Equity Investment through Mutual Fund is growing at a very fast pace and so has been the number of Asset Management Companies in the market.Mutual Fund Companies charge a fees called expense ratio for managing the funds. ETF on the other hand track the broad market Index.The fees for ETF are lower (.05%-.2%) compared to MF(1%-2.5%). There are many articles on MF and ETF comparison weighing pros and cons of each.

A combination of both can be used to generate more optimum returns.A three tier analysis of the Mutual Fund and ETF will give insights to construct a robust portfolio :

- Comparison of various Mutual Funds with Benchmark Index(and Total Return Index)

- Dissection of a “Large Cap” marketed Mutual fund

- Replication of Portfolio with ETF,Index Funds and Small Cap fund.

Total Number of Funds in Large Cap Category: 114

Total Funds older than 5 year :90

Nifty 50 and Nifty Next 50 Total Return Index (includes dividend) Annualized Returns across various period

| Index | 1Y Return | 3Y Return | 5Y Return | |

|---|---|---|---|---|

| 1 | Nifty 50 | 15.29% | 9.46% | 12.17% |

| 2 | Nifty Next50 | 12.11% | 16.18% | 19.19% |

| 3 | Nifty 50 TRI | 16.60% | 10.77% | 13.46% |

| 4 | Nifty Next 50 TRI | 14.29% | 17.93% | 20.85% |

Out of 90 funds 36 were able to beat Nifty 50 Total Return Index Return for 3 year. I took the 3 year period because if you compare older returns you will see more Mutual Fund out performance because market was not very efficient and lot of alpha was there to pick which has gradually eroded mostly in the Large Cap space.

Below is the List of funds which made the cut.

