds:

I also ensure that my portfolio has minimum overlapping and concentration across one stock. People may also opt for index fund in the large cap space. One drawback of index fund is that it has very high exposure to 2-3 names and with the corporate governance issues these days I prefer to keep lower exposure .People who are substantially diversified in other asset classes and also have comparatively lower large cap exposure may use ETF or Index fund in lieu of Large Cap Mutual Fund

Step 4) Check diversification

You can easily check diversification by selecting the weight of funds in your portfolio in a portal like value research.For mutual fund overlap you can go to fundoo.com.For rolling return rupeevest.com

For instance: if you hold

| Mirae Large Cap | 15% |

| Axis Mid Cap | 10% |

| SBI Small Cap | 10% |

| Axis Small Cap | 10% |

| Franklin US opportunity | 10% |

Then your top exposure is:

| HDFC Bank Limited | 1.35% |

| ICICI Bank Limited | 0.95% |

| Reliance Industries Limited | 0.91% |

| Axis Bank Limited | 0.67% |

| Infosys Limited | 0.60% |

| City Union Bank Limited | 0.79% |

| Info Edge (India) Limited | 0.78% |

| Avenue Supermarts Limited | 0.77% |

| NIIT Technologies Limited | 0.827% |

| City Union Bank Limited | 0.785% |

| Mas Financial Services Limited | 0.553% |

Even after a company goes bust your portfolio won’t be in deep red!

Step 5) check your liquidity status

I always ensure through my investment in

1)Invoice Discounting

2)P2P

3) arbitrage and Liquid Fund, Saving Bank account

I have enough liquidity to last 9-12 months. Equity investment portfolio should be such that you can live with a 50% fall in the market value and not lose your sleep. Think of it like a 10 year closed ended plan

Lot of people recommend 90% exposure to equity for youngsters. They should factor in that with 10% exposure to other assets the person should be able to meet all the expenses during emergency!

Conclusion: I have tried to construct a portfolio of mutual funds for passive investments which can be rebalanced in 6 months or so. It is important that we hold few but good mutual funds rather than buying whatever they hear from various sources.

Bottomline: You should do your own study and create your own filters .You can post them in the comments!

Note:

Cheapest discount broking and Mutual Fund Investment Platform Zerodha

For alternate investment you can use these links

I2I Referral Link

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Mail me to get Cashkumar Referral

For starting invoice discounting mail me or drop a message on 9967974993 or mail me at rohanrautela9@gmail.com

I do not get the correlation between if a stock is highly researched = can generate less alpha.

When the majority of alpha in a stock’s lifetime is actually generated by its earnings engine and not its valuation. if on get the valuation wrong and earnings call right (big companies like bajaj finance, nestle, page, Asian paints etc) one will still earn a solid cagr over a 5 year + period. If one gets the valuation wrong and the earnings call wrong too he or she will be stuck in the worst-case scenario. If one gets the PE or valuation call right and the earnings call wrong, the person will earn very minimal from PE expansion and marginal earnings growth which does happen. What I mean to say is: if E+V=R, E being the earnings and V being the valuation and R being returns; E will have a much higher weight on what effect it has on C

Investing in good companies with great corporate governance, great history, good capital allocation and the ability to plough back its earnings into the business and consistently generate healthy ROCE along with having a good moat and a sustainable competitive advantage is the only way to be able to get very rich by investing in stocks directly and facing less volatility.

Another thing we need to consider is the dividend we get (which keeps increasing as a percentage of the amount invested) is a very good source of passive income over longer periods. I see this point missing from almost all your posts.

Rest you have done a great job at explaining alternate investment about which people still have very less idea.

Thanks

Hi,

I dont disagree that right earning call can huge impact on the stock growth.What I mean when I say ” Highly researched stocks can generate less alpha” means an actively managed index of the top researched stocks(let’s say top 5) will have no significant alpha over the index.(Nifty 50 TRI)

The reason being market is partially Efficient i.e means in factor in information quickly into prices. It means that stocks which have a particular price(either due to valuation or earning) is because of all the available information for the stock.

Now if you take a stock like Infosys and say that you think earning are going to be much better than everybody expect is based on information already available to all participants in the market and thus you are only speculating.

Information which is not known by most people is restricted to a handful(insider information) .

Thus a rationale person has no means to predict a mispricing in a very highly researched stock unless he takes more risk than the market( like people buying yes bank).

But if a stock is a small less researched company not all partcipants cover it (due to size, risk etc) so mispricing is more common if the fund manager does really good research on his own( small caps which turn largecaps)

I agree to the dividend contribution but again for most stocks there is a trade off between growth and earning and all dividend stocks do not provide great growth (eg coal india) and lot of growth stocks do not provide dividend so it’s a choice

Disclaimer: I am looking forward to having a discussion and this is no way an attack on what you have said in the posts. Looking forward to learning more.

Did a small lookout. Other than SBI small-cap (18%) fund most funds 5-year cagr hover between 9-13%. comparing this with funds made of bigger, well-researched companies one can see that small-cap fund doesn’t really give more risk-adjusted returns when compared to safer multi-cap or Large and midcap funds. Add to that liquidity issue on smaller companies which often makes the shares of such companies go down every time the MF house wants to dump its own holdings. Thus drowning under its own weight.

A company commands a valuation and PE based on not only its future earning capacity but also the longevity of that earning and also the volatility of the earnings. I have seen investors divided into two schools of thought. One that wants to gain from a mismatch in perception and reality of a company. Such gains are quick and quite handsome. But depending only such a strategy leads to very high churning of ones portfolio. Because when the mismatch is matched, they want to get out saying the stock is fully priced to what its perception is and there is no more gap left to earn from it.

Now if that is true, companies like PIDILITE, NESTLE, ASIAN PAINTS, BERGER PAINTS, RELAXO, PAGE, BATA, WHIRLPOOl were almost already fully priced in at various points of time in recent and distant history and this might have triggered numerous participants to get in and get out of these companies based on the notion of the prices being fully matched to its earnings.

Now if we look at the past, irrespective of a very less price mismatch in these stocks as they are well researched, they have given healthy CAGR over past periods of 3yrs, 5yrs, 7yrs and 10years. How does one explain that?

We can conclude that banking on looking out for price mismatch in the stock market as the sole means to generate alpha can be a very expensive (brokerage,time-wise) ordeal for most normal retail investors. Instead understanding the business model of a company, its sustainable advantage, its moat, keeping in mind its management quality (feel bad for Porinju), choosing businesses with good ROCE and then taking a calculated decision on its future earning potential is not that much of speculation at all. The management runs the business and generates more cash, this increases the EPS periodically, generates high free cash flow and deploying them in the business again and repeating this, again and again, is what drives the share price of a company for a very long period. If we can get this right, worrying about finding price mismatch and investing in them because the markets are efficient will be a thing of the past I believe.

Excerpt from an article by Nick Maggiulli:

“For example, is a CAPE of 20 high or low? It isn’t either. It’s just high or low relative to what people have paid historically. That’s it. If investors collectively decide that they want to pay more for the same amount of earnings going forward, then what used to be considered “high” is now normal. As economic circumstances change, so will peoples’ willingness to pay more (or less) for stocks.” Whilst Nick’s arguments are at the market level, similar arguments for the shortcomings of the use of PE as the last word on valuation can be made for single stocks as well – PE fails to capture the extent of future growth, the longevity of growth nor the volatility of growth. In a separate blog from earlier this year, Morgan Housel comes at it from the point of investing time horizon – longer the horizon less the effect of starting PE on eventual returns, beautifully bringing out the fact that PE multiples DO NOT compound but earnings do, mostly.

I’ll leave some links here. Because what I want to say has been expressed here in much better way.

https://marcellus.in/newsletter/valuing-longevity-of-healthy-fundamentals/

https://www.collaborativefund.com/blog/why-time-horizon-works/

https://ofdollarsanddata.com/a-margin-of-safety/

Hope to listen back from you.

Thanks

Hi , Thanks for your insight and I respect your opinion!

I want to first reiterate that I dont deny that large caps do not generate high returns.

I have mentioned is that its tough to generate alpha in Large cap funds.

why?

let’s say the benchmark is nifty 50 which provides you the market return

Now you have a large cap mutual fund which will have an excess return over the market return (which cannot be explained by beta) .

How do the fund manager get the alpha.. Either through stock selection or stock allocation.

So it means if the nifty 50 has 8% infosys our fund manager either took 4% infy or he took some other stock instead of infy which resulted in higher return.right?

Now how did he know that he should have taken 4% of Infy instead of 6% of Infy.

He read the balance sheet,saw the business model etc

How many research analyst covering Infosys. Atleast 50 ( you can think of the biggest names, GS,Jefferies, UBS etc,some tracking ADR).

All the information about Infosys is available to everyone in the market.Based on that if you overweight or underweight infy in your portfolio is mere speculation.

But most people think they can find something in a stock which others cant and if that becomes correct which can be based out of luck ,people tend attribute to skill.

Having said that there are people who have beaten Index in the past consistently and the reason for that is their research is extraordinary( could be quant based :Renaissance technology , qualitative : David einhorn etc, investigative search : like shorting valeant pharma).

For a normal retail person it’s almost impossible to pick a good stock (especially a large cap ) and find out something which nobody knows in the market and attribute it to his skill.

Coming to why large cap is beating small cap. the answer is since 2016 market has been sideways. In a falling or flat market large cap will always beat small cap but in a bull run small cap will beat.(eg till 2016 cagr of some small cap was 30% +).Thats why famma french model has (Small cap – large cap) as a factor which is used by many smart beta too!

Also it’s not fair to go back 10 years in time or so. Till 2008 we had less technology in broking and trading(less HFT too).News took time to factor in the prices. People generated more alpha as only a limited hands traded. Now prices more really fast . it’s becoming difficult to beat passive funds.

You can see how many large cap funds can beat TRI .if 5 out 20 beat ,how do you find those 5? it’s again a an attribute of superior manager selection of which you have very limited knowledge(how much do you know about a manager)!

Large cap can provide great returns but you can always get that holding an index fund!

Sometimes growth stocks can outperform value stocks (Remember 2000 ,Internet stocks). May portfolio managers perished shorting stock with crazy business models as they would keep rising. In hindsight bubbles seem to obvious.

People who invested in wework were not stupid. They though themselves to be great investors.

Offcourse there are some people who have that gift ,then they can generate alpha even in large cap , but most people cant and most fund managers cant and most cant find those fund managers.alas!