| Scheme | Return 1Y | Return 3Y | Return 5y | |

|---|---|---|---|---|

| 1 | Tata Equity P/E | 13.80% | 18.30% | 24.80% |

| 2 | Sahara Power & Natural Resources | 6.20% | 16.80% | 16.80% |

| 3 | IDFC Focused Equity | 21.90% | 13.80% | 15.30% |

| 4 | Tata Retirement Savings Progressive | 16.70% | 17.80% | 20.20% |

| 5 | Axis Focused 25 | 20.70% | 17.50% | 18.00% |

| 6 | JM Core 11 | 11.40% | 15.10% | 18.10% |

| 7 | Canara Robeco F.O.R.C.E | 17.50% | 15.70% | 18.30% |

| 8 | ICICI Prudential Indo Asia Equity | 12.30% | 11.20% | 18.90% |

| 9 | Templeton India G | 12.40% | 14.50% | 17.10% |

| 10 | Invesco India G | 22.30% | 14.30% | 19.40% |

| 11 | Reliance G | 12.90% | 13.80% | 19.90% |

| 12 | Sahara R.E.A.L -G | 13.80% | 17.30% | 24.10% |

| 13 | Kotak Classic Equity -G | 20.70% | 12.60% | 15.80% |

| 14 | Aditya Birla Sun Life India GenNext -G | 14.50% | 16.20% | 19.80% |

| 15 | Kotak Select Focus -G | 10.10% | 14.80% | 20.70% |

| 16 | HDFC G | 13.70% | 13.30% | 15.20% |

| 17 | BOI AXA Equity | 20.70% | 12.70% | 16.30% |

| 18 | ICICI Prudential Dynamic-G | 12.60% | 11.90% | 17.80% |

| 19 | ICICI Prudential Focused Bluechip Equity -G | 15.30% | 12.50% | 16.80% |

| 20 | Sundaram Select Focus | 16.20% | 11.20% | 13.90% |

| 21 | ICICI Prudential Top 100 -G | 9.10% | 11.30% | 16.40% |

| 22 | HSBC Equity -G | 13.40% | 11.80% | 14.30% |

| 23 | Indiabulls Blue Chip -G | 12.40% | 13.30% | 13.70% |

| 24 | Escorts High Yield Equity-G | 4.70% | 15.70% | 23.90% |

| 25 | Escorts G | 17.20% | 15.10% | 22.00% |

| 26 | Principal Large Cap -G | 12.60% | 11.00% | 15.80% |

| 27 | UTI Equity | 18.30% | 11.60% | 16.80% |

| 28 | Invesco India Dynamic Equity -G | 14.50% | 11.40% | 15.40% |

| 29 | Axis Equity -G | 20.70% | 12.00% | 15.10% |

| 30 | Escorts Leading Sectors -G | 16.70% | 14.70% | 23.10% |

| 31 | Canara Robeco Large Cap+ | 12.50% | 10.80% | 13.80% |

| 32 | Aditya Birla Sun Life Top 100 -G | 9.80% | 11.30% | 17.40% |

| 33 | Peerless Equity -G | 7.40% | 12.70% | 13.80% |

| 34 | Invesco India Business Leaders -G | 16.10% | 10.90% | 15.40% |

| 35 | SBI Blue Chip | 13.20% | 12.50% | 17.90% |

| 36 | Quantum Long-Term Equity -G | 9.00% | 12.70% | 16.10% |

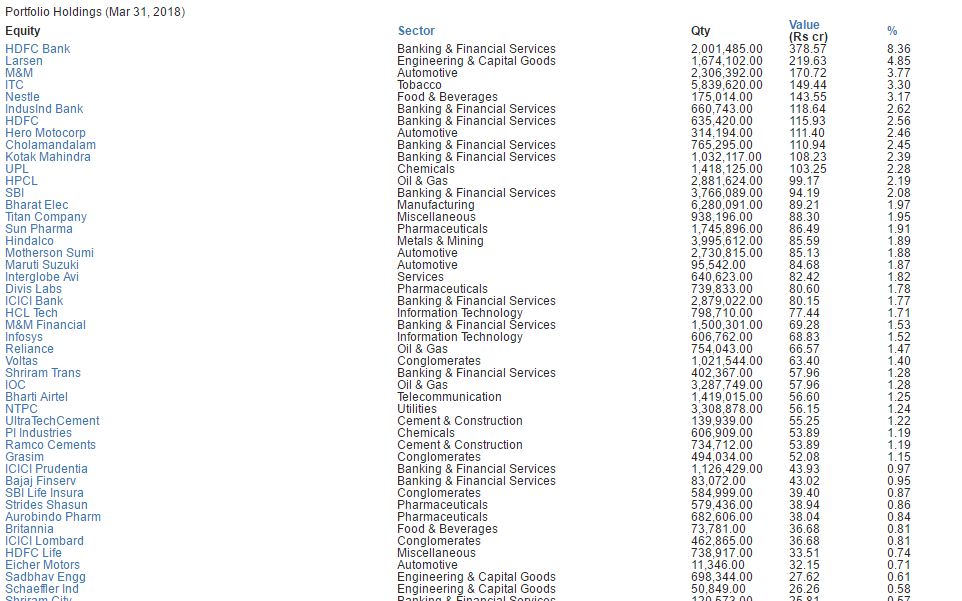

So 40%(36/90) were able to beat Nifty.Lets go one step further and see what holdings these so called “Large Cap” Funds have.I will take SBI Blue Chip as it is quite popular in the Large Cap Category.Here is a snapshot of the holdings:

Wow its marketed as a Large Cap Fund and it has not more than 50% in stocks with market capitalization more than 50000 Cr .Well the thing is categorization by market cap is very subjective and often misused.

Its not fair to compare a multi cap fund to Nifty 50 TRI index. We should compare it to atleast Nifty 100 .ie. 50%Nifty50 and 50%Niftynext50 which gives around 15% return!!! Using this benchmark hardly 10% funds are beating Index investment.Picking the ideal Mutual Fund is again a matter of luck to an extent !

Now another surprise

Around 8% of money is in cash generating close to 6%. Its not a bad thing to keep money as cash and deploy when right time comes but what if we can generate higher return from that cash! .Secondly it means that Fund Manager is using 92% money to invest and beat 100% of Index.Doing this consistently is tough .

So summarizing what inference we have drawn:

- Most Mutual Funds are not able to beat total return index

- Most Large Cap Funds are generally Multi Cap Fund

- Around 5-10% of money is parked as cash.

Now lets say Mr X bought 3 funds (1 Large Cap,1 Mid Cap,1 Small Cap) .In reality he is holding some amount of Nifty and lot of Small and Midcaps. How can he get the same exposure more efficiently. What we do is we replicate our portfolio using low cost Nifty ETF, Nifty Next50 Index fund and one small cap fund for the Alpha.We put the extra cash according to our risk appetite. I will demonstrate in my next post how I replicated a mutual fund portfolio and achieved higher return at lower volatility.

Hey just wanted to give you a quick heads up. The text in your post seem to be running off the screen in Ie. I’m not sure if this is a format issue or something to do with web browser compatibility but I thought I’d post to let you know. The design and style look great though! Hope you get the problem fixed soon. Cheers

Thanks for the feedback